Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

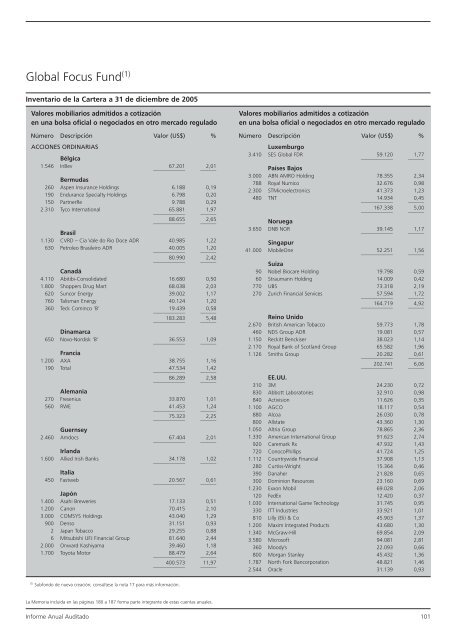

Global Focus Fund (1)<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

ACCIONES ORDINARIAS<br />

Bélgica<br />

1.546 InBev<br />

____________<br />

67.201<br />

______<br />

2,01<br />

Bermudas<br />

260 Aspen Insurance Holdings 6.188 0,19<br />

190 Endurance Specialty Holdings 6.798 0,20<br />

150 PartnerRe 9.788 0,29<br />

2.310 Tyco International<br />

____________<br />

65.881<br />

______<br />

1,97<br />

____________<br />

88.655<br />

______<br />

2,65<br />

Brasil<br />

1.130 CVRD – Cia Vale do Rio Doce ADR 40.985 1,22<br />

630 Petroleo Brasileiro ADR<br />

____________<br />

40.005<br />

______<br />

1,20<br />

____________<br />

80.990<br />

______<br />

2,42<br />

Canadá<br />

4.110 Abitibi-Consolidated 16.680 0,50<br />

1.800 Shoppers Drug Mart 68.038 2,03<br />

620 Suncor Energy 39.002 1,17<br />

760 Talisman Energy 40.124 1,20<br />

360 Teck Cominco ‘B’<br />

____________<br />

19.439<br />

______<br />

0,58<br />

____________<br />

183.283<br />

______<br />

5,48<br />

Dinamarca<br />

650 Novo-Nordisk ‘B’<br />

____________<br />

36.553<br />

______<br />

1,09<br />

Francia<br />

1.200 AXA 38.755 1,16<br />

190 Total<br />

____________<br />

47.534<br />

______<br />

1,42<br />

____________<br />

86.289<br />

______<br />

2,58<br />

Alemania<br />

270 Fresenius 33.870 1,01<br />

560 RWE<br />

____________<br />

41.453<br />

______<br />

1,24<br />

____________<br />

75.323<br />

______<br />

2,25<br />

Guernsey<br />

2.460 Amdocs<br />

____________<br />

67.404<br />

______<br />

2,01<br />

Irlanda<br />

1.600 Allied Irish Banks<br />

____________<br />

34.178<br />

______<br />

1,02<br />

Italia<br />

450 Fastweb<br />

____________<br />

20.567<br />

______<br />

0,61<br />

Japón<br />

1.400 Asahi Breweries 17.133 0,51<br />

1.200 Canon 70.415 2,10<br />

3.000 COMSYS Holdings 43.040 1,29<br />

900 Denso 31.151 0,93<br />

2 Japan Tobacco 29.255 0,88<br />

6 Mitsubishi UFJ Financial Group 81.640 2,44<br />

2.000 Onward Kashiyama 39.460 1,18<br />

1.700 Toyota Motor<br />

____________<br />

88.479<br />

______<br />

2,64<br />

____________<br />

400.573<br />

______<br />

11,97<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

Luxemburgo<br />

3.410 SES Global FDR<br />

____________<br />

59.120<br />

______<br />

1,77<br />

Países Bajos<br />

3.000 ABN AMRO Holding 78.355 2,34<br />

788 Royal Numico 32.676 0,98<br />

2.300 STMicroelectronics 41.373 1,23<br />

480 TNT<br />

____________<br />

14.934<br />

______<br />

0,45<br />

____________<br />

167.338<br />

______<br />

5,00<br />

Noruega<br />

3.650 DNB NOR<br />

____________<br />

39.145<br />

______<br />

1,17<br />

Singapur<br />

41.000 MobileOne<br />

____________<br />

52.251<br />

______<br />

1,56<br />

Suiza<br />

90 Nobel Biocare Holding 19.798 0,59<br />

60 Straumann Holding 14.009 0,42<br />

770 UBS 73.318 2,19<br />

270 Zurich Financial Services<br />

____________<br />

57.594<br />

______<br />

1,72<br />

____________<br />

164.719<br />

______<br />

4,92<br />

Reino Unido<br />

2.670 British American Tobacco 59.773 1,78<br />

460 NDS Group ADR 19.081 0,57<br />

1.150 Reckitt Benckiser 38.023 1,14<br />

2.170 Royal Bank of Scotland Group 65.582 1,96<br />

1.126 Smiths Group<br />

____________<br />

20.282<br />

______<br />

0,61<br />

____________<br />

202.741<br />

______<br />

6,06<br />

EE.UU.<br />

310 3M 24.230 0,72<br />

830 Abbott Laboratories 32.910 0,98<br />

840 Activision 11.626 0,35<br />

1.100 AGCO 18.117 0,54<br />

880 Alcoa 26.030 0,78<br />

800 Allstate 43.360 1,30<br />

1.050 Altria Group 78.865 2,36<br />

1.330 American International Group 91.623 2,74<br />

920 Caremark Rx 47.932 1,43<br />

720 ConocoPhillips 41.724 1,25<br />

1.112 Countrywide Financial 37.908 1,13<br />

280 Curtiss-Wright 15.364 0,46<br />

390 Danaher 21.828 0,65<br />

300 Dominion Resources 23.160 0,69<br />

1.230 Exxon Mobil 69.028 2,06<br />

120 FedEx 12.420 0,37<br />

1.030 International Game Technology 31.745 0,95<br />

330 ITT Industries 33.921 1,01<br />

810 Lilly (Eli) & Co 45.903 1,37<br />

1.200 Maxim Integrated Products 43.680 1,30<br />

1.340 McGraw-Hill 69.854 2,09<br />

3.580 Microsoft 94.081 2,81<br />

360 Moody’s 22.093 0,66<br />

800 Morgan Stanley 45.432 1,36<br />

1.787 North Fork Bancorporation 48.821 1,46<br />

2.544 Oracle 31.139 0,93<br />

(1) Subfondo de nueva creación; consúltese la nota 17 para más información.<br />

La Memoria incluida en las páginas 180 a 187 forma parte integrante de estas cuentas <strong>anual</strong>es.<br />

<strong>Informe</strong> Anual Auditado 101