Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 70<br />

6. Income <strong>and</strong> expenditure<br />

6.1 Revenue - general<br />

Note: In June 2010, the IASB <strong>and</strong> FASB issued proposed guidance, Revenue from Contracts with Customers, as part<br />

of a joint project to develop a common revenue recognition st<strong>and</strong>ard for IFRS <strong>and</strong> U.S. <strong>GAAP</strong>. The proposed guidance<br />

would supersede the guidance in IAS 18, Revenue, <strong>and</strong> IAS 11, Construction Contracts, <strong>and</strong> most existing guidance in<br />

ASC 605, Revenue Recognition. The proposed guidance would establish principles that entities would apply to provide<br />

financial statement users with useful information about the amount, timing, <strong>and</strong> uncertainty of revenue <strong>and</strong> cash flows<br />

resulting from contracts with customers.<br />

The proposed guidance would apply to most contracts with customers to provide goods or services. It would not apply<br />

to certain contracts that are within the scope of other generally accepted accounting st<strong>and</strong>ards, such as lease<br />

contracts, insurance contracts, financial instruments, <strong>and</strong> nonmonetary exchanges <strong>between</strong> entities in the same line of<br />

business to facilitate sales to third party customers.<br />

The core principle of the proposed guidance would require an entity to recognize revenue in a manner that depicts the<br />

transfer of control of goods or services to customers in an amount that reflects the consideration the entity receives or<br />

expects to receive for those goods or services. To apply this principle, an entity would apply the following steps:<br />

• Identify the contract with a customer<br />

• Identify the separate performance obligations in the contract<br />

• Determine the transaction price<br />

• Allocate the transaction price to each separate performance obligation<br />

• Recognize revenue as the entity satisfies each performance obligation<br />

The Exposure Draft does not specify an effective date because the Boards plan to separately address the effective<br />

dates for all of their convergence projects. Entities would be required to apply the new revenue guidance<br />

retrospectively.<br />

The Boards received significant feedback on the proposed guidance through the comment letter process, roundtable<br />

discussions, <strong>and</strong> outreach activities <strong>and</strong> are in the process of redeliberating the conclusions in the proposed guidance.<br />

The Boards have targeted June 2011 as the date a final st<strong>and</strong>ard will be issued.<br />

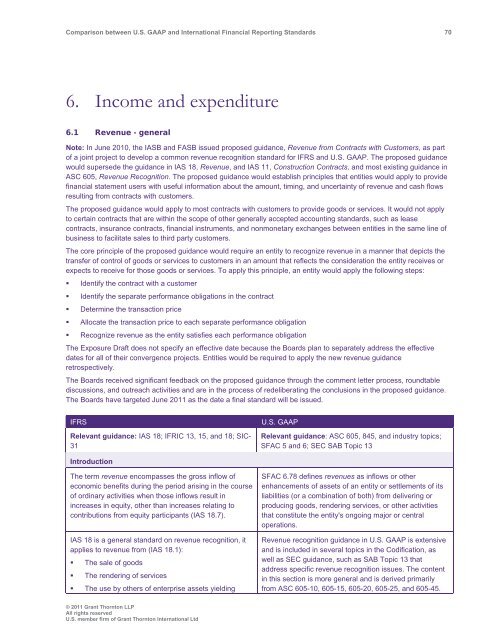

IFRS<br />

Relevant guidance: IAS 18; IFRIC 13, 15, <strong>and</strong> 18; SIC-<br />

31<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: ASC 605, 845, <strong>and</strong> industry topics;<br />

SFAC 5 <strong>and</strong> 6; SEC SAB Topic 13<br />

Introduction<br />

The term revenue encompasses the gross inflow of<br />

economic benefits during the period arising in the course<br />

of ordinary activities when those inflows result in<br />

increases in equity, other than increases relating to<br />

contributions from equity participants (IAS 18.7).<br />

IAS 18 is a general st<strong>and</strong>ard on revenue recognition, it<br />

applies to revenue from (IAS 18.1):<br />

• The sale of goods<br />

• The rendering of services<br />

• The use by others of enterprise assets yielding<br />

SFAC 6.78 defines revenues as inflows or other<br />

enhancements of assets of an entity or settlements of its<br />

liabilities (or a combination of both) from delivering or<br />

producing goods, rendering services, or other activities<br />

that constitute the entity's ongoing major or central<br />

operations.<br />

Revenue recognition guidance in U.S. <strong>GAAP</strong> is extensive<br />

<strong>and</strong> is included in several topics in the Codification, as<br />

well as SEC guidance, such as SAB Topic 13 that<br />

address specific revenue recognition issues. The content<br />

in this section is more general <strong>and</strong> is derived primarily<br />

from ASC 605-10, 605-15, 605-20, 605-25, <strong>and</strong> 605-45.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd