Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

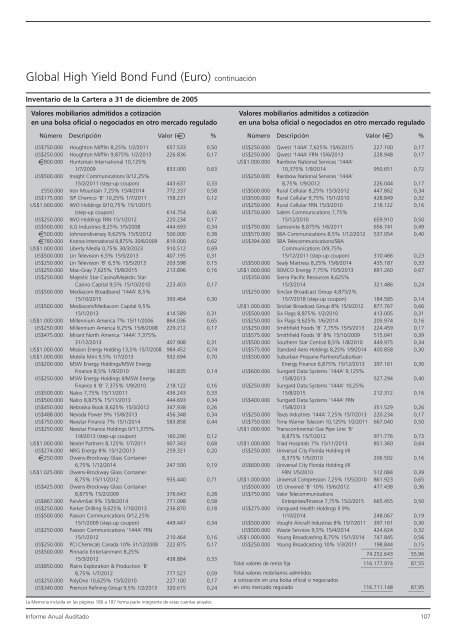

Global High Yield Bond Fund (Euro) continuación<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (e) %<br />

US$750.000 Houghton Mifflin 8,25% 1/2/2011 657.533 0,50<br />

US$250.000 Houghton Mifflin 9,875% 1/2/2013 226.836 0,17<br />

e800.000 Huntsman International 10,125%<br />

1/7/2009 833.000 0,63<br />

US$500.000 Insight Communications 0/12,25%<br />

15/2/2011 (step-up coupon) 443.637 0,33<br />

£550.000 Iron Mountain 7,25% 15/4/2014 772.337 0,58<br />

US$175.000 ISP Chemco ‘B’ 10,25% 1/7/2011 158.231 0,12<br />

US$1.000.000 IWO Holdings 0/10,75% 15/1/2015<br />

(step-up coupon) 614.754 0,46<br />

US$250.000 IWO Holdings FRN 15/1/2012 220.234 0,17<br />

US$500.000 JLG Industries 8,25% 1/5/2008 444.693 0,34<br />

e500.000 Johnsondiversey 9,625% 15/5/2012 500.000 0,38<br />

e780.000 Kronos International 8,875% 30/6/2009 819.000 0,62<br />

US$1.000.000 Liberty Media 0,75% 30/3/2023 910.512 0,69<br />

US$500.000 Lin Television 6,5% 15/5/2013 407.195 0,31<br />

US$250.000 Lin Television ‘B’ 6,5% 15/5/2013 203.598 0,15<br />

US$250.000 Mac-Gray 7,625% 15/8/2015 213.896 0,16<br />

US$250.000 Majestic Star Casino/Majestic Star<br />

Casino Capital 9,5% 15/10/2010 223.403 0,17<br />

US$500.000 Mediacom Broadband ‘144A’ 8,5%<br />

15/10/2015 393.464 0,30<br />

US$500.000 Mediacom/Mediacom Capital 9,5%<br />

15/1/2013 414.589 0,31<br />

US$1.000.000 Millennium America 7% 15/11/2006 864.036 0,65<br />

US$250.000 Millennium America 9,25% 15/6/2008 229.212 0,17<br />

US$475.000 Mirant North America ‘144A’ 7,375%<br />

31/12/2013 407.908 0,31<br />

US$1.000.000 Mission Energy Holding 13,5% 15/7/2008 984.452 0,74<br />

US$1.000.000 Mobile Mini 9,5% 1/7/2013 932.694 0,70<br />

US$200.000 MSW Energy Holdings/MSW Energy<br />

Finance 8,5% 1/9/2010 180.835 0,14<br />

US$250.000 MSW Energy Holdings II/MSW Energy<br />

Finance II ‘B’ 7,375% 1/9/2010 218.122 0,16<br />

US$500.000 Nalco 7,75% 15/11/2011 436.243 0,33<br />

US$500.000 Nalco 8,875% 15/11/2013 444.693 0,34<br />

US$450.000 Nebraska Book 8,625% 15/3/2012 347.938 0,26<br />

US$488.000 Nevada Power 9% 15/8/2013 456.348 0,34<br />

US$750.000 Nexstar Finance 7% 15/1/2014 583.858 0,44<br />

US$250.000 Nexstar Finance Holdings 0/11,375%<br />

1/4/2013 (step-up coupon) 160.290 0,12<br />

US$1.000.000 Nextel Partners 8,125% 1/7/2011 907.343 0,68<br />

US$274.000 NRG Energy 8% 15/12/2013 259.321 0,20<br />

e250.000 Owens-Brockway Glass Container<br />

6,75% 1/12/2014 247.500 0,19<br />

US$1.025.000 Owens-Brockway Glass Container<br />

8,75% 15/11/2012 935.440 0,71<br />

US$425.000 Owens-Brockway Glass Container<br />

8,875% 15/2/2009 376.643 0,28<br />

US$867.000 PanAmSat 9% 15/8/2014 771.098 0,58<br />

US$250.000 Parker Drilling 9,625% 1/10/2013 236.870 0,18<br />

US$500.000 Paxson Communications 0/12,25%<br />

15/1/2009 (step-up coupon) 449.447 0,34<br />

US$250.000 Paxson Communications ‘144A’ FRN<br />

15/1/2012 210.464 0,16<br />

US$250.000 PCI Chemicals Canada 10% 31/12/2008 222.875 0,17<br />

US$500.000 Pinnacle Entertainment 8,25%<br />

15/3/2012 438.884 0,33<br />

US$850.000 Plains Exploration & Production ‘B’<br />

8,75% 1/7/2012 777.527 0,59<br />

US$250.000 PolyOne 10,625% 15/5/2010 227.100 0,17<br />

US$340.000 Premcor Refining Group 9,5% 1/2/2013 320.615 0,24<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (e) %<br />

