Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

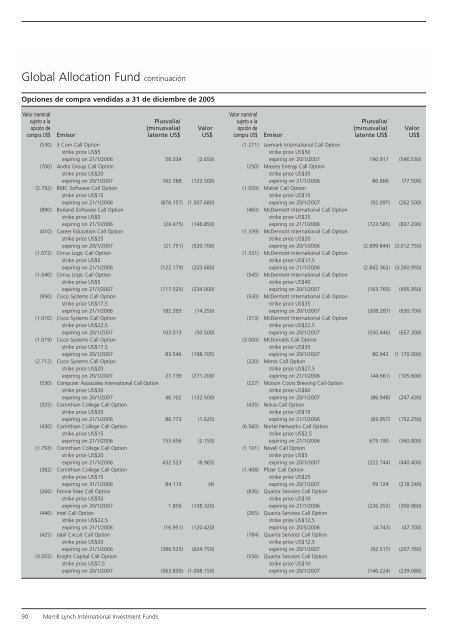

Global Allocation Fund continuación<br />

Opciones de compra vendidas a 31 de diciembre de 2005<br />

Valor nominal<br />

sujeto a la<br />

opción de<br />

compra US$<br />

Emisor<br />

Plusvalía/<br />

(minusvalía)<br />

latente US$<br />

Valor<br />

US$<br />

(530) 3 Com Call Option<br />

strike price US$5<br />

expiring on 21/1/2006 58.034 (2.650)<br />

(700) Andrx Group Call Option<br />

strike price US$20<br />

expiring on 20/1/2007 162.388 (122.500)<br />

(2.792) BMC Software Call Option<br />

strike price US$15<br />

expiring on 21/1/2006 (876.157) (1.507.680)<br />

(890) Borland Software Call Option<br />

strike price US$5<br />

expiring on 21/1/2006 (20.475) (146.850)<br />

(410) Career Education Call Option<br />

strike price US$25<br />

expiring on 20/1/2007 (21.751) (520.700)<br />

(1.072) Cirrus Logic Call Option<br />

strike price US$5<br />

expiring on 21/1/2006 (122.179) (203.680)<br />

(1.040) Cirrus Logic Call Option<br />

strike price US$5<br />

expiring on 21/1/2007 (117.525) (234.000)<br />

(950) Cisco Systems Call Option<br />

strike price US$17,5<br />

expiring on 21/1/2006 182.393 (14.250)<br />

(1.010) Cisco Systems Call Option<br />

strike price US$22,5<br />

expiring on 20/1/2007 103.013 (50.500)<br />

(1.019) Cisco Systems Call Option<br />

strike price US$17,5<br />

expiring on 20/1/2007 83.546 (198.705)<br />

(2.712) Cisco Systems Call Option<br />

strike price US$20<br />

expiring on 20/1/2007 27.739 (271.200)<br />

(530) Computer Associates International Call Option<br />

strike price US$30<br />

expiring on 20/1/2007 46.102 (132.500)<br />

(325) Corinthian College Call Option<br />

strike price US$20<br />

expiring on 21/1/2006 86.773 (1.625)<br />

(430) Corinthian College Call Option<br />

strike price US$15<br />

expiring on 21/1/2006 155.656 (2.150)<br />

(1.793) Corinthian College Call Option<br />

strike price US$20<br />

expiring on 21/1/2006 432.523 (8.965)<br />

(382) Corinthian College Call Option<br />

strike price US$15<br />

expiring on 31/1/2006 84.113 (4)<br />

(266) Fannie Mae Call Option<br />

strike price US$50<br />

expiring on 20/1/2007 1.856 (138.320)<br />

(446) Intel Call Option<br />

strike price US$22,5<br />

expiring on 21/1/2006 (16.951) (120.420)<br />

(425) Jabil Circuit Call Option<br />

strike price US$20<br />

expiring on 21/1/2006 (396.533) (624.750)<br />

(3.055) Knight Capital Call Option<br />

strike price US$7,5<br />

expiring on 20/1/2007 (563.830) (1.008.150)<br />

Valor nominal<br />

sujeto a la<br />

opción de<br />

compra US$<br />

Emisor<br />

Plusvalía/<br />

(minusvalía)<br />

latente US$<br />

Valor<br />

US$<br />

(1.271) Lexmark International Call Option<br />

strike price US$50<br />

expiring on 20/1/2007 190.917 (546.530)<br />

(250) Massey Energy Call Option<br />

strike price US$35<br />

expiring on 21/1/2006 86.866 (77.500)<br />

(1.050) Mattel Call Option<br />

strike price US$15<br />

expiring on 20/1/2007 (92.097) (262.500)<br />

(460) McDermott International Call Option<br />

strike price US$25<br />

expiring on 21/1/2006 (723.585) (837.200)<br />

(1.339) McDermott International Call Option<br />

strike price US$20<br />

expiring on 20/1/2006 (2.699.844) (3.012.750)<br />

(1.331) McDermott International Call Option<br />

strike price US$17,5<br />

expiring on 21/1/2006 (2.842.362) (3.260.950)<br />

(545) McDermott International Call Option<br />

strike price US$40<br />

expiring on 20/1/2007 (163.765) (495.950)<br />

(530) McDermott International Call Option<br />

strike price US$35<br />

expiring on 20/1/2007 (208.287) (630.700)<br />

(313) McDermott International Call Option<br />

strike price US$22,5<br />

expiring on 20/1/2007 (550.446) (657.300)<br />

(3.000) McDonalds Call Option<br />

strike price US$35<br />

expiring on 20/1/2007 80.942 (1.170.000)<br />

(220) Merck Call Option<br />

strike price US$27,5<br />

expiring on 21/1/2006 (44.661) (105.600)<br />

(227) Molson Coors Brewing Call Option<br />

strike price US$60<br />

expiring on 20/1/2007 (86.948) (247.430)<br />

(435) Nokia Call Option<br />

strike price US$15<br />

expiring on 21/1/2006 (83.957) (152.250)<br />

(6.560) Nortel Networks Call Option<br />

strike price US$2,5<br />

expiring on 21/1/2006 675.190 (360.800)<br />

(1.101) Novell Call Option<br />

strike price US$5<br />

expiring on 20/1/2007 (222.744) (440.400)<br />

(1.408) Pfizer Call Option<br />

strike price US$25<br />

expiring on 20/1/2007 59.124 (218.240)<br />

(836) Quanta Services Call Option<br />

strike price US$10<br />

expiring on 21/1/2006 (226.352) (300.960)<br />

(265) Quanta Services Call Option<br />

strike price US$12,5<br />

expiring on 20/5/2006 (4.743) (47.700)<br />

(784) Quanta Services Call Option<br />

strike price US$12,5<br />

expiring on 20/1/2007 (92.517) (207.760)<br />

(556) Quanta Services Call Option<br />

strike price US$10<br />

expiring on 20/1/2007 (146.224) (239.080)<br />

90 Merrill Lynch International Investment Funds