Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

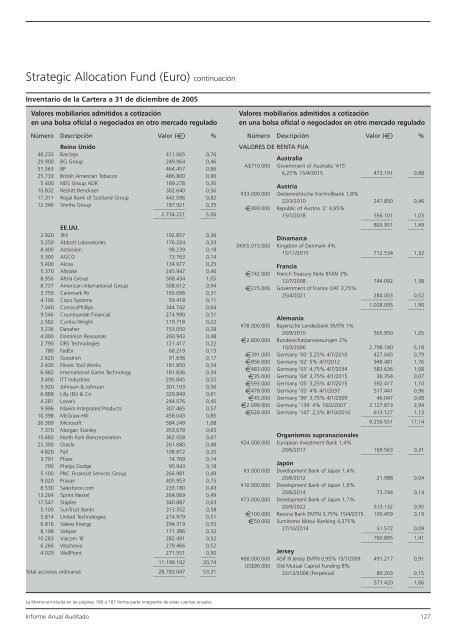

Strategic Allocation Fund (Euro) continuación<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (e) %<br />

Reino Unido<br />

46.233 Barclays 411.065 0,76<br />

29.900 BG Group 249.964 0,46<br />

51.563 BP 464.457 0,86<br />

25.733 British American Tobacco 486.800 0,90<br />

5.400 NDS Group ADR 189.278 0,35<br />

10.832 Reckitt Benckiser 302.640 0,56<br />

17.311 Royal Bank of Scotland Group 442.096 0,82<br />

12.346 Smiths Group<br />

____________<br />

187.921<br />

______<br />

0,35<br />

____________<br />

2.734.221<br />

______<br />

5,06<br />

EE.UU.<br />

2.920 3M 192.857 0,36<br />

5.259 Abbott Laboratories 176.204 0,33<br />

8.400 Activision 98.239 0,18<br />

5.300 AGCO 73.763 0,14<br />

5.400 Alcoa 134.977 0,25<br />

5.370 Allstate 245.947 0,46<br />

8.956 Altria Group 568.434 1,05<br />

8.737 American International Group 508.612 0,94<br />

3.750 Caremark Rx 165.096 0,31<br />

4.100 Cisco Systems 59.418 0,11<br />

7.040 ConocoPhillips 344.742 0,64<br />

9.546 Countrywide Financial 274.990 0,51<br />

2.582 Curtiss-Wright 119.718 0,22<br />

3.236 Danaher 153.050 0,28<br />

4.000 Dominion Resources 260.943 0,48<br />

2.790 DRS Technologies 121.417 0,22<br />

780 FedEx 68.219 0,13<br />

2.620 Goodrich 91.636 0,17<br />

2.430 Illinois Tool Works 181.850 0,34<br />

6.982 International Game Technology 181.836 0,34<br />

3.406 ITT Industries 295.845 0,55<br />

5.920 Johnson & Johnson 301.103 0,56<br />

6.888 Lilly (Eli) & Co 329.849 0,61<br />

4.281 Lowe’s 244.076 0,45<br />

9.996 Maxim Integrated Products 307.465 0,57<br />

10.398 McGraw-Hill 458.043 0,85<br />

26.309 Microsoft 584.249 1,08<br />

7.370 Morgan Stanley 353.678 0,65<br />

15.683 North Fork Bancorporation 362.058 0,67<br />

25.300 Oracle 261.680 0,48<br />

4.820 Pall 108.872 0,20<br />

3.791 Pfizer 74.769 0,14<br />

790 Phelps Dodge 95.943 0,18<br />

5.100 PNC Financial Services Group 266.981 0,49<br />

9.020 Praxair 405.953 0,75<br />

8.530 Salesforce.com 233.180 0,43<br />

13.264 Sprint Nextel 264.069 0,49<br />

17.547 Staples 340.887 0,63<br />

5.100 SunTrust Banks 313.352 0,58<br />

5.814 United Technologies 274.979 0,51<br />

6.816 Valero Energy 294.319 0,55<br />

8.198 Valspar 171.386 0,32<br />

10.283 Viacom ‘B’ 282.491 0,52<br />

6.266 Wachovia 279.466 0,52<br />

4.029 WellPoint<br />

____________<br />

271.551<br />

______<br />

0,50<br />

____________<br />

11.198.192<br />

______<br />

20,74<br />

Total acciones ordinarias<br />

____________<br />

28.783.047<br />

______<br />

53,31<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (e) %<br />

