Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The subject makes extensive use <strong>of</strong> audit oriented s<strong>of</strong>tware<br />

packages.<br />

Textbooks<br />

Weber, R. EDP: Conceptual Foundations and Practice. 2nd edn, New<br />

York, McGraw-Hill, 1988<br />

Current journals and articles<br />

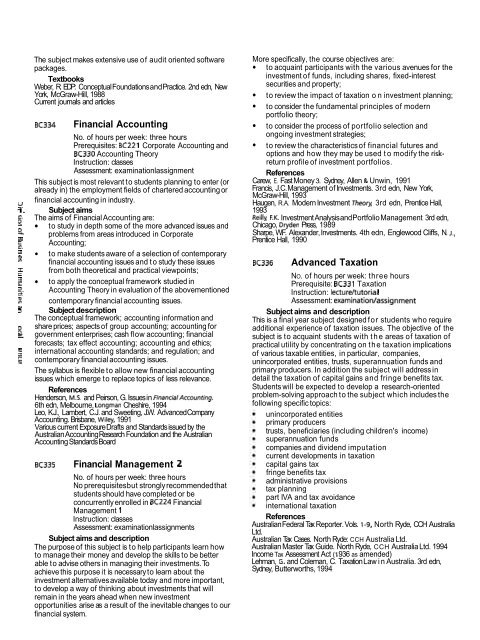

~ ~ 3 3 4 Financial Accounting<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisites: BC221 Corporate Accounting and<br />

BC330 Accounting Theory<br />

Instruction: classes<br />

Assessment: examinationlassignment<br />

This subject is most relevant to students planning to enter (or<br />

already in) the employment fields <strong>of</strong> chartered accounting or<br />

-<br />

u<br />

financial accounting in industry.<br />

-.<br />

1. Subject aims<br />

g. The aims <strong>of</strong> Financial Accounting are:<br />

to study in depth some <strong>of</strong> the more advanced issues and<br />

% problems from areas introduced in Corporate<br />

6.<br />

Accounting;<br />

to make students aware <strong>of</strong> a selection <strong>of</strong> contemporary<br />

W VI<br />

financial accounting issues and to study these issues<br />

I from both theoretical and practical viewpoints;<br />

C -<br />

to apply the conceptual framework studied in<br />

1. Accounting Theory in evaluation <strong>of</strong> the abovementioned<br />

CT<br />

3 contemporary financial accounting issues.<br />

OI<br />

2 Subject description<br />

The conceptual framework; accounting information and<br />

g. share prices; aspects <strong>of</strong> group accounting; accounting for<br />

L government enterprises; cash flow accounting; financial<br />

forecasts; tax effect accounting; accounting and ethics;<br />

international accounting standards; and regulation; and<br />

contemporary financial accounting issues.<br />

The syllabus is flexible to allow new financial accounting<br />

issues which emerge to replace topics <strong>of</strong> less relevance.<br />

References<br />

Henderson, M.S. and Peirson, G. Issues in FinancialAccounting.<br />

6th edn, Melbourne, Longman Cheshire, 1994<br />

Leo, K.J., Lambert, C.J. and Sweeting, J.W. Advanced Company<br />

Accounting. Brisbane, Wiley, 1991<br />

Various current Exposure Drafts and Standards issued by the<br />

Australian Accounting Research Foundation and the Australian<br />

Accounting Standards Board<br />

~ ~ 3 3 5 Financial Management 2<br />

No. <strong>of</strong> hours per week: three hours<br />

No prerequisites but strongly recommended that<br />

students should have completed or be<br />

concurrently enrolled in BC224 Financial<br />

Management I<br />

Instruction: classes<br />

Assessment: examinationlassignments<br />

Subject aims and description<br />

The purpose <strong>of</strong> this subject is to help participants learn how<br />

to manage their money and develop the skills to be better<br />

able to advise others in managing their investments. To<br />

achieve this purpose it is necessary to learn about the<br />

investment alternatives available today and more important,<br />

to develop a way <strong>of</strong> thinking about investments that will<br />

remain in the years ahead when new investment<br />

opportunities arise as a result <strong>of</strong> the inevitable changes to our<br />

financial system.<br />

More specifically, the course objectives are:<br />

to acquaint participants with the various avenues for the<br />

investment <strong>of</strong> funds, including shares, fixed-interest<br />

securities and property;<br />

to review the impact <strong>of</strong> taxation on investment planning;<br />

to consider the fundamental principles <strong>of</strong> modern<br />

portfolio theory;<br />

to consider the process <strong>of</strong> portfolio selection and<br />

ongoing investment strategies;<br />

to review the characteristics <strong>of</strong> financial futures and<br />

options and how they may be used to modify the riskreturn<br />

pr<strong>of</strong>ile <strong>of</strong> investment portfolios.<br />

References<br />

Carew, E. Fast Money 3. Sydney, Allen & Unwin, 1991<br />

Francis, J.C. Management <strong>of</strong> Investments. 3rd edn, New York,<br />

McGraw-Hill, 1993<br />

Haugen, R.A. Modern Investment Theorx 3rd edn, Prentice Hall,<br />

1993<br />

Reilly, F.K. Investment Analysis and Portfolio Management 3rd edn,<br />

Chicago, Dryden Press, 1989<br />

Sharpe, W.F. Alexander, Investments. 4th edn, Englewood Cliffs, N. J.,<br />

Prentice Hall, 1990<br />

BC336<br />

Advanced Taxation<br />

NO. <strong>of</strong> hours per week: three hours<br />

Prerequisite: BC331 Taxation<br />

Instruction: lectureltutorial<br />

Assessment: examination/assignment<br />

Subject aims and description<br />

This is a final year subject designed for students who require<br />

additional experience <strong>of</strong> taxation issues. The objective <strong>of</strong> the<br />

subject is to acquaint students with the areas <strong>of</strong> taxation <strong>of</strong><br />

practical utility by concentrating on the taxation implications<br />

<strong>of</strong> various taxable entities, in particular, companies,<br />

unincorporated entities, trusts, superannuation funds and<br />

primary producers. In addition the subject will address in<br />

detail the taxation <strong>of</strong> capital gains and fringe benefits tax.<br />

Students will be expected to develop a research-oriented<br />

problem-solving approach to the subject which includes the<br />

following specific topics:<br />

unincorporated entities<br />

primary producers<br />

trusts, beneficiaries (including children's income)<br />

superannuation funds<br />

companies and dividend imputation<br />

current developments in taxation<br />

capital gains tax<br />

fringe benefits tax<br />

administrative provisions<br />

tax planning<br />

part IVA and tax avoidance<br />

international taxation<br />

References<br />

Australian Federal Tax Reporter. Vols. 1-9, North Ryde, CCH Australia<br />

Ltd.<br />

Australian Tax Cases. North Ryde: CCH Australia Ltd.<br />

Australian Master Tax Guide. North Ryde, CCH Australia Ltd. 1994<br />

Income Tax Assessment Act (1 936 as amended)<br />

Lehman, G, and Coleman, C. Taxation Law in Australia. 3rd edn,<br />

Sydney, Butterworths, 1994