Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

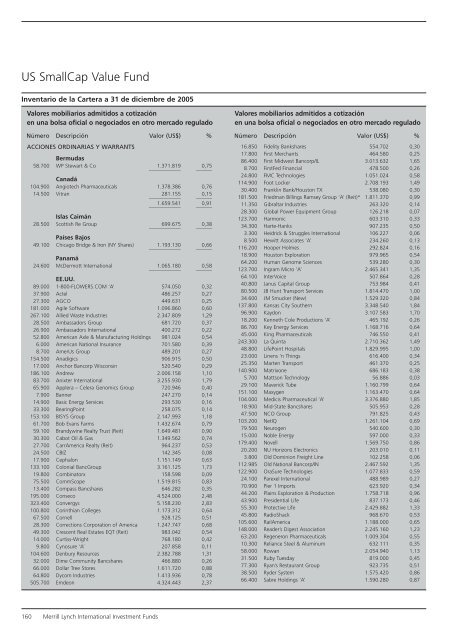

US SmallCap Value Fund<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

ACCIONES ORDINARIAS Y WARRANTS<br />

Bermudas<br />

58.700 WP Stewart & Co<br />

____________<br />

1.371.819<br />

______<br />

0,75<br />

Canadá<br />

104.900 Angiotech Pharmaceuticals 1.378.386 0,76<br />

14.500 Vitran<br />

____________<br />

281.155<br />

______<br />

0,15<br />

____________<br />

1.659.541<br />

______<br />

0,91<br />

Islas Caimán<br />

28.500 Scottish Re Group<br />

____________<br />

699.675<br />

______<br />

0,38<br />

Países Bajos<br />

49.100 Chicago Bridge & Iron (NY Shares)<br />

____________<br />

1.193.130<br />

______<br />

0,66<br />

Panamá<br />

24.600 McDermott International<br />

____________<br />

1.065.180<br />

______<br />

0,58<br />

EE.UU.<br />

89.000 1-800-FLOWERS.COM ‘A’ 574.050 0,32<br />

37.900 Actel 486.257 0,27<br />

27.300 AGCO 449.631 0,25<br />

181.000 Agile Software 1.096.860 0,60<br />

267.100 Allied Waste Industries 2.347.809 1,29<br />

28.500 Ambassadors Group 681.720 0,37<br />

26.900 Ambassadors International 400.272 0,22<br />

52.800 American Axle & Manufacturing Holdings 981.024 0,54<br />

6.000 American National Insurance 701.580 0,39<br />

8.700 AmerUs Group 489.201 0,27<br />

154.500 Anadigics 906.915 0,50<br />

17.000 Anchor Bancorp Wisconsin 520.540 0,29<br />

186.100 Andrew 2.006.158 1,10<br />

83.700 Anixter International 3.255.930 1,79<br />

65.900 Applera – Celera Genomics Group 720.946 0,40<br />

7.900 Banner 247.270 0,14<br />

14.900 Basic Energy Services 293.530 0,16<br />

33.300 BearingPoint 258.075 0,14<br />

153.100 BISYS Group 2.147.993 1,18<br />

61.700 Bob Evans Farms 1.432.674 0,79<br />

59.100 Brandywine Realty Trust (Reit) 1.649.481 0,90<br />

30.300 Cabot Oil & Gas 1.349.562 0,74<br />

27.700 CarrAmerica Realty (Reit) 964.237 0,53<br />

24.500 CBIZ 142.345 0,08<br />

17.900 Cephalon 1.151.149 0,63<br />

133.100 Colonial BancGroup 3.161.125 1,73<br />

19.800 Combinatorx 158.598 0,09<br />

75.500 CommScope 1.519.815 0,83<br />

13.400 Compass Bancshares 646.282 0,35<br />

195.000 Conseco 4.524.000 2,48<br />

323.400 Convergys 5.158.230 2,83<br />

100.800 Corinthian Colleges 1.173.312 0,64<br />

67.500 Cornell 928.125 0,51<br />

28.300 Corrections Corporation of America 1.247.747 0,68<br />

49.300 Crescent Real Estates EQT (Reit) 983.042 0,54<br />

14.000 Curtiss-Wright 768.180 0,42<br />

9.800 Cynosure ‘A’ 207.858 0,11<br />

104.600 Denbury Resources 2.382.788 1,31<br />

32.000 Dime Community Bancshares 466.880 0,26<br />

66.000 Dollar Tree Stores 1.611.720 0,88<br />

64.800 Dycom Industries 1.413.936 0,78<br />

505.700 Emdeon 4.324.443 2,37<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

