Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

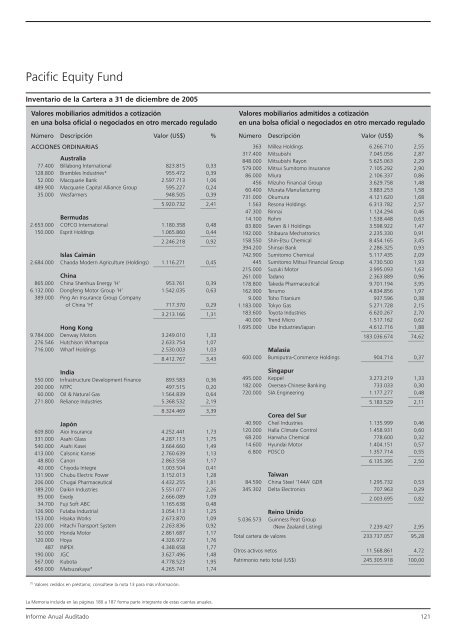

Pacific Equity Fund<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

ACCIONES ORDINARIAS<br />

Australia<br />

77.400 Billabong International 823.815 0,33<br />

128.800 Brambles Industries* 955.472 0,39<br />

52.000 Macquarie Bank 2.597.713 1,06<br />

489.900 Macquarie Capital Alliance Group 595.227 0,24<br />

35.000 Wesfarmers<br />

____________<br />

948.505<br />

______<br />

0,39<br />

____________<br />

5.920.732<br />

______<br />

2,41<br />

Bermudas<br />

2.653.000 COFCO International 1.180.358 0,48<br />

150.000 Esprit Holdings<br />

____________<br />

1.065.860<br />

______<br />

0,44<br />

____________<br />

2.246.218<br />

______<br />

0,92<br />

Islas Caimán<br />

2.684.000 Chaoda Modern Agriculture (Holdings)<br />

____________<br />

1.116.271<br />

______<br />

0,45<br />

China<br />

865.000 China Shenhua Energy ‘H’ 953.761 0,39<br />

6.132.000 Dongfeng Motor Group ‘H’ 1.542.035 0,63<br />

389.000 Ping An Insurance Group Company<br />

of China ‘H’<br />

____________<br />

717.370<br />

______<br />

0,29<br />

____________<br />

3.213.166<br />

______<br />

1,31<br />

Hong Kong<br />

9.784.000 Denway Motors 3.249.010 1,33<br />

276.546 Hutchison Whampoa 2.633.754 1,07<br />

716.000 Wharf Holdings<br />

____________<br />

2.530.003<br />

______<br />

1,03<br />

____________<br />

8.412.767<br />

______<br />

3,43<br />

India<br />

550.000 Infrastructure Development Finance 893.583 0,36<br />

200.000 NTPC 497.515 0,20<br />

60.000 Oil & Natural Gas 1.564.839 0,64<br />

271.800 Reliance Industries<br />

____________<br />

5.368.532<br />

______<br />

2,19<br />

____________<br />

8.324.469<br />

______<br />

3,39<br />

Japón<br />

609.800 Aioi Insurance 4.252.441 1,73<br />

331.000 Asahi Glass 4.287.113 1,75<br />

540.000 Asahi Kasei 3.664.660 1,49<br />

413.000 Calsonic Kansei 2.760.639 1,13<br />

48.800 Canon 2.863.558 1,17<br />

40.000 Chiyoda Integre 1.003.504 0,41<br />

131.900 Chubu Electric Power 3.152.013 1,28<br />

206.000 Chugai Pharmaceutical 4.432.255 1,81<br />

189.200 Daikin Industries 5.551.077 2,26<br />

95.000 Exedy 2.666.089 1,09<br />

34.700 Fuji Soft ABC 1.165.638 0,48<br />

126.900 Futaba Industrial 3.054.113 1,25<br />

153.000 Hisaka Works 2.673.870 1,09<br />

220.000 Hitachi Transport System 2.263.836 0,92<br />

50.000 Honda Motor 2.861.687 1,17<br />

120.000 Hoya 4.326.972 1,76<br />

487 INPEX 4.348.658 1,77<br />

190.000 JGC 3.627.496 1,48<br />

567.000 Kubota 4.778.523 1,95<br />

456.000 Matsuzakaya* 4.265.741 1,74<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

363 Millea Holdings 6.266.710 2,55<br />