US$250.000 Qwest ‘144A’ 7,625% 15/6/2015 227.100 0,17<br />

US$250.000 Qwest ‘144A’ FRN 15/6/2013 228.948 0,17<br />

US$1.000.000 Rainbow National Services ‘144A’<br />

10,375% 1/9/2014 950.651 0,72<br />

US$250.000 Rainbow National Services ‘144A’<br />

8,75% 1/9/2012 226.044 0,17<br />

US$500.000 Rural Cellular 8,25% 15/3/2012 447.862 0,34<br />

US$500.000 Rural Cellular 9,75% 15/1/2010 428.849 0,32<br />

US$250.000 Rural Cellular FRN 15/3/2010 218.122 0,16<br />

US$750.000 Salem Communications 7,75%<br />

15/12/2010 659.910 0,50<br />

US$750.000 Samsonite 8,875% 1/6/2011 656.741 0,49<br />

US$570.000 SBA Communications 8,5% 1/12/2012 537.054 0,40<br />

US$394.000 SBA Telecommunications/SBA<br />

Communications 0/9,75%<br />

15/12/2011 (step-up coupon) 310.466 0,23<br />

US$500.000 Sealy Mattress 8,25% 15/6/2014 435.187 0,33<br />

US$1.000.000 SEMCO Energy 7,75% 15/5/2013 891.260 0,67<br />

US$350.000 Sierra Pacific Resources 8,625%<br />

15/3/2014 321.486 0,24<br />

US$250.000 Sinclair Broadcast Group 4,875/2%<br />

15/7/2018 (step-up coupon) 184.585 0,14<br />

US$1.000.000 Sinclair Broadcast Group 8% 15/3/2012 877.767 0,66<br />

US$500.000 Six Flags 8,875% 1/2/2010 413.005 0,31<br />

US$250.000 Six Flags 9,625% 1/6/2014 205.974 0,16<br />

US$250.000 Smithfield Foods ‘B’ 7,75% 15/5/2013 224.459 0,17<br />

US$575.000 Smithfield Foods ‘B’ 8% 15/10/2009 515.041 0,39<br />

US$500.000 Southern Star Central 8,5% 1/8/2010 449.975 0,34<br />

US$575.000 Standard Aero Holdings 8,25% 1/9/2014 400.858 0,30<br />

US$500.000 Suburban Propane Partners/Suburban<br />

Energy Finance 6,875% 15/12/2013 397.161 0,30<br />

US$600.000 Sungard Data Systems ‘144A’ 9,125%<br />

15/8/2013 527.294 0,40<br />

US$250.000 Sungard Data Systems ‘144A’ 10,25%<br />

15/8/2015 212.312 0,16<br />

US$400.000 Sungard Data Systems ‘144A’ FRN<br />

15/8/2013 351.529 0,26<br />

US$250.000 Texas Industries ‘144A’ 7,25% 15/7/2013 220.234 0,17<br />

US$750.000 Time Warner Telecom 10,125% 1/2/2011 667.040 0,50<br />

US$1.000.000 Transcontinental Gas Pipe Line ‘B’<br />

8,875% 15/7/2012 971.776 0,73<br />

US$1.000.000 Triad Hospitals 7% 15/11/2013 851.360 0,64<br />

US$250.000 Universal City Florida Holding I/II<br />

8,375% 1/5/2010 206.502 0,16<br />

US$600.000 Universal City Florida Holding I/II<br />

FRN 1/5/2010 512.084 0,39<br />

US$1.000.000 Universal Compression 7,25% 15/5/2010 861.923 0,65<br />

US$500.000 US Unwired ‘B’ 10% 15/6/2012 477.438 0,36<br />

US$750.000 Valor Telecommunications<br />

Enterprises/Finance 7,75% 15/2/2015 665.455 0,50<br />

US$275.000 Vanguard Health Holdings II 9%<br />

1/10/2014 248.067 0,19<br />

US$500.000 Vought Aircraft Industries 8% 15/7/2011 397.161 0,30<br />

US$500.000 Waste Services 9,5% 15/4/2014 424.624 0,32<br />

US$1.000.000 Young Broadcasting 8,75% 15/1/2014 747.845 0,56<br />

US$250.000 Young Broadcasting 10% 1/3/2011<br />

____________<br />

198.844<br />

______<br />

0,15<br />

____________<br />

74.252.643<br />

______<br />

55,96<br />

Total valores de renta fija<br />

____________<br />

116.177.974<br />

______<br />

87,55<br />

Total valores mobiliarios admitidos<br />

a cotización en una bolsa oficial o negociados<br />

en otro mercado regulado<br />

____________<br />

116.711.148<br />

______<br />

87,95<br />

La Memoria incluida en las páginas 180 a 187 forma parte integrante de estas cuentas <strong>anual</strong>es.<br />

<strong>Informe</strong> Anual Auditado 107