16.850 Fidelity Bankshares 554.702 0,30<br />

17.800 First Merchants 464.580 0,25<br />

86.400 First Midwest Bancorp/IL 3.013.632 1,65<br />

8.700 FirstFed Financial 478.500 0,26<br />

24.800 FMC Technologies 1.051.024 0,58<br />

114.900 Foot Locker 2.708.193 1,49<br />

30.400 Franklin Bank/Houston TX 538.080 0,30<br />

181.500 Friedman Billings Ramsey Group ‘A’ (Reit)* 1.811.370 0,99<br />

11.350 Gibraltar Industries 263.320 0,14<br />

28.300 Global Power Equipment Group 126.218 0,07<br />

123.700 Harmonic 603.310 0,33<br />

34.300 Harte-Hanks 907.235 0,50<br />

3.300 Heidrick & Struggles International 106.227 0,06<br />

8.500 Hewitt Associates ‘A’ 234.260 0,13<br />

116.200 Hooper Holmes 292.824 0,16<br />

18.900 Houston Exploration 979.965 0,54<br />

64.200 Human Genome Sciences 539.280 0,30<br />

123.700 Ingram Micro ‘A’ 2.465.341 1,35<br />

64.100 InterVoice 507.864 0,28<br />

40.800 Janus Capital Group 753.984 0,41<br />

80.500 JB Hunt Transport Services 1.814.470 1,00<br />

34.600 JM Smucker (New) 1.529.320 0,84<br />

137.800 Kansas City Southern 3.348.540 1,84<br />

96.900 Kaydon 3.107.583 1,70<br />

18.200 Kenneth Cole Productions ‘A’ 465.192 0,26<br />

86.700 Key Energy Services 1.168.716 0,64<br />

45.000 King Pharmaceuticals 746.550 0,41<br />

243.300 La Quinta 2.710.362 1,49<br />

48.800 LifePoint Hospitals 1.829.995 1,00<br />

23.000 Linens ’n Things 616.400 0,34<br />

25.350 Marten Transport 461.370 0,25<br />

140.900 Matrixone 686.183 0,38<br />

5.700 Mattson Technology 56.886 0,03<br />

29.100 Maverick Tube 1.160.799 0,64<br />

151.100 Maxygen 1.163.470 0,64<br />

104.000 Medicis Pharmaceutical ‘A’ 3.376.880 1,85<br />

18.900 Mid-State Bancshares 505.953 0,28<br />

47.500 NCO Group 791.825 0,43<br />

103.200 NetIQ 1.261.104 0,69<br />

79.500 Neurogen 540.600 0,30<br />

15.000 Noble Energy 597.000 0,33<br />

179.400 Novell 1.569.750 0,86<br />

20.200 NU Horizons Electronics 203.010 0,11<br />

3.800 Old Dominion Freight Line 102.258 0,06<br />

112.985 Old National Bancorp/IN 2.467.592 1,35<br />

122.900 OraSure Technologies 1.077.833 0,59<br />

24.100 Parexel International 488.989 0,27<br />

70.900 Pier 1 Imports 623.920 0,34<br />

44.200 Plains Exploration & Production 1.758.718 0,96<br />

43.900 Presidential Life 837.173 0,46<br />

55.300 Protective Life 2.429.882 1,33<br />

45.800 RadioShack 968.670 0,53<br />

105.600 RailAmerica 1.188.000 0,65<br />

148.000 Reader’s Digest Association 2.245.160 1,23<br />

63.200 Regeneron Pharmaceuticals 1.009.304 0,55<br />

10.300 Reliance Steel & Aluminum 632.111 0,35<br />

58.000 Rowan 2.054.940 1,13<br />

31.500 Ruby Tuesday 819.000 0,45<br />

77.300 Ryan’s Restaurant Group 923.735 0,51<br />

38.500 Ryder System 1.575.420 0,86<br />

66.400 Sabre Holdings ‘A’ 1.590.280 0,87<br />

160 Merrill Lynch International Investment Funds