- Page 1 and 2:

CONTENTSGeneral Conditions of Emplo

- Page 3 and 4:

CONTENTSGeneral Conditions of Emplo

- Page 5 and 6:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 7 and 8:

1 GENERAL CONDITIONS OF EMPLOYMENTp

- Page 9 and 10:

1 GENERAL CONDITIONS OF EMPLOYMENTd

- Page 11 and 12:

1 GENERAL CONDITIONS OF EMPLOYMENT

- Page 13 and 14:

1 GENERAL CONDITIONS OF EMPLOYMENTm

- Page 15 and 16:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 17 and 18:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 19 and 20:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 21 and 22:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 23 and 24:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 25 and 26:

1 GENERAL CONDITIONS OF EMPLOYMENT

- Page 27 and 28:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 29 and 30:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 31 and 32:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 33 and 34:

1 GENERAL CONDITIONS OF EMPLOYMENTi

- Page 35 and 36:

1 GENERAL CONDITIONS OF EMPLOYMENTE

- Page 37 and 38:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 39 and 40:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 41 and 42:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 43 and 44:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 45 and 46:

1 GENERAL CONDITIONS OF EMPLOYMENTi

- Page 47 and 48:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 49 and 50:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 51 and 52:

1 GENERAL CONDITIONS OF EMPLOYMENT1

- Page 53 and 54:

2 SUPPORT SERVICES2.1 HEALTH AND SA

- Page 55 and 56:

2 SUPPORT SERVICESBoth self referra

- Page 57 and 58:

2 STAFF WELFARE AND SUPPORT SERVICE

- Page 59 and 60:

2 STAFF WELFARE AND SUPPORT SERVICE

- Page 61 and 62:

CONTENTSLeave4.3.4 CALCULATION OF L

- Page 63 and 64:

CONTENTSLeave4.7.6.1 Recognition of

- Page 65 and 66:

CONTENTSLeave4.11.7.3 Periodic Trea

- Page 67 and 68:

CONTENTSLeave4.13.4 RELIEF 714.13.5

- Page 69 and 70:

CONTENTSLeave4.17.5 LEAVE ENTITLEME

- Page 71 and 72:

4 LEAVE1. Go to www.schools.nsw.edu

- Page 73 and 74:

4 LEAVE4.2 ADOPTION, MATERNITY AND

- Page 75 and 76:

4 LEAVEb) Where both parents of the

- Page 77 and 78:

4 LEAVEb) Maternity leave is only a

- Page 79 and 80:

4 LEAVE4.2.5 PARENTAL LEAVE4.2.5.1

- Page 81 and 82:

4 LEAVE4.2.6 GENERAL CONDITIONSThe

- Page 83 and 84:

4 LEAVE4.2.6.3 Right to requestto r

- Page 85 and 86:

4 LEAVEHowever, unpaid adoption, ma

- Page 87 and 88:

4 LEAVEThe period of part time adop

- Page 89 and 90:

4 LEAVE4.3 ANNUAL LEAVE LOADING4.3.

- Page 91 and 92:

4 LEAVE4.4 ENTITLEMENTS FOR SHORT T

- Page 93 and 94:

4 LEAVEIn normal circumstances, a s

- Page 95 and 96:

4 LEAVEi) on the completion of five

- Page 97 and 98:

4 LEAVEfull rate of allowance and w

- Page 99 and 100:

4 LEAVE2002, staff members eligible

- Page 101 and 102:

4 LEAVEA staff member who has acqui

- Page 103 and 104:

4 LEAVEonly if the Director-General

- Page 105 and 106:

4 LEAVE4.7 LEAVE WITHOUT PAY4.7.1 G

- Page 107 and 108:

4 LEAVEReplacement staff members ar

- Page 109 and 110:

4 LEAVEPart time leave without pay

- Page 111 and 112:

4 LEAVE4.8 MILITARY LEAVEMilitary l

- Page 113 and 114:

4 LEAVE4.9 RECREATION LEAVE4.9.1 RE

- Page 115 and 116:

4 LEAVEa) To take accrued recreatio

- Page 117 and 118:

4 LEAVE4.10 ROSTERED DAYS OFF4.10.1

- Page 119 and 120:

4 LEAVE4.11.2.4 New Appointeesa) St

- Page 121 and 122:

4 LEAVE4.11.4 EXHAUSTION OF PAID SI

- Page 123 and 124:

4 LEAVESection 4.11.8; orc) the Dir

- Page 125 and 126:

4 LEAVE4.11.9.3 Grant of Special Le

- Page 127 and 128:

4 LEAVEa) of their fitness or other

- Page 129 and 130:

4 LEAVEAPPENDIX ATHE UNDERTAKINGUND

- Page 131 and 132:

4 LEAVE4.12 SPECIAL LEAVE4.12.1 GEN

- Page 133 and 134:

4 LEAVE4.12.6 EMERGENCIESWhere a st

- Page 135 and 136:

4 LEAVE4.12.8.2 Return HomeStaff un

- Page 137 and 138:

4 LEAVESpecial leave for up to one

- Page 139 and 140:

4 LEAVEc) private study for an appr

- Page 141 and 142:

4 LEAVEhas been granted to a staff

- Page 143 and 144:

4 LEAVECourses for which study time

- Page 145 and 146:

4 LEAVE4.14.2.18 AccumulationSubjec

- Page 147 and 148: 4 LEAVE4.14.5 STUDY LEAVE4.14.5.1 G

- Page 149 and 150: 4 LEAVEb) Meetings of the union’s

- Page 151 and 152: 4 LEAVEc) Workplace conference or m

- Page 153 and 154: 4 LEAVEThe on loan arrangements app

- Page 155 and 156: 4 LEAVE4.16 VACATION LEAVE4.16.1 VA

- Page 157 and 158: 4 LEAVE4.17 WORKERS’ COMPENSATION

- Page 159 and 160: 4 LEAVE4.17.5 LEAVE ENTITLEMENTSAcc

- Page 161 and 162: CONTENTSOccupational Health and Saf

- Page 163 and 164: 6 OCCUPATIONAL HEALTH AND SAFETY Em

- Page 165 and 166: 6 OCCUPATIONAL HEALTH AND SAFETY Em

- Page 167 and 168: 6 OCCUPATIONAL HEALTH AND SAFETY Oc

- Page 169 and 170: RATES OF PAY AND ALLOWANCES7.1 PAYM

- Page 171 and 172: RATES OF PAY AND ALLOWANCES(i)(ii)a

- Page 173 and 174: RATES OF PAY AND ALLOWANCESGeneral

- Page 175 and 176: RATES OF PAY AND ALLOWANCES7.2.3 NO

- Page 177 and 178: RATES OF PAY AND ALLOWANCES• when

- Page 179 and 180: RATES OF PAY AND ALLOWANCESGrade C

- Page 181 and 182: RATES OF PAY AND ALLOWANCESthe plac

- Page 183 and 184: CONTENTSSeparation from the Service

- Page 185 and 186: 8 SEPARATION FROM THE SERVICE8.1.3

- Page 187 and 188: 8 SEPARATION FROM THE SERVICE8.1.8

- Page 189 and 190: 8 SEPARATION FROM THE SERVICE8.2 ME

- Page 191 and 192: 8 SEPARATION FROM THE SERVICE8.2.8.

- Page 193 and 194: CONTENTSSuperannuation9.3.5 SASS CO

- Page 195 and 196: CONTENTSSuperannuation9.1 INTRODUCT

- Page 197: 9 SUPERANNUATIONcannot accept perso

- Page 201 and 202: 9 SUPERANNUATION9.4 STATE SUPERANNU

- Page 203 and 204: 9 SUPERANNUATIONarranged through co

- Page 205 and 206: 9 SUPERANNUATIONyears, early volunt

- Page 207 and 208: 9 SUPERANNUATION9.5.4.6 Employee’

- Page 209 and 210: 9 SUPERANNUATION9.5.6 CHOICE OF SUP

- Page 211 and 212: 9 SUPERANNUATIONFor more informatio

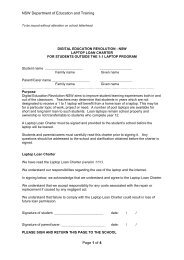

- Page 213 and 214: APPENDICES10 APPENDICES10.1 REGIONA

- Page 215 and 216: APPENDICESfax: (02) 4251 9945Goulbu

- Page 217 and 218: APPENDICES10.1.5 NORTHERN SYDNEY RE

- Page 219 and 220: APPENDICESfax: (02) 9582 6340 fax:

- Page 221 and 222: APPENDICESphone: (02) 6883 6300fax:

- Page 223 and 224: APPENDICES10.2 OTHER ADDRESSES10.2.

- Page 225 and 226: APPENDICES10.3 APPENDICES TO STAFF

- Page 227: APPENDICESEXAMPLE OF LOCAL SUPPORT