Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

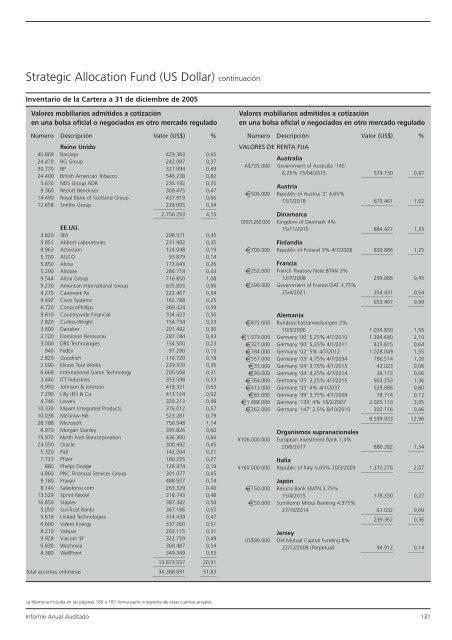

Strategic Allocation Fund (US Dollar) continuación<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

Reino Unido<br />

40.809 Barclays 429.383 0,65<br />

24.470 BG Group 242.087 0,37<br />

30.770 BP 327.994 0,49<br />

24.400 British American Tobacco 546.238 0,82<br />

5.670 NDS Group ADR 235.192 0,35<br />

9.360 Reckitt Benckiser 309.475 0,47<br />

14.490 Royal Bank of Scotland Group 437.919 0,66<br />

12.658 Smiths Group<br />

____________<br />

228.005<br />

______<br />

0,34<br />

____________<br />

2.756.293<br />

______<br />

4,15<br />

EE.UU.<br />

3.820 3M 298.571 0,45<br />

5.851 Abbott Laboratories 231.992 0,35<br />

8.963 Activision 124.048 0,19<br />

5.700 AGCO 93.879 0,14<br />

5.850 Alcoa 173.043 0,26<br />

5.290 Allstate 286.718 0,43<br />

9.544 Altria Group 716.850 1,08<br />

9.230 American International Group 635.855 0,96<br />

4.270 Caremark Rx 222.467 0,34<br />

9.492 Cisco Systems 162.788 0,25<br />

6.720 ConocoPhillips 389.424 0,59<br />

9.810 Countrywide Financial 334.423 0,50<br />

2.820 Curtiss-Wright 154.734 0,23<br />

3.600 Danaher 201.492 0,30<br />

3.720 Dominion Resources 287.184 0,43<br />

3.000 DRS Technologies 154.500 0,23<br />

940 FedEx 97.290 0,15<br />

2.820 Goodrich 116.720 0,18<br />

2.590 Illinois Tool Works 229.370 0,35<br />

6.668 International Game Technology 205.508 0,31<br />

3.440 ITT Industries 353.598 0,53<br />

6.950 Johnson & Johnson 418.321 0,63<br />

7.290 Lilly (Eli) & Co 413.124 0,62<br />

4.746 Lowe’s 320.213 0,48<br />

10.330 Maxim Integrated Products 376.012 0,57<br />

10.038 McGraw-Hill 523.281 0,79<br />

28.788 Microsoft 756.548 1,14<br />

6.970 Morgan Stanley 395.826 0,60<br />

15.970 North Fork Bancorporation 436.300 0,66<br />

24.550 Oracle 300.492 0,45<br />

5.320 Pall 142.204 0,21<br />

7.723 Pfizer 180.255 0,27<br />

880 Phelps Dodge 126.474 0,19<br />

4.860 PNC Financial Services Group 301.077 0,45<br />

9.180 Praxair 488.927 0,74<br />

8.140 Salesforce.com 263.329 0,40<br />

13.529 Sprint Nextel 318.743 0,48<br />

16.850 Staples 387.382 0,58<br />

5.050 SunTrust Banks 367.186 0,55<br />

5.618 United Technologies 314.439 0,47<br />

6.600 Valero Energy 337.260 0,51<br />

8.210 Valspar 203.115 0,31<br />

9.928 Viacom ‘B’ 322.759 0,49<br />

6.830 Wachovia 360.487 0,54<br />

4.380 WellPoint<br />

____________<br />

349.349<br />

______<br />

0,53<br />

____________<br />

13.873.557<br />

______<br />

20,91<br />

Total acciones ordinarias<br />

____________<br />

34.388.691<br />

