Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

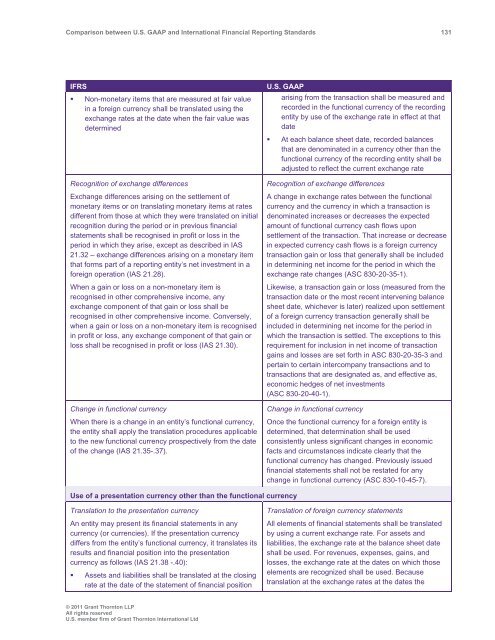

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 131<br />

IFRS<br />

• Non-monetary items that are measured at fair value<br />

in a foreign currency shall be translated using the<br />

exchange rates at the date when the fair value was<br />

determined<br />

Recognition of exchange differences<br />

Exchange differences arising on the settlement of<br />

monetary items or on translating monetary items at rates<br />

different from those at which they were translated on initial<br />

recognition during the period or in previous financial<br />

statements shall be recognised in profit or loss in the<br />

period in which they arise, except as described in IAS<br />

21.32 – exchange differences arising on a monetary item<br />

that forms part of a reporting entity’s net investment in a<br />

foreign operation (IAS 21.28).<br />

When a gain or loss on a non-monetary item is<br />

recognised in other comprehensive income, any<br />

exchange component of that gain or loss shall be<br />

recognised in other comprehensive income. Conversely,<br />

when a gain or loss on a non-monetary item is recognised<br />

in profit or loss, any exchange component of that gain or<br />

loss shall be recognised in profit or loss (IAS 21.30).<br />

Change in functional currency<br />

When there is a change in an entity’s functional currency,<br />

the entity shall apply the translation procedures applicable<br />

to the new functional currency prospectively from the date<br />

of the change (IAS 21.35-.37).<br />

U.S. <strong>GAAP</strong><br />

arising from the transaction shall be measured <strong>and</strong><br />

recorded in the functional currency of the recording<br />

entity by use of the exchange rate in effect at that<br />

date<br />

• At each balance sheet date, recorded balances<br />

that are denominated in a currency other than the<br />

functional currency of the recording entity shall be<br />

adjusted to reflect the current exchange rate<br />

Recognition of exchange differences<br />

A change in exchange rates <strong>between</strong> the functional<br />

currency <strong>and</strong> the currency in which a transaction is<br />

denominated increases or decreases the expected<br />

amount of functional currency cash flows upon<br />

settlement of the transaction. That increase or decrease<br />

in expected currency cash flows is a foreign currency<br />

transaction gain or loss that generally shall be included<br />

in determining net income for the period in which the<br />

exchange rate changes (ASC 830-20-35-1).<br />

Likewise, a transaction gain or loss (measured from the<br />

transaction date or the most recent intervening balance<br />

sheet date, whichever is later) realized upon settlement<br />

of a foreign currency transaction generally shall be<br />

included in determining net income for the period in<br />

which the transaction is settled. The exceptions to this<br />

requirement for inclusion in net income of transaction<br />

gains <strong>and</strong> losses are set forth in ASC 830-20-35-3 <strong>and</strong><br />

pertain to certain intercompany transactions <strong>and</strong> to<br />

transactions that are designated as, <strong>and</strong> effective as,<br />

economic hedges of net investments<br />

(ASC 830-20-40-1).<br />

Change in functional currency<br />

Once the functional currency for a foreign entity is<br />

determined, that determination shall be used<br />

consistently unless significant changes in economic<br />

facts <strong>and</strong> circumstances indicate clearly that the<br />

functional currency has changed. Previously issued<br />

financial statements shall not be restated for any<br />

change in functional currency (ASC 830-10-45-7).<br />

Use of a presentation currency other than the functional currency<br />

Translation to the presentation currency<br />

An entity may present its financial statements in any<br />

currency (or currencies). If the presentation currency<br />

differs from the entity’s functional currency, it translates its<br />

results <strong>and</strong> financial position into the presentation<br />

currency as follows (IAS 21.38 -.40):<br />

• Assets <strong>and</strong> liabilities shall be translated at the closing<br />

rate at the date of the statement of financial position<br />

Translation of foreign currency statements<br />

All elements of financial statements shall be translated<br />

by using a current exchange rate. For assets <strong>and</strong><br />

liabilities, the exchange rate at the balance sheet date<br />

shall be used. For revenues, expenses, gains, <strong>and</strong><br />

losses, the exchange rate at the dates on which those<br />

elements are recognized shall be used. Because<br />

translation at the exchange rates at the dates the<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd