1 general conditions of employment - Department of Education and ...

1 general conditions of employment - Department of Education and ...

1 general conditions of employment - Department of Education and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

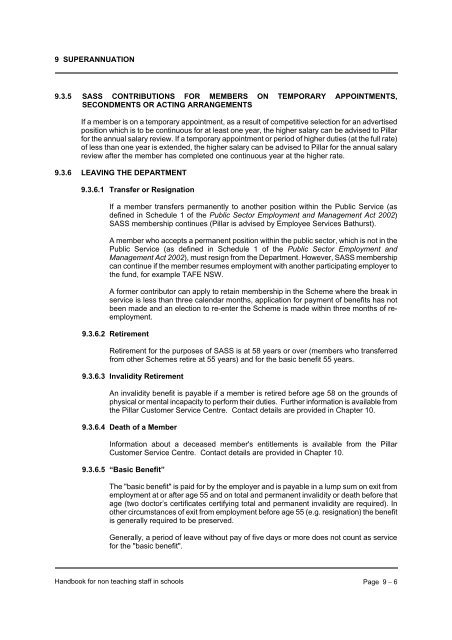

9 SUPERANNUATION9.3.5 SASS CONTRIBUTIONS FOR MEMBERS ON TEMPORARY APPOINTMENTS,SECONDMENTS OR ACTING ARRANGEMENTSIf a member is on a temporary appointment, as a result <strong>of</strong> competitive selection for an advertisedposition which is to be continuous for at least one year, the higher salary can be advised to Pillarfor the annual salary review. If a temporary appointment or period <strong>of</strong> higher duties (at the full rate)<strong>of</strong> less than one year is extended, the higher salary can be advised to Pillar for the annual salaryreview after the member has completed one continuous year at the higher rate.9.3.6 LEAVING THE DEPARTMENT9.3.6.1 Transfer or ResignationIf a member transfers permanently to another position within the Public Service (asdefined in Schedule 1 <strong>of</strong> the Public Sector Employment <strong>and</strong> Management Act 2002)SASS membership continues (Pillar is advised by Employee Services Bathurst).A member who accepts a permanent position within the public sector, which is not in thePublic Service (as defined in Schedule 1 <strong>of</strong> the Public Sector Employment <strong>and</strong>Management Act 2002), must resign from the <strong>Department</strong>. However, SASS membershipcan continue if the member resumes <strong>employment</strong> with another participating employer tothe fund, for example TAFE NSW.A former contributor can apply to retain membership in the Scheme where the break inservice is less than three calendar months, application for payment <strong>of</strong> benefits has notbeen made <strong>and</strong> an election to re-enter the Scheme is made within three months <strong>of</strong> re<strong>employment</strong>.9.3.6.2 RetirementRetirement for the purposes <strong>of</strong> SASS is at 58 years or over (members who transferredfrom other Schemes retire at 55 years) <strong>and</strong> for the basic benefit 55 years.9.3.6.3 Invalidity RetirementAn invalidity benefit is payable if a member is retired before age 58 on the grounds <strong>of</strong>physical or mental incapacity to perform their duties. Further information is available fromthe Pillar Customer Service Centre. Contact details are provided in Chapter 10.9.3.6.4 Death <strong>of</strong> a MemberInformation about a deceased member's entitlements is available from the PillarCustomer Service Centre. Contact details are provided in Chapter 10.9.3.6.5 “Basic Benefit”The "basic benefit" is paid for by the employer <strong>and</strong> is payable in a lump sum on exit from<strong>employment</strong> at or after age 55 <strong>and</strong> on total <strong>and</strong> permanent invalidity or death before thatage (two doctor’s certificates certifying total <strong>and</strong> permanent invalidity are required). Inother circumstances <strong>of</strong> exit from <strong>employment</strong> before age 55 (e.g. resignation) the benefitis <strong>general</strong>ly required to be preserved.Generally, a period <strong>of</strong> leave without pay <strong>of</strong> five days or more does not count as servicefor the "basic benefit".H<strong>and</strong>book for non teaching staff in schools Page 9 − 6