______<br />

51,83<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

VALORES DE RENTA FIJA<br />

Australia<br />

A$735.000 Government of Australia ‘145’<br />

6,25% 15/04/2015<br />

____________<br />

579.730<br />

______<br />

0,87<br />

Austria<br />

e506.000 Republic of Austria ‘2’ 4,65%<br />

15/1/2018<br />

____________<br />

675.461<br />

______<br />

1,02<br />

Dinamarca<br />

DKK5.260.000 Kingdom of Denmark 4%<br />

15/11/2015<br />

____________<br />

884.427<br />

______<br />

1,33<br />

Finlandia<br />

e700.000 Republic of Finland 3% 4/7/2008<br />

____________<br />

830.886<br />

______<br />

1,25<br />

Francia<br />

e252.000 French Treasury Note BTAN 3%<br />

12/7/2008 299.066 0,45<br />

e290.000 Government of France OAT 3,75%<br />

25/4/2021<br />

____________<br />

354.431<br />

______<br />

0,54<br />

____________<br />

653.497<br />

______<br />

0,99<br />

Alemania<br />

e875.000 Bundesschatzanweisungen 2%<br />

10/3/2006 1.034.830 1,56<br />

e1.079.000 Germany ‘00’ 5,25% 4/7/2010 1.394.640 2,10<br />

e327.000 Germany ‘00’ 5,25% 4/1/2011 425.815 0,64<br />

e784.000 Germany ‘02’ 5% 4/7/2012 1.028.049 1,55<br />

e557.000 Germany ‘03’ 4,75% 4/7/2034 796.514 1,20<br />

e35.000 Germany ‘04’ 3,75% 4/1/2015 43.023 0,06<br />

e30.000 Germany ‘04’ 4,25% 4/7/2014 38.173 0,06<br />

e764.000 Germany ‘05’ 3,25% 4/7/2015 903.253 1,36<br />

e413.000 Germany ‘05’ 4% 4/1/2037 529.086 0,80<br />

e65.000 Germany ‘99’ 3,75% 4/1/2009 78.714 0,12<br />

e1.688.000 Germany ‘139’ 4% 16/2/2007 2.025.110 3,05<br />

e262.000 Germany ‘147’ 2,5% 8/10/2010<br />

____________<br />

302.716<br />

______<br />

0,46<br />

____________<br />

8.599.923<br />

______<br />

12,96<br />

Organismos supranacionales<br />

¥106.000.000 European Investment Bank 1,4%<br />

20/6/2017<br />

____________<br />

886.282<br />

______<br />

1,34<br />

Italia<br />

¥160.000.000 Republic of Italy 0,65% 20/3/2009<br />

____________<br />

1.370.276<br />

______<br />

2,07<br />

Japón<br />

e150.000 Resona Bank EMTN 3,75%<br />

15/4/2015 178.330 0,27<br />

e50.000 Sumitomo Mitsui Banking 4,375%<br />

27/10/2014<br />

____________<br />

61.032<br />

______<br />

0,09<br />

____________<br />

239.362<br />

______<br />

0,36<br />

Jersey<br />

US$90.000 Old Mutual Capital Funding 8%<br />

22/12/2008 (Perpetual)<br />

____________<br />

94.912<br />

______<br />

0,14<br />

La Memoria incluida en las páginas 180 a 187 forma parte integrante de estas cuentas <strong>anual</strong>es.<br />

<strong>Informe</strong> Anual Auditado 131