Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

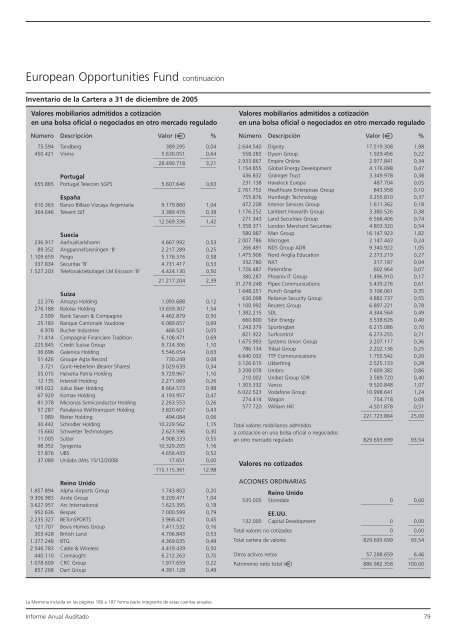

European Opportunities Fund continuación<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (e) %<br />

75.594 Tandberg 389.295 0,04<br />

450.421 Visma<br />

____________<br />

5.630.051<br />

______<br />

0,64<br />

____________<br />

28.490.718<br />

______<br />

3,21<br />

Portugal<br />

655.865 Portugal Telecom SGPS<br />

____________<br />

5.607.646<br />

______<br />

0,63<br />

España<br />

610.363 Banco Bilbao Vizcaya Argentaria 9.179.860 1,04<br />

364.646 Telvent GIT<br />

____________<br />

3.389.476<br />

______<br />

0,38<br />

____________<br />

12.569.336<br />

______<br />

1,42<br />

Suecia<br />

236.917 AarhusKarlshamn 4.667.992 0,53<br />

89.352 Angpanneforeningen ‘B’ 2.217.289 0,25<br />

1.109.659 Pergo 5.176.376 0,58<br />

337.834 Securitas ‘B’ 4.731.417 0,53<br />

1.527.203 Telefonaktiebolaget LM Ericsson ‘B’<br />

____________<br />

4.424.130<br />

______<br />

0,50<br />

____________<br />

21.217.204<br />

______<br />

2,39<br />

Suiza<br />

22.376 Amazys Holding 1.093.688 0,12<br />

276.188 Baloise Holding 13.659.307 1,54<br />

2.599 Bank Sarasin & Compagnie 4.462.879 0,50<br />

25.183 Banque Cantonale Vaudoise 6.089.657 0,69<br />

6.978 Bucher Industries 468.521 0,05<br />

71.414 Compagnie Financiere Tradition 6.108.471 0,69<br />

225.845 Credit Suisse Group 9.724.306 1,10<br />

36.696 Galenica Holding 5.546.054 0,63<br />

51.426 Groupe Agta Record 730.249 0,08<br />

3.721 Gurit-Heberlein (Bearer Shares) 3.029.639 0,34<br />

55.015 Helvetia Patria Holding 9.729.967 1,10<br />

12.135 Interroll Holding 2.271.069 0,26<br />

145.022 Julius Baer Holding 8.664.573 0,98<br />

67.929 Komax Holding 4.193.957 0,47<br />

81.378 Micronas Semiconductor Holding 2.263.553 0,26<br />

57.287 Panalpina Welttransport Holding 3.820.607 0,43<br />

1.989 Rieter Holding 494.084 0,06<br />

30.442 Schindler Holding 10.229.562 1,15<br />

15.660 Schweiter Technologies 2.623.596 0,30<br />

11.005 Sulzer 4.908.333 0,55<br />

98.352 Syngenta 10.329.205 1,16<br />

57.876 UBS 4.656.433 0,52<br />

37.089 Unilabs (Wts 15/12/2008)<br />

____________<br />

17.651<br />

______<br />

0,00<br />

____________<br />

115.115.361<br />

______<br />

12,98<br />

Reino Unido<br />

1.857.894 Alpha Airports Group 1.743.803 0,20<br />

9.306.983 Anite Group 9.209.471 1,04<br />

3.627.957 Arc International 1.623.395 0,18<br />

952.636 Bespak 7.000.599 0,79<br />

2.235.327 BETonSPORTS 3.968.421 0,45<br />

121.707 Bovis Homes Group 1.411.532 0,16<br />

303.428 British Land 4.706.843 0,53<br />

1.377.248 BTG 4.369.035 0,49<br />

2.546.783 Cable & Wireless 4.419.439 0,50<br />

440.110 Connaught 6.212.263 0,70<br />

1.078.609 CRC Group 1.977.659 0,22<br />

857.268 Dart Group 4.391.128 0,49<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (e) %<br />

2.644.540 Dignity 17.519.308 1,98<br />

558.283 Dyson Group 1.929.456 0,22<br />

2.933.867 Empire Online 2.977.841 0,34<br />

1.154.855 Global Energy Development 4.176.098 0,47<br />

436.832 Grainger Trust 3.349.978 0,38<br />

231.138 Havelock Europa 487.704 0,05<br />

2.761.752 Healthcare Enterprises Group 843.958 0,10<br />

755.876 Huntleigh Technology 3.255.810 0,37<br />

472.208 Interior Services Group 1.611.362 0,18<br />

1.176.252 Lambert Howarth Group 3.380.526 0,38<br />

271.343 Land Securities Group 6.566.406 0,74<br />

1.358.371 London Merchant Securities 4.803.320 0,54<br />

580.987 Man Group 16.147.923 1,82<br />

2.007.786 Microgen 2.147.443 0,24<br />

266.491 NDS Group ADR 9.340.922 1,05<br />

1.475.906 Nord Anglia Education 2.373.219 0,27<br />

332.780 NXT 317.187 0,04<br />

1.726.487 Patientline 602.964 0,07<br />

380.287 Phoenix IT Group 1.496.910 0,17<br />

31.279.248 Pipex Communications 5.439.276 0,61<br />

1.648.251 Punch Graphix 3.106.061 0,35<br />

636.098 Reliance Security Group 4.882.737 0,55<br />

1.100.992 Reuters Group 6.897.221 0,78<br />

1.382.215 SDL 4.344.564 0,49<br />

660.800 Sibir Energy 3.538.626 0,40<br />

1.243.379 Sportingbet 6.215.086 0,70<br />

821.922 Surfcontrol 6.273.255 0,71<br />

1.675.993 Systems Union Group 3.207.117 0,36<br />

786.134 Tribal Group 2.202.136 0,25<br />

4.640.032 TTP Communications 1.755.542 0,20<br />

3.126.615 Ukbetting 2.525.133 0,28<br />

3.208.078 Umbro 7.609.382 0,86<br />

210.002 Unibet Group SDR 3.589.720 0,40<br />

1.303.332 Vanco 9.520.848 1,07<br />

6.022.523 Vodafone Group 10.998.641 1,24<br />

274.414 Wagon 754.718 0,08<br />

577.720 William Hill<br />

____________<br />

4.501.878<br />

______<br />

0,51<br />

____________<br />

221.723.864<br />

______<br />

25,00<br />

Total valores mobiliarios admitidos<br />

a cotización en una bolsa oficial o negociados<br />

en otro mercado regulado<br />

____________<br />

829.693.699<br />

______<br />

93,54<br />

Valores no cotizados<br />

ACCIONES ORDINARIAS<br />

Reino Unido<br />

535.005 Storedale<br />

____________<br />

0<br />

______<br />

0,00<br />

EE.UU.<br />

132.000 Capital Development<br />

____________<br />

0<br />

______<br />

0,00<br />

Total valores no cotizados<br />

____________<br />

0<br />

______<br />

0,00<br />

Total cartera de valores 829.693.699 93,54<br />

Otros activos netos<br />

____________<br />

57.288.659<br />

______<br />

6,46<br />

Patrimonio neto total (e)<br />

____________<br />

886.982.358 100,00<br />

______<br />

La Memoria incluida en las páginas 180 a 187 forma parte integrante de estas cuentas <strong>anual</strong>es.<br />

<strong>Informe</strong> Anual Auditado 79