Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

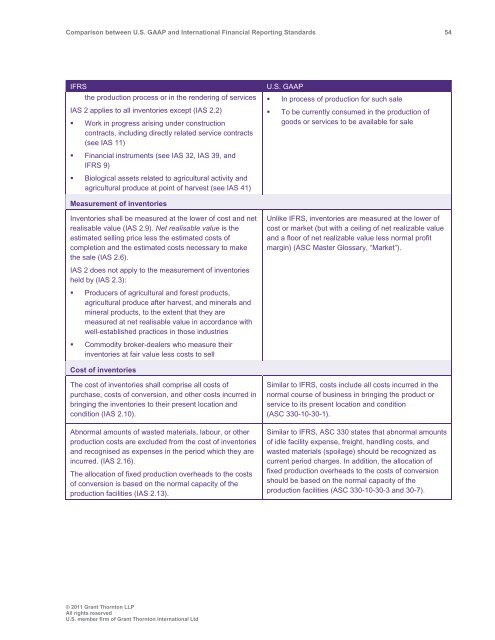

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 54<br />

IFRS<br />

the production process or in the rendering of services<br />

IAS 2 applies to all inventories except (IAS 2.2)<br />

• Work in progress arising under construction<br />

contracts, including directly related service contracts<br />

(see IAS 11)<br />

• Financial instruments (see IAS 32, IAS 39, <strong>and</strong><br />

IFRS 9)<br />

• Biological assets related to agricultural activity <strong>and</strong><br />

agricultural produce at point of harvest (see IAS 41)<br />

U.S. <strong>GAAP</strong><br />

• In process of production for such sale<br />

• To be currently consumed in the production of<br />

goods or services to be available for sale<br />

Measurement of inventories<br />

Inventories shall be measured at the lower of cost <strong>and</strong> net<br />

realisable value (IAS 2.9). Net realisable value is the<br />

estimated selling price less the estimated costs of<br />

completion <strong>and</strong> the estimated costs necessary to make<br />

the sale (IAS 2.6).<br />

Unlike IFRS, inventories are measured at the lower of<br />

cost or market (but with a ceiling of net realizable value<br />

<strong>and</strong> a floor of net realizable value less normal profit<br />

margin) (ASC Master Glossary, “Market”).<br />

IAS 2 does not apply to the measurement of inventories<br />

held by (IAS 2.3):<br />

• Producers of agricultural <strong>and</strong> forest products,<br />

agricultural produce after harvest, <strong>and</strong> minerals <strong>and</strong><br />

mineral products, to the extent that they are<br />

measured at net realisable value in accordance with<br />

well-established practices in those industries<br />

• Commodity broker-dealers who measure their<br />

inventories at fair value less costs to sell<br />

Cost of inventories<br />

The cost of inventories shall comprise all costs of<br />

purchase, costs of conversion, <strong>and</strong> other costs incurred in<br />

bringing the inventories to their present location <strong>and</strong><br />

condition (IAS 2.10).<br />

Abnormal amounts of wasted materials, labour, or other<br />

production costs are excluded from the cost of inventories<br />

<strong>and</strong> recognised as expenses in the period which they are<br />

incurred. (IAS 2.16).<br />

The allocation of fixed production overheads to the costs<br />

of conversion is based on the normal capacity of the<br />

production facilities (IAS 2.13).<br />

Similar to IFRS, costs include all costs incurred in the<br />

normal course of business in bringing the product or<br />

service to its present location <strong>and</strong> condition<br />

(ASC 330-10-30-1).<br />

Similar to IFRS, ASC 330 states that abnormal amounts<br />

of idle facility expense, freight, h<strong>and</strong>ling costs, <strong>and</strong><br />

wasted materials (spoilage) should be recognized as<br />

current period charges. In addition, the allocation of<br />

fixed production overheads to the costs of conversion<br />

should be based on the normal capacity of the<br />

production facilities (ASC 330-10-30-3 <strong>and</strong> 30-7).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd