Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

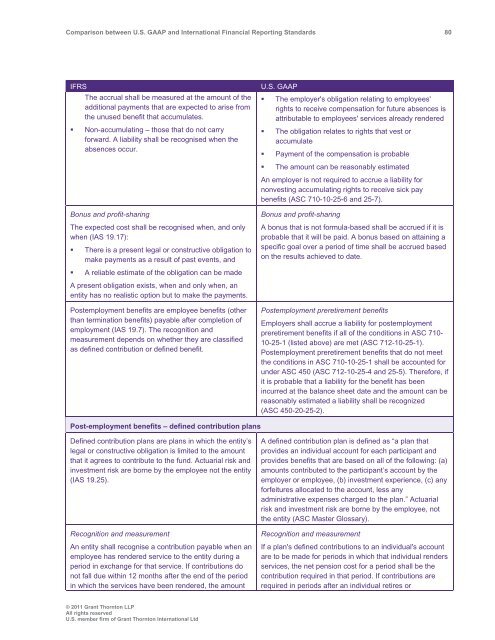

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 80<br />

IFRS<br />

The accrual shall be measured at the amount of the<br />

additional payments that are expected to arise from<br />

the unused benefit that accumulates.<br />

• Non-accumulating – those that do not carry<br />

forward. A liability shall be recognised when the<br />

absences occur.<br />

Bonus <strong>and</strong> profit-sharing<br />

The expected cost shall be recognised when, <strong>and</strong> only<br />

when (IAS 19.17):<br />

• There is a present legal or constructive obligation to<br />

make payments as a result of past events, <strong>and</strong><br />

• A reliable estimate of the obligation can be made<br />

A present obligation exists, when <strong>and</strong> only when, an<br />

entity has no realistic option but to make the payments.<br />

Postemployment benefits are employee benefits (other<br />

than termination benefits) payable after completion of<br />

employment (IAS 19.7). The recognition <strong>and</strong><br />

measurement depends on whether they are classified<br />

as defined contribution or defined benefit.<br />

U.S. <strong>GAAP</strong><br />

• The employer's obligation relating to employees'<br />

rights to receive compensation for future absences is<br />

attributable to employees' services already rendered<br />

• The obligation relates to rights that vest or<br />

accumulate<br />

• Payment of the compensation is probable<br />

• The amount can be reasonably estimated<br />

An employer is not required to accrue a liability for<br />

nonvesting accumulating rights to receive sick pay<br />

benefits (ASC 710-10-25-6 <strong>and</strong> 25-7).<br />

Bonus <strong>and</strong> profit-sharing<br />

A bonus that is not formula-based shall be accrued if it is<br />

probable that it will be paid. A bonus based on attaining a<br />

specific goal over a period of time shall be accrued based<br />

on the results achieved to date.<br />

Postemployment preretirement benefits<br />

Employers shall accrue a liability for postemployment<br />

preretirement benefits if all of the conditions in ASC 710-<br />

10-25-1 (listed above) are met (ASC 712-10-25-1).<br />

Postemployment preretirement benefits that do not meet<br />

the conditions in ASC 710-10-25-1 shall be accounted for<br />

under ASC 450 (ASC 712-10-25-4 <strong>and</strong> 25-5). Therefore, if<br />

it is probable that a liability for the benefit has been<br />

incurred at the balance sheet date <strong>and</strong> the amount can be<br />

reasonably estimated a liability shall be recognized<br />

(ASC 450-20-25-2).<br />

Post-employment benefits – defined contribution plans<br />

Defined contribution plans are plans in which the entity’s<br />

legal or constructive obligation is limited to the amount<br />

that it agrees to contribute to the fund. Actuarial risk <strong>and</strong><br />

investment risk are borne by the employee not the entity<br />

(IAS 19.25).<br />

Recognition <strong>and</strong> measurement<br />

An entity shall recognise a contribution payable when an<br />

employee has rendered service to the entity during a<br />

period in exchange for that service. If contributions do<br />

not fall due within 12 months after the end of the period<br />

in which the services have been rendered, the amount<br />

A defined contribution plan is defined as “a plan that<br />

provides an individual account for each participant <strong>and</strong><br />

provides benefits that are based on all of the following: (a)<br />

amounts contributed to the participant’s account by the<br />

employer or employee, (b) investment experience, (c) any<br />

forfeitures allocated to the account, less any<br />

administrative expenses charged to the plan.” Actuarial<br />

risk <strong>and</strong> investment risk are borne by the employee, not<br />

the entity (ASC Master Glossary).<br />

Recognition <strong>and</strong> measurement<br />

If a plan's defined contributions to an individual's account<br />

are to be made for periods in which that individual renders<br />

services, the net pension cost for a period shall be the<br />

contribution required in that period. If contributions are<br />

required in periods after an individual retires or<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd