Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Textbook<br />

Henderson, M.S. and Peirson, G. Issues in Financial Accounting. 6th<br />

edn, Melbourne, Longman Cheshire, 1994<br />

References<br />

Godfrey, J. etal., Accounting Theor)! 2nd edn, Brisbane, Wiley, 1994<br />

Henderson, MS., Peirson, G. and Brown, R. FinancialAccounting<br />

Theory, Its Nature and Development. 2nd edn, Melbourne, Longman<br />

Cheshire, 1992<br />

Matthews, M. and Perera, M. Accounting Theory& Development.<br />

2nd edn, Melbourne, Nelson, 1993<br />

Whittred, G. and Zirnmer, I. Financial Accounting: Incentive Effects &<br />

Economic Consequences. 3rd edn, Sydney, Holt, Rinehart and<br />

Winston, 1992<br />

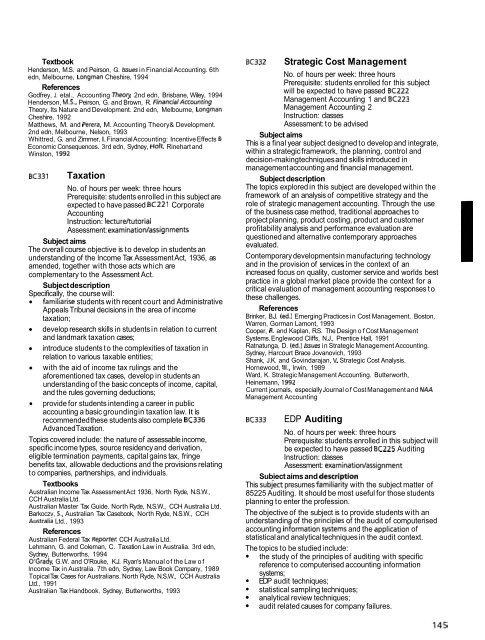

~ ~ 3 3 1 Taxation<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: students enrolled in this subject are<br />

expected to have passed BC22l Corporate<br />

Accounting<br />

Instruction: lectureltutorial<br />

Assessment: examination/assignments<br />

Subject aims<br />

The overall course objective is to develop in students an<br />

understanding <strong>of</strong> the lncome Tax Assessment Act, 1936, as<br />

amended, together with those acts which are<br />

complementary to the Assessment Act.<br />

Subject description<br />

Specifically, the course will:<br />

familiarise students with recent court and Administrative<br />

Appeals Tribunal decisions in the area <strong>of</strong> income<br />

taxation;<br />

develop research skills in students in relation to current<br />

and landmark taxation cases;<br />

introduce students to the complexities <strong>of</strong> taxation in<br />

relation to various taxable entities;<br />

with the aid <strong>of</strong> income tax rulings and the<br />

aforementioned tax cases, develop in students an<br />

understanding <strong>of</strong> the basic concepts <strong>of</strong> income, capital,<br />

and the rules governing deductions;<br />

provide for students intending a career in public<br />

accounting a basic grounding in taxation law. It is<br />

recommended these students also complete BC336<br />

Advanced Taxation.<br />

Topics covered include: the nature <strong>of</strong> assessable income,<br />

specific income types, source residency and derivation,<br />

eligible termination payments, capital gains tax, fringe<br />

benefits tax, allowable deductions and the provisions relating<br />

to companies, partnerships, and individuals.<br />

Textbooks<br />

Australian lncome Tax Assessment Act 1936, North Ryde, N.S.W.,<br />

CCH Australia Ltd.<br />

Australian Master Tax Guide. North Ryde, N.S.W., CCH Australia Ltd.<br />

Barkoczv, 5.. Australian Tax Casebook, North Ryde, N.S.W., CCH<br />

~ustralia Ltd., 1993<br />

References<br />

Australian Federal Tax Reporte,: CCH Australia Ltd.<br />

Lehmann, G. and Coleman, C. Taxation Law in Australia. 3rd edn,<br />

Sydney, Butterworths, 1994<br />

O'Grady, G.W. and O'Rouke, K.J. Ryan's Manual <strong>of</strong> the Law <strong>of</strong><br />

lncome Tax in Australia. 7th edn, Sydney, Law Book Company, 1989<br />

Topical Tax Cases for Australians. North Ryde, N.S.W., CCH Australia<br />

Ltd., 1991<br />

Australian Tax Handbook. Sydney, Butterworths, 1993<br />

8~332 Strategic Cost Management<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: students enrolled for this subject<br />

will be expected to have passed BC222<br />

Management Accounting 1 and BC223<br />

Management Accounting 2<br />

Instruction: classes<br />

Assessment: to be advised<br />

Subject aims<br />

This is a final year subject designed to develop and integrate,<br />

within a strategic framework, the planning, control and<br />

decision-making techniques and skills introduced in<br />

management accounting and financial management.<br />

Subject description<br />

The topics explored in this subject are developed within the<br />

framework <strong>of</strong> an analysis <strong>of</strong> competitive strategy and the<br />

role <strong>of</strong> strategic management accounting. Through the use<br />

<strong>of</strong> the business case method, traditional a~~roaches to<br />

project planning, product costing, product and customer<br />

pr<strong>of</strong>itability analysis and performance evaluation are<br />

questioned and alternative contemporary approaches<br />

evaluated.<br />

Contemporary developments in manufacturing technology<br />

and in the provision <strong>of</strong> services in the context <strong>of</strong> an<br />

increased focus on quality, customer service and worlds best<br />

practice in a global market place provide the context for a<br />

critical evaluation <strong>of</strong> management accounting responses to<br />

these challenges.<br />

References<br />

Brinker, B.J. (ed.) Emerging Practices in Cost Management. Boston,<br />

Warren, Gorman Lamont, 1993<br />

Cooper, R, and Kaplan, R.S. The Design <strong>of</strong> Cost Management<br />

Systems. Englewood Cliffs, N.J., Prentice Hall, 1991<br />

Ratnatunga, D. (ed.) Issues in Strategic Management Accounting.<br />

Sydney, Harcourt Brace Jovanovich, 1993<br />

Shank, J.K. and Govindarajan, V. Strategic Cost Analysis.<br />

Hornewood, Ill., Irwin, 1989<br />

Ward, K. Strategic Management Accounting. Butterworth,<br />

Heinemann, 1992<br />

Current journals, especially Journal <strong>of</strong> Cost Management and NAA<br />

Management Accounting<br />

~ ~ 3 3 3 EDP Auditing<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: students enrolled in this subject will<br />

be expected to have passed 8C225 Auditing<br />

Instruction: classes<br />

Assessment: examinationfassignment<br />

Subiect aims and descri~tion<br />

This subject presumes familiaity with the subject matter <strong>of</strong><br />

85225 Auditing. It should be most useful for those students<br />

planning to enter the pr<strong>of</strong>ession.<br />

The objective <strong>of</strong> the subject is to provide students with an<br />

understandina <strong>of</strong> the orincioles <strong>of</strong> the audit <strong>of</strong> comouterised<br />

accounting idormatidn sysiems and the applicatioi <strong>of</strong><br />

statistical and analytical techniques in the audit context.<br />

The topics to be studied include:<br />

the study <strong>of</strong> the principles <strong>of</strong> auditing with specific<br />

reference to computerised accounting information<br />

systems;<br />

EDP audit techniques;<br />

statistical sampling techniques;<br />

analytical review techniques;<br />

audit related causes for company failures.