317.400 Mitsubishi 7.045.056 2,87<br />

848.000 Mitsubishi Rayon 5.625.063 2,29<br />

579.000 Mitsui Sumitomo Insurance 7.105.292 2,90<br />

86.000 Miura 2.106.337 0,86<br />

456 Mizuho Financial Group 3.629.758 1,48<br />

60.400 Murata Manufacturing 3.883.253 1,58<br />

731.000 Okumura 4.121.620 1,68<br />

1.563 Resona Holdings 6.313.782 2,57<br />

47.300 Rinnai 1.124.294 0,46<br />

14.100 Rohm 1.538.448 0,63<br />

83.800 Seven & I Holdings 3.598.922 1,47<br />

192.000 Shibaura Mechatronics 2.235.330 0,91<br />

158.550 Shin-Etsu Chemical 8.454.165 3,45<br />

394.200 Shinsei Bank 2.286.325 0,93<br />

742.900 Sumitomo Chemical 5.117.435 2,09<br />

445 Sumitomo Mitsui Financial Group 4.730.500 1,93<br />

215.000 Suzuki Motor 3.995.093 1,63<br />

261.000 Tadano 2.363.889 0,96<br />

178.800 Takeda Pharmaceutical 9.701.194 3,95<br />

162.900 Terumo 4.834.856 1,97<br />

9.000 Toho Titanium 937.596 0,38<br />

1.183.000 Tokyo Gas 5.271.728 2,15<br />

183.600 Toyota Industries 6.620.267 2,70<br />

40.000 Trend Micro 1.517.162 0,62<br />

1.695.000 Ube Industries/Japan<br />

____________<br />

4.612.716<br />

______<br />

1,88<br />

____________<br />

183.036.674<br />

______<br />

74,62<br />

Malasia<br />

600.000 Bumiputra-Commerce Holdings<br />

____________<br />

904.714<br />

______<br />

0,37<br />

Singapur<br />

495.000 Keppel 3.273.219 1,33<br />

182.000 Oversea-Chinese Banking 733.033 0,30<br />

720.000 SIA Engineering<br />

____________<br />

1.177.277<br />

______<br />

0,48<br />

____________<br />

5.183.529<br />

______<br />

2,11<br />

Corea del Sur<br />

40.900 Cheil Industries 1.135.999 0,46<br />

120.000 Halla Climate Control 1.458.931 0,60<br />

68.200 Hanwha Chemical 778.600 0,32<br />

14.600 Hyundai Motor 1.404.151 0,57<br />

6.800 POSCO<br />

____________<br />

1.357.714<br />

______<br />

0,55<br />

____________<br />

6.135.395<br />

______<br />

2,50<br />

Taiwan<br />

84.590 China Steel ‘144A’ GDR 1.295.732 0,53<br />

345.302 Delta Electronics<br />

____________<br />

707.963<br />

______<br />

0,29<br />

____________<br />

2.003.695<br />

______<br />

0,82<br />

Reino Unido<br />

5.036.573 Guinness Peat Group<br />

(New Zealand Listing)<br />

____________<br />

7.239.427<br />

______<br />

2,95<br />

Total cartera de valores 233.737.057 95,28<br />

Otros activos netos<br />

____________<br />

11.568.861<br />

______<br />

4,72<br />

Patrimonio neto total (US$)<br />

____________<br />

245.305.918 100,00<br />

______<br />

(*) Valores cedidos en préstamo; consúltese la nota 13 para más información.<br />

La Memoria incluida en las páginas 180 a 187 forma parte integrante de estas cuentas <strong>anual</strong>es.<br />

<strong>Informe</strong> Anual Auditado 121