VALORES DE RENTA FIJA<br />

Australia<br />

A$710.000 Government of Australia ‘415’<br />

6,25% 15/4/2015<br />

____________<br />

473.191<br />

______<br />

0,88<br />

Austria<br />

¥33.000.000 Oesterreichische Kontrollbank 1,8%<br />

22/3/2010 247.850 0,46<br />

e493.000 Republic of Austria ‘2’ 4,65%<br />

15/1/2018<br />

____________<br />

556.101<br />

______<br />

1,03<br />

____________<br />

803.951<br />

______<br />

1,49<br />

Dinamarca<br />

DKK5.015.000 Kingdom of Denmark 4%<br />

15/11/2015<br />

____________<br />

712.534<br />

______<br />

1,32<br />

Francia<br />

e742.000 French Treasury Note BTAN 3%<br />

12/7/2008 744.092 1,38<br />

e275.000 Government of France OAT 3,75%<br />

25/4/2021<br />

____________<br />

284.003<br />

______<br />

0,52<br />

____________<br />

1.028.095<br />

______<br />

1,90<br />

Alemania<br />

¥78.000.000 Bayerische Landesbank EMTN 1%<br />

20/9/2010 565.950 1,05<br />

e2.800.000 Bundesschatzanweisungen 2%<br />

10/3/2006 2.798.180 5,18<br />

e391.000 Germany ‘00’ 5,25% 4/7/2010 427.045 0,79<br />

e856.000 Germany ‘02’ 5% 4/7/2012 948.481 1,76<br />

e483.000 Germany ‘03’ 4,75% 4/7/2034 583.636 1,08<br />

e35.000 Germany ‘04’ 3,75% 4/1/2015 36.354 0,07<br />

e593.000 Germany ‘05’ 3,25% 4/7/2015 592.417 1,10<br />

e478.000 Germany ‘05’ 4% 4/1/2037 517.441 0,96<br />

e45.000 Germany ‘99’ 3,75% 4/1/2009 46.047 0,08<br />

e2.099.000 Germany ‘139’ 4% 16/2/2007 2.127.873 3,94<br />

e628.000 Germany ‘147’ 2,5% 8/10/2010<br />

____________<br />

613.127<br />

______<br />

1,13<br />

____________<br />

9.256.551<br />

______<br />

17,14<br />

Organismos supranacionales<br />

¥24.000.000 European Investment Bank 1,4%<br />

20/6/2017<br />

____________<br />

169.563<br />

______<br />

0,31<br />

Japón<br />

¥3.000.000 Development Bank of Japan 1,4%<br />

20/6/2012 21.988 0,04<br />

¥10.000.000 Development Bank of Japan 1,6%<br />

20/6/2014 73.744 0,14<br />

¥73.000.000 Development Bank of Japan 1,7%<br />

20/9/2022 513.132 0,95<br />

e100.000 Resona Bank EMTN 3,75% 15/4/2015 100.459 0,19<br />

e50.000 Sumitomo Mitsui Banking 4,375%<br />

27/10/2014<br />

____________<br />

51.572<br />

______<br />

0,09<br />

____________<br />

760.895<br />

______<br />

1,41<br />

Jersey<br />

¥68.000.000 ASIF III Jersey EMTN 0,95% 15/7/2009 491.217 0,91<br />

US$90.000 Old Mutual Capital Funding 8%<br />

22/12/2008 (Perpetual)<br />

____________<br />

80.203<br />

______<br />

0,15<br />

____________<br />

571.420<br />

______<br />

1,06<br />

La Memoria incluida en las páginas 180 a 187 forma parte integrante de estas cuentas <strong>anual</strong>es.<br />

<strong>Informe</strong> Anual Auditado 127