Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

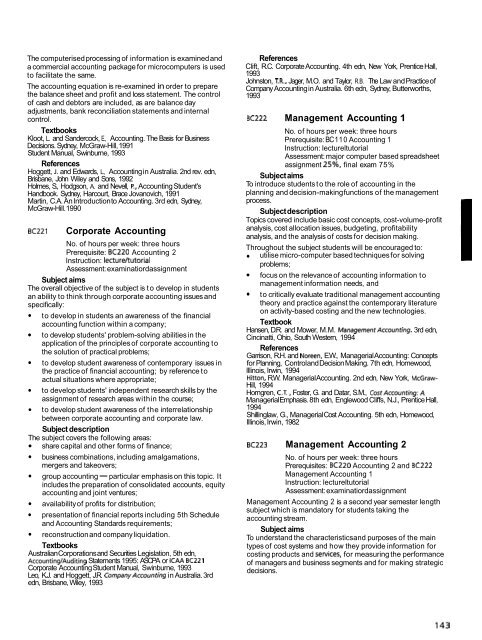

The computerised processing <strong>of</strong> information is examined and<br />

a commercial accounting package for microcomputers is used<br />

to facilitate the same.<br />

The accounting equation is re-examined in order to prepare<br />

the balance sheet and pr<strong>of</strong>it and loss statement. The control<br />

<strong>of</strong> cash and debtors are included, as are balance day<br />

adjustments, bank reconciliation statements and internal<br />

control.<br />

Textbooks<br />

Kloot, L. and Sandercock, E., Accounting. The Basis for Business<br />

Decisions. Sydney, McGraw-Hill, 1991<br />

Student Manual, <strong>Swinburne</strong>, 1993<br />

References<br />

Hoggett, J. and Edwards, L., Accounting in Australia. 2nd rev. edn,<br />

Brisbane, John Wiley and Sons, 1992<br />

Holmes, S., Hodgson, A. and Nevell, P., Accounting Student's<br />

Handbook. Sydney, Harcourt, Brace Jovanovich, 1991<br />

Martin, C.A. An Introduction to Accounting. 3rd edn, Sydney,<br />

McGraw-Hill. 1990<br />

~ ~ 2 2 1 Corporate Accounting<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: BC220 Accounting 2<br />

Instruction: lectureftutorial<br />

Assessment: examinatiordassignment<br />

Subject aims<br />

The overall objective <strong>of</strong> the subject is to develop in students<br />

an ability to think through corporate accounting issues and<br />

specifically:<br />

to develop in students an awareness <strong>of</strong> the financial<br />

accounting function within a company;<br />

to develop students' problem-solving abilities in the<br />

application <strong>of</strong> the principles <strong>of</strong> corporate accounting to<br />

the solution <strong>of</strong> practical problems;<br />

to develop student awareness <strong>of</strong> contemporary issues in<br />

the practice <strong>of</strong> financial accounting; by reference to<br />

actual situations where appropriate;<br />

to develop students' independent research skills by the<br />

assignment <strong>of</strong> research areas within the course;<br />

to develop student awareness <strong>of</strong> the interrelationship<br />

between corporate accounting and corporate law.<br />

Subject description<br />

The subject covers the following areas:<br />

share capital and other forms <strong>of</strong> finance;<br />

business combinations, including amalgamations,<br />

mergers and takeovers;<br />

group accounting - particular emphasis on this topic. It<br />

includes the preparation <strong>of</strong> consolidated accounts, equity<br />

accounting and joint ventures;<br />

availability <strong>of</strong> pr<strong>of</strong>its for distribution;<br />

presentation <strong>of</strong> financial reports including 5th Schedule<br />

and Accounting Standards requirements;<br />

reconstruction and company liquidation.<br />

Textbooks<br />

Australian Corporations and Securities Legislation, 5th edn,<br />

AccountingIAuditing Statements 1995: ASCPA or ICAA BC22l<br />

Corporate Accounting Student Manual, <strong>Swinburne</strong>, 1993<br />

Leo, K.J. and Hoggett, J.R. CompanyAccounting in Australia. 3rd<br />

edn, Brisbane, Wiley, 1993<br />

References<br />

Clift, R.C. Corporate Accounting. 4th edn, New York, Prentice Hall,<br />

1993<br />

Johnston, T.R., Jager, M.O. and Taylor, R.B. The Law and Practice <strong>of</strong><br />

Company Accounting in Australia. 6th edn, Sydney, Butterworths,<br />

1993<br />

BC222 Management Accounting 1<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: BC 1 10 Accounting 1<br />

Instruction: lectureltutorial<br />

Assessment: major computer based spreadsheet<br />

assignment 25%, final exam 75%<br />

Subject aims<br />

To introduce students to the role <strong>of</strong> accounting in the<br />

planning and decision-making functions <strong>of</strong> the management<br />

process.<br />

Subject description<br />

Topics covered include basic cost concepts, cost-volume-pr<strong>of</strong>it<br />

analysis, cost allocation issues, budgeting, pr<strong>of</strong>itability<br />

analysis, and the analysis <strong>of</strong> costs for decision making.<br />

Throughout the subject students will be encouraged to:<br />

utilise micro-computer based techniques for solving<br />

problems;<br />

focus on the relevance <strong>of</strong> accounting information to<br />

management information needs, and<br />

to critically evaluate traditional management accounting<br />

theory and practice against the contemporary literature<br />

on activity-based costing and the new technologies.<br />

Textbook<br />

Hansen, D.R. and Mower, M.M. ManagementAccounting. 3rd edn,<br />

Cincinatti, Ohio, South Western, 1994<br />

References<br />

Garrison, R.H. and Noreen, E.W., Managerial Accounting: Concepts<br />

for Planning, Control and Decision Making. 7th edn, Homewood,<br />

Illinois, Irwin, 1994<br />

Hitton, R.W. Managerial Accounting. 2nd edn, New York, McGraw-<br />

Hill, 1994<br />

Horngren, C.T., Foster, G. and Datar, S.M., CostAccounting:A<br />

Managerial Emphasis. 8th edn, Englewood Cliffs, N.J., Prentice Hall,<br />

1994<br />

Shillinglaw, G., Managerial Cost Accounting. 5th edn, Homewood,<br />

Illinois, Irwin, 1982<br />

8~223 Management Accounting 2<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisites: BC22O Accounting 2 and BC222<br />

Management Accounting 1<br />

Instruction: lectureltutorial<br />

Assessment: examinatiordassignment<br />

Management Accounting 2 is a second year semester length<br />

subject which is mandatory for students taking the<br />

accounting stream.<br />

Subject aims<br />

To understand the characteristics and purposes <strong>of</strong> the main<br />

types <strong>of</strong> cost systems and how they provide information for<br />

costing products and sewices, for measuring the performance<br />

<strong>of</strong> managers and business segments and for making strategic<br />

decisions.