Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

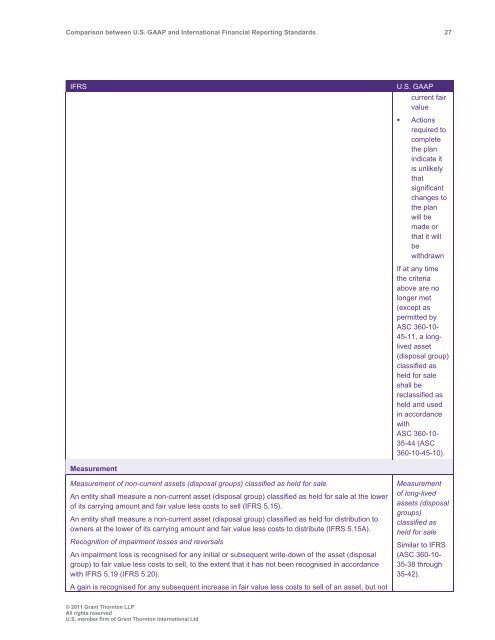

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 27<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

current fair<br />

value<br />

• Actions<br />

required to<br />

complete<br />

the plan<br />

indicate it<br />

is unlikely<br />

that<br />

significant<br />

changes to<br />

the plan<br />

will be<br />

made or<br />

that it will<br />

be<br />

withdrawn<br />

If at any time<br />

the criteria<br />

above are no<br />

longer met<br />

(except as<br />

permitted by<br />

ASC 360-10-<br />

45-11, a longlived<br />

asset<br />

(disposal group)<br />

classified as<br />

held for sale<br />

shall be<br />

reclassified as<br />

held <strong>and</strong> used<br />

in accordance<br />

with<br />

ASC 360-10-<br />

35-44 (ASC<br />

360-10-45-10).<br />

Measurement<br />

Measurement of non-current assets (disposal groups) classified as held for sale<br />

An entity shall measure a non-current asset (disposal group) classified as held for sale at the lower<br />

of its carrying amount <strong>and</strong> fair value less costs to sell (IFRS 5.15).<br />

An entity shall measure a non-current asset (disposal group) classified as held for distribution to<br />

owners at the lower of its carrying amount <strong>and</strong> fair value less costs to distribute (IFRS 5.15A).<br />

Recognition of impairment losses <strong>and</strong> reversals<br />

An impairment loss is recognised for any initial or subsequent write-down of the asset (disposal<br />

group) to fair value less costs to sell, to the extent that it has not been recognised in accordance<br />

with IFRS 5.19 (IFRS 5.20).<br />

A gain is recognised for any subsequent increase in fair value less costs to sell of an asset, but not<br />

Measurement<br />

of long-lived<br />

assets (disposal<br />

groups)<br />

classified as<br />

held for sale<br />

Similar to IFRS<br />

(ASC 360-10-<br />

35-38 through<br />

35-42).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd