Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

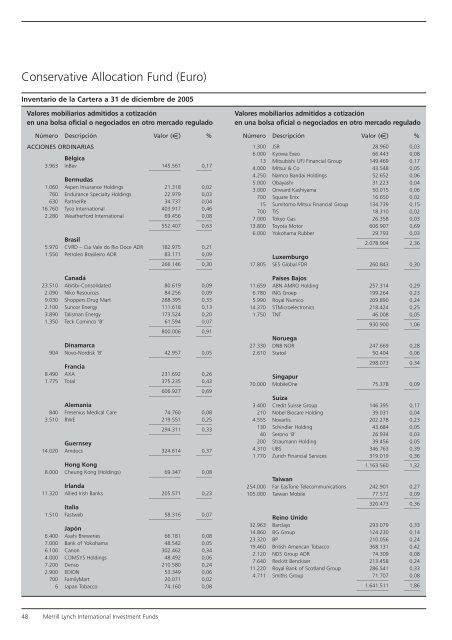

Conservative Allocation Fund (Euro)<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (e) %<br />

ACCIONES ORDINARIAS<br />

Bélgica<br />

3.963 InBev<br />

____________<br />

145.561<br />

______<br />

0,17<br />

Bermudas<br />

1.060 Aspen Insurance Holdings 21.318 0,02<br />

760 Endurance Specialty Holdings 22.979 0,03<br />

630 PartnerRe 34.737 0,04<br />

16.760 Tyco International 403.917 0,46<br />

2.280 Weatherford International<br />

____________<br />

69.456<br />

______<br />

0,08<br />

____________<br />

552.407<br />

______<br />

0,63<br />

Brasil<br />

5.970 CVRD – Cia Vale do Rio Doce ADR 182.975 0,21<br />

1.550 Petroleo Brasileiro ADR 83.171<br />

____________<br />

0,09<br />

______<br />

____________<br />

266.146<br />

______<br />

0,30<br />

Canadá<br />

23.510 Abitibi-Consolidated 80.619 0,09<br />

2.090 Niko Resources 84.256 0,09<br />

9.030 Shoppers Drug Mart 288.395 0,33<br />

2.100 Suncor Energy 111.618 0,13<br />

3.890 Talisman Energy 173.524 0,20<br />

1.350 Teck Cominco ‘B’<br />

____________<br />

61.594<br />

______<br />

0,07<br />

____________<br />

800.006<br />

______<br />

0,91<br />

Dinamarca<br />

904 Novo-Nordisk ‘B’<br />

____________<br />

42.957<br />

______<br />

0,05<br />

Francia<br />

8.490 AXA 231.692 0,26<br />

1.775 Total<br />

____________<br />

375.235<br />

______<br />

0,43<br />

____________<br />

606.927<br />

______<br />

0,69<br />

Alemania<br />

840 Fresenius Medical Care 74.760 0,08<br />

3.510 RWE<br />

____________<br />

219.551<br />

______<br />

0,25<br />

____________<br />

294.311<br />

______<br />

0,33<br />

Guernsey<br />

14.020 Amdocs<br />

____________<br />

324.614<br />

______<br />

0,37<br />

Hong Kong<br />

8.000 Cheung Kong (Holdings)<br />

____________<br />

69.347<br />

______<br />

0,08<br />

Irlanda<br />

11.320 Allied Irish Banks<br />

____________<br />

205.571<br />

______<br />

0,23<br />

Italia<br />

1.510 Fastweb<br />

____________<br />

58.316<br />

______<br />

0,07<br />

Japón<br />

6.400 Asahi Breweries 66.181 0,08<br />

7.000 Bank of Yokohama 48.542 0,05<br />

6.100 Canon 302.462 0,34<br />

4.000 COMSYS Holdings 48.492 0,06<br />

7.200 Denso 210.580 0,24<br />

2.900 EDION 53.349 0,06<br />

700 FamilyMart 20.071 0,02<br />

6 Japan Tobacco 74.160 0,08<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (e) %<br />

1.300 JSR 28.960 0,03<br />

6.000 Kyowa Exeo 66.443 0,08<br />

13 Mitsubishi UFJ Financial Group 149.469 0,17<br />

4.000 Mitsui & Co 43.548 0,05<br />

4.250 Namco Bandai Holdings 52.652 0,06<br />

5.000 Obayashi 31.223 0,04<br />

3.000 Onward Kashiyama 50.015 0,06<br />

700 Square Enix 16.650 0,02<br />

15 Sumitomo Mitsui Financial Group 134.739 0,15<br />

700 TIS 18.310 0,02<br />

7.000 Tokyo Gas 26.358 0,03<br />

13.800 Toyota Motor 606.907 0,69<br />

6.000 Yokohama Rubber<br />

____________<br />

29.793<br />

______<br />

0,03<br />

____________<br />

2.078.904<br />

______<br />

2,36<br />

Luxemburgo<br />

17.805 SES Global FDR<br />

____________<br />

260.843<br />

______<br />

0,30<br />

Países Bajos<br />

11.659 ABN AMRO Holding 257.314 0,29<br />

6.780 ING Groep 199.264 0,23<br />

5.990 Royal Numico 209.890 0,24<br />

14.370 STMicroelectronics 218.424 0,25<br />

1.750 TNT<br />

____________<br />

46.008<br />

______<br />

0,05<br />

____________<br />

930.900<br />

______<br />

1,06<br />

Noruega<br />

27.330 DNB NOR 247.669 0,28<br />

2.610 Statoil<br />

____________<br />

50.404<br />

______<br />

0,06<br />

____________<br />

298.073<br />

______<br />

0,34<br />

Singapur<br />

70.000 MobileOne<br />

____________<br />

75.378<br />

______<br />

0,09<br />

Suiza<br />

3.400 Credit Suisse Group 146.395 0,17<br />

210 Nobel Biocare Holding 39.031 0,04<br />

4.555 Novartis 202.278 0,23<br />

130 Schindler Holding 43.684 0,05<br />

40 Serono ‘B’ 26.934 0,03<br />

200 Straumann Holding 39.456 0,05<br />

4.310 UBS 346.763 0,39<br />

1.770 Zurich Financial Services<br />

____________<br />

319.019<br />

______<br />

0,36<br />

____________<br />

1.163.560<br />

______<br />

1,32<br />

Taiwan<br />

254.000 Far EasTone Telecommunications 242.901 0,27<br />

105.000 Taiwan Mobile<br />

____________<br />

77.572<br />

______<br />

0,09<br />

____________<br />

320.473<br />

______<br />

0,36<br />

Reino Unido<br />

32.963 Barclays 293.079 0,33<br />

14.860 BG Group 124.230 0,14<br />

23.320 BP 210.056 0,24<br />

19.460 British American Tobacco 368.131 0,42<br />

2.120 NDS Group ADR 74.309 0,08<br />

7.640 Reckitt Benckiser 213.458 0,24<br />

11.220 Royal Bank of Scotland Group 286.541 0,33<br />

4.711 Smiths Group<br />

____________<br />

71.707<br />

______<br />

0,08<br />

____________<br />

1.641.511<br />

______<br />

1,86<br />

48 Merrill Lynch International Investment Funds