Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

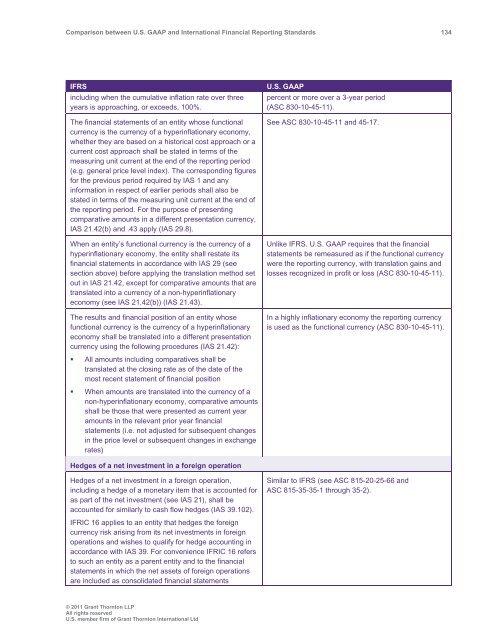

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 134<br />

IFRS<br />

including when the cumulative inflation rate over three<br />

years is approaching, or exceeds, 100%.<br />

The financial statements of an entity whose functional<br />

currency is the currency of a hyperinflationary economy,<br />

whether they are based on a historical cost approach or a<br />

current cost approach shall be stated in terms of the<br />

measuring unit current at the end of the reporting period<br />

(e.g. general price level index). The corresponding figures<br />

for the previous period required by IAS 1 <strong>and</strong> any<br />

information in respect of earlier periods shall also be<br />

stated in terms of the measuring unit current at the end of<br />

the reporting period. For the purpose of presenting<br />

comparative amounts in a different presentation currency,<br />

IAS 21.42(b) <strong>and</strong> .43 apply (IAS 29.8).<br />

When an entity’s functional currency is the currency of a<br />

hyperinflationary economy, the entity shall restate its<br />

financial statements in accordance with IAS 29 (see<br />

section above) before applying the translation method set<br />

out in IAS 21.42, except for comparative amounts that are<br />

translated into a currency of a non-hyperinflationary<br />

economy (see IAS 21.42(b)) (IAS 21.43).<br />

The results <strong>and</strong> financial position of an entity whose<br />

functional currency is the currency of a hyperinflationary<br />

economy shall be translated into a different presentation<br />

currency using the following procedures (IAS 21.42):<br />

U.S. <strong>GAAP</strong><br />

percent or more over a 3-year period<br />

(ASC 830-10-45-11).<br />

See ASC 830-10-45-11 <strong>and</strong> 45-17.<br />

Unlike IFRS. U.S. <strong>GAAP</strong> requires that the financial<br />

statements be remeasured as if the functional currency<br />

were the reporting currency, with translation gains <strong>and</strong><br />

losses recognized in profit or loss (ASC 830-10-45-11).<br />

In a highly inflationary economy the reporting currency<br />

is used as the functional currency (ASC 830-10-45-11).<br />

• All amounts including comparatives shall be<br />

translated at the closing rate as of the date of the<br />

most recent statement of financial position<br />

• When amounts are translated into the currency of a<br />

non-hyperinflationary economy, comparative amounts<br />

shall be those that were presented as current year<br />

amounts in the relevant prior year financial<br />

statements (i.e. not adjusted for subsequent changes<br />

in the price level or subsequent changes in exchange<br />

rates)<br />

Hedges of a net investment in a foreign operation<br />

Hedges of a net investment in a foreign operation,<br />

including a hedge of a monetary item that is accounted for<br />

as part of the net investment (see IAS 21), shall be<br />

accounted for similarly to cash flow hedges (IAS 39.102).<br />

Similar to IFRS (see ASC 815-20-25-66 <strong>and</strong><br />

ASC 815-35-35-1 through 35-2).<br />

IFRIC 16 applies to an entity that hedges the foreign<br />

currency risk arising from its net investments in foreign<br />

operations <strong>and</strong> wishes to qualify for hedge accounting in<br />

accordance with IAS 39. For convenience IFRIC 16 refers<br />

to such an entity as a parent entity <strong>and</strong> to the financial<br />

statements in which the net assets of foreign operations<br />

are included as consolidated financial statements<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd