Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Subject description<br />

A selection <strong>of</strong> topics including the scheme <strong>of</strong> the income tax<br />

assessment act, assessable income, statutory inclusions and<br />

exclusions in income, source derivation and residency,<br />

allowable and specific deductions.<br />

References<br />

Australian Master Tax Guide, North Ryde, N.S.W. CCH Australia Ltd.<br />

Australian lncome Tax Assessment Act 1936, CCH Australia Ltd.<br />

Australian Federal Tax Reporte~ North R yde, N.S.W. CC H Australia<br />

Ltd.<br />

~orkocz~, S. Australian Tax Casebook, North Ryde, N.S.W., CCH<br />

Australia Ltd, 1993<br />

Lehmann, G. and Coleman, C. Taxation Law in Australia, 3rd edn,<br />

Sydney, Butterworths, 1994<br />

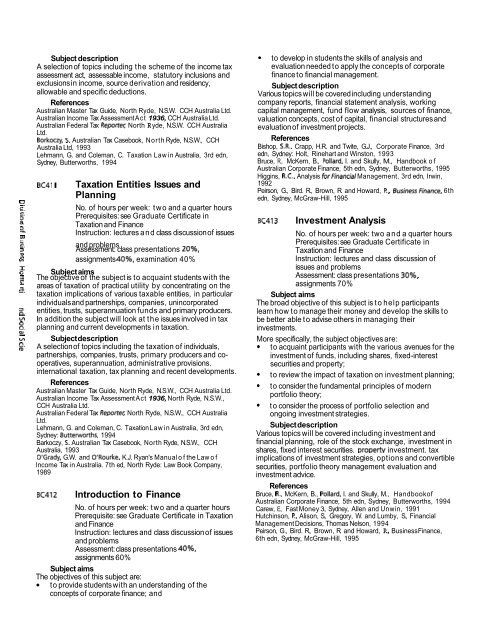

BC~I Taxation Entities Issues and<br />

Planning<br />

-. 0<br />

c -. No. <strong>of</strong> hours per week: two and a quarter hours<br />

g. Prerequisites: see Graduate Certificate in<br />

a<br />

Taxation and Finance<br />

2.<br />

Instruction: lectures and class discussion <strong>of</strong> issues<br />

m<br />

6 and problems<br />

=I Assessment: class presentations 20%,<br />

W<br />

vl assignments 40%, examination 40%<br />

I c<br />

Subject aims<br />

The objective <strong>of</strong> the subject is to acquaint students with the<br />

2, areas <strong>of</strong> taxation <strong>of</strong> practical utility by concentrating on the<br />

" taxation implications <strong>of</strong> various taxable entities, in particular<br />

cn<br />

individuals and partnerships, companies, unincorporated<br />

entities, trusts, superannuation funds and primary producers.<br />

In addition the subject will look at the issues involved in tax<br />

4. planning and current developments in taxation.<br />

L<br />

~1 Subject description<br />

2. A selection <strong>of</strong> topics including the taxation <strong>of</strong> individuals,<br />

partnerships, companies, trusts, primary producers and cooperatives,<br />

superannuation, administrative provisions.<br />

international taxation, tax planning and recent developments.<br />

References<br />

Australian Master Tax Guide, North Ryde, N.S.W., CCH Australia Ltd.<br />

Australian lncome Tax Assessment Act 1936, North Ryde, N.S.W.,<br />

CCH Australia Ltd.<br />

Australian Federal Tax Reportec North Ryde, N.S.W., CCH Australia<br />

Ltd.<br />

Lehmann, G. and Coleman, C. Taxation Law in Australia, 3rd edn,<br />

Sydney: Butteworths, 1994<br />

Barkoczy, 5. Australian Tax Casebook, North Ryde, N.S.W., CCH<br />

Australia, 1993<br />

O'Grady, G.W. and O'Rourke, K.J. Ryan's Manual <strong>of</strong> the Law <strong>of</strong><br />

lncome Tax in Australia. 7th ed, North Ryde: Law Book Company,<br />

1989<br />

~ ~ 4 1 2 Introduction to Finance<br />

No. <strong>of</strong> hours per week: two and a quarter hours<br />

Prerequisite: see Graduate Certificate in Taxation<br />

and Finance<br />

Instruction: lectures and class discussion <strong>of</strong> issues<br />

and problems<br />

Assessment: class presentations 40%,<br />

assignments 60%<br />

Subject aims<br />

The objectives <strong>of</strong> this subject are:<br />

to provide students with an understanding <strong>of</strong> the<br />

concepts <strong>of</strong> corporate finance; and<br />

to develop in students the skills <strong>of</strong> analysis and<br />

evaluation needed to apply the concepts <strong>of</strong> corporate<br />

finance to financial management.<br />

Subject description<br />

Various topics will be covered including understanding<br />

company reports, financial statement analysis, working<br />

capital management, fund flow analysis, sources <strong>of</strong> finance,<br />

valuation concepts, cost <strong>of</strong> capital, financial structures and<br />

evaluation <strong>of</strong> investment projects.<br />

References<br />

Bishop, S.R., Crapp, H.R. and Twite, G.J., Corporate Finance, 3rd<br />

edn, Sydney: Holt, Rinehart and Winston, 1993<br />

Bruce, R., McKern, B., Pollard, I. and Skully, M., Handbook <strong>of</strong><br />

Australian Corporate Finance, 5th edn, Sydney, Butterworths, 1995<br />

Higgins, R.C.. Analysis forFinancia1 Management, 3rd edn, Irwin,<br />

1992<br />

Peirson, G., Bird. R., Brown, R. and Howard, P., BusinessFinance, 6th<br />

edn, Sydney, McGraw-Hill, 1995<br />

BC413 Investment Analysis<br />

No. <strong>of</strong> hours per week: two and a quarter hours<br />

Prerequisites: see Graduate Certificate in<br />

Taxation and Finance<br />

Instruction: lectures and class discussion <strong>of</strong><br />

issues and problems<br />

Assessment: class presentations 30%,<br />

assignments 70%<br />

Subject aims<br />

The broad objective <strong>of</strong> this subject is to help participants<br />

learn how to manage their money and develop the skills to<br />

be better able to advise others in managing their<br />

investments.<br />

More specifically, the subject objectives are:<br />

to acquaint participants with the various avenues for the<br />

investment <strong>of</strong> funds, including shares, fixed-interest<br />

securities and property;<br />

to review the impact <strong>of</strong> taxation on investment planning;<br />

to consider the fundamental principles <strong>of</strong> modern<br />

portfolio theory;<br />

to consider the process <strong>of</strong> portfolio selection and<br />

ongoing investment strategies.<br />

Subject description<br />

Various topics will be covered including investment and<br />

financial planning, role <strong>of</strong> the stock exchange, investment in<br />

shares, fixed interest securities. Dropertv investment. tax<br />

implications <strong>of</strong> investment strategies, options and convertible<br />

securities, portfolio theory management evaluation and<br />

investment advice.<br />

References<br />

Bruce, R., McKern, B., Pollard, I. and Skully, M., Handbook<strong>of</strong><br />

Australian Corporate Finance, 5th edn, Sydney, Butterworths, 1994<br />

Carew, E., Fast Money 3, Sydney, Allen and Unwin, 1991<br />

Hutchinson, P., Alison, S., Gregory, W. and Lumby, S., Financial<br />

Management Decisions, Thomas Nelson, 1994<br />

Peirson, G., Bird. R., Brown, R. and Howard, P., Business Finance,<br />

6th edn, Sydney, McGraw-Hill, 1995