Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

E.<br />

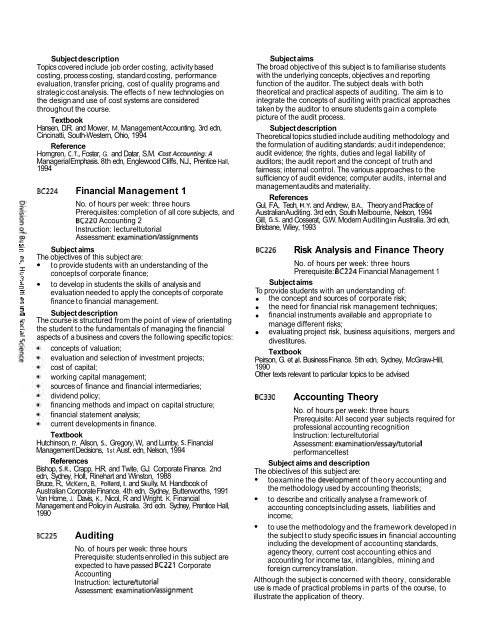

Subject description<br />

Topics covered include job order costing, activity based<br />

costing, process costing, standard costing, performance<br />

evaluation, transfer pricing, cost <strong>of</strong> quality programs and<br />

strategic cost analysis. The effects <strong>of</strong> new technologies on<br />

the design and use <strong>of</strong> cost systems are considered<br />

throughout the course.<br />

Textbook<br />

Hansen, D.R. and Mower, M. Management Accounting. 3rd edn,<br />

Cincinatti, South-Western, Ohio, 1994<br />

Reference<br />

Horngren, C.T., Foster, G. and Datar, S.M. CostAccounting:A<br />

Managerial Emphasis. 8th edn, Englewood Cliffs, N.J., Prentice Hall,<br />

1994<br />

~ ~ 2 2 4 Financial Management 1<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisites: completion <strong>of</strong> all core subjects, and<br />

BC220 Accounting 2<br />

Instruction: lectureltutorial<br />

Assessment: examination/assignments<br />

3 Subject aims<br />

2 The objectives <strong>of</strong> this subject are:<br />

V)<br />

; to provide students with an understanding <strong>of</strong> the<br />

C concepts <strong>of</strong> corporate finance;<br />

3<br />

3<br />

to develop in students the skills <strong>of</strong> analysis and<br />

-.<br />

R evaluation needed to apply the concepts <strong>of</strong> corporate<br />

2 -. finance to financial management.<br />

,a<br />

3<br />

a<br />

Subject description<br />

The course is structured from the point <strong>of</strong> view <strong>of</strong> orientating<br />

4. the student to the fundamentals <strong>of</strong> managing the financial<br />

aspects <strong>of</strong> a business and covers the following specific topics:<br />

concepts <strong>of</strong> valuation;<br />

evaluation and selection <strong>of</strong> investment projects;<br />

cost <strong>of</strong> capital;<br />

working capital management;<br />

sources <strong>of</strong> finance and financial intermediaries;<br />

dividend policy;<br />

financing methods and impact on capital structure;<br />

financial statement analysis;<br />

current developments in finance.<br />

Textbook<br />

Hutchinson, I?, Alison, 5.. Gregory, W., and Lumby, S. Financial<br />

Management Decisions, 1 st Aust. edn, Nelson, 1994<br />

References<br />

Bishop, S.R., Crapp, H.R. and Twite, G.J. Corporate Finance. 2nd<br />

edn, Sydney, Holt, Rinehart and Winston, 1988<br />

Bruce, R., McKern, B., Pollard, I. and Skully, M. Handbook <strong>of</strong><br />

Australian Corporate Finance. 4th edn, Sydney, Butterworths, 1991<br />

Van Horne, J., Davis, K., Nicol, R. and Wright. K. Financial<br />

Management and Policy in Australia. 3rd edn. Sydney, Prentice Hall,<br />

1990<br />

~ ~ 2 2 5 Auditing<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: students enrolled in this subject are<br />

expected to have passed BC221 Corporate<br />

Accounting<br />

Instruction: lecture/tutorial<br />

Assessment: examinationlassignment<br />

Subject aims<br />

The broad objective <strong>of</strong> this subject is to familiarise students<br />

with the underlying concepts, objectives and reporting<br />

function <strong>of</strong> the auditor. The subject deals with both<br />

theoretical and practical aspects <strong>of</strong> auditing. The aim is to<br />

integrate the concepts <strong>of</strong> auditing with practical approaches<br />

taken by the auditor to ensure students gain a complete<br />

picture <strong>of</strong> the audit process.<br />

Subject description<br />

Theoretical topics studied include auditing methodology and<br />

the formulation <strong>of</strong> auditing standards; audit independence;<br />

audit evidence; the rights, duties and legal liability <strong>of</strong><br />

auditors; the audit report and the concept <strong>of</strong> truth and<br />

fairness; internal control. The various approaches to the<br />

sufficiency <strong>of</strong> audit evidence; computer audits, internal and<br />

management audits and materiality.<br />

References<br />

Gul, F.A., Teoh, H.Y. and Andrew, B.A., Theory and Practice <strong>of</strong><br />

Australian Auditing. 3rd edn, South Melbourne, Nelson, 1994<br />

Gill, 6.5. and Cosserat, G.W. Modern Auditing in Australia. 3rd edn,<br />

Brisbane, Wiley, 1993<br />

BC226<br />

Risk Analysis and Finance Theory<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: BC224 Financial Management 1<br />

Subject aims<br />

To provide students with an understanding <strong>of</strong>:<br />

the concept and sources <strong>of</strong> corporate risk;<br />

the need for financial risk management techniques;<br />

financial instruments available and appropriate to<br />

manage different risks;<br />

evaluating project risk, business aquisitions, mergers and<br />

divestitures.<br />

Textbook<br />

Peirson, G. et al. Business Finance. 5th edn, Sydney, McGraw-Hill,<br />

1990<br />

Other texts relevant to particular topics to be advised<br />

BC330<br />

Accounting Theory<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: All second year subjects required for<br />

pr<strong>of</strong>essional accounting recognition<br />

Instruction: lectureltutorial<br />

Assessment: examination/essayltutorial<br />

performanceltest<br />

Subject aims and description<br />

The obiectives <strong>of</strong> this subiect are:<br />

toexamine the deve~b~ment <strong>of</strong> theory accounting and<br />

the methodology used by accounting theorists;<br />

to describe and critically analyse a framework <strong>of</strong><br />

accounting concepts including assets, liabilities and<br />

income;<br />

to use the methodology and the framework developed in<br />

the subject to study specific issues in financial accounting<br />

including the development <strong>of</strong> accountinq standards,<br />

agency theory, current cost accounting ethics and<br />

accounting for income tax, intangibles, mining and<br />

foreign currency translation.<br />

Although the subject is concerned with theory, considerable<br />

use is made <strong>of</strong> practical problems in parts <strong>of</strong> the course, to<br />

illustrate the application <strong>of</strong> theory.