Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

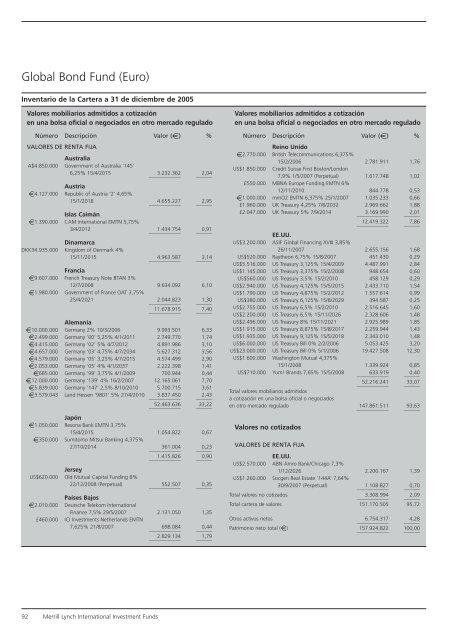

Global Bond Fund (Euro)<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (e) %<br />

VALORES DE RENTA FIJA<br />

Australia<br />

A$4.850.000 Government of Australia ‘145’<br />

6,25% 15/4/2015<br />

____________<br />

3.232.362<br />

______<br />

2,04<br />

Austria<br />

e4.127.000 Republic of Austria ‘2’ 4,65%<br />

15/1/2018<br />

____________<br />

4.655.227<br />

______<br />

2,95<br />

Islas Caimán<br />

e1.390.000 CAM International EMTN 5,75%<br />

3/4/2012<br />

____________<br />

1.434.754<br />

______<br />

0,91<br />

Dinamarca<br />

DKK34.935.000 Kingdom of Denmark 4%<br />

15/11/2015<br />

____________<br />

4.963.587<br />

______<br />

3,14<br />

Francia<br />

e9.607.000 French Treasury Note BTAN 3%<br />

12/7/2008 9.634.092 6,10<br />

e1.980.000 Government of France OAT 3,75%<br />

25/4/2021<br />

____________<br />

2.044.823<br />

______<br />

1,30<br />

____________<br />

11.678.915<br />

______<br />

7,40<br />

Alemania<br />

e10.000.000 Germany 2% 10/3/2006 9.993.501 6,33<br />

e2.499.000 Germany ‘00’ 5,25% 4/1/2011 2.749.770 1,74<br />

e4.415.000 Germany ‘02’ 5% 4/7/2012 4.891.986 3,10<br />

e4.657.000 Germany ‘03’ 4,75% 4/7/2034 5.627.312 3,56<br />

e4.579.000 Germany ‘05’ 3,25% 4/7/2015 4.574.499 2,90<br />

e2.053.000 Germany ‘05’ 4% 4/1/2037 2.222.398 1,41<br />

e685.000 Germany ‘99’ 3,75% 4/1/2009 700.944 0,44<br />

e12.000.000 Germany ‘139’ 4% 16/2/2007 12.165.061 7,70<br />

e5.839.000 Germany ‘147’ 2,5% 8/10/2010 5.700.715 3,61<br />

e3.579.043 Land Hessen ‘9801’ 5% 27/4/2010<br />

____________<br />

3.837.450<br />

______<br />

2,43<br />

____________<br />

52.463.636<br />

______<br />

33,22<br />

Japón<br />

e1.050.000 Resona Bank EMTN 3,75%<br />

15/4/2015 1.054.822 0,67<br />

e350.000 Sumitomo Mitsui Banking 4,375%<br />

27/10/2014<br />

____________<br />

361.004<br />

______<br />

0,23<br />

____________<br />

1.415.826<br />

______<br />

0,90<br />

Jersey<br />

US$620.000 Old Mutual Capital Funding 8%<br />

22/12/2008 (Perpetual)<br />

____________<br />

552.507<br />

______<br />

0,35<br />

Países Bajos<br />

e2.010.000 Deutsche Telekom International<br />

Finance 7,5% 29/5/2007 2.131.050 1,35<br />

£460.000 ICI Investments Netherlands EMTN<br />

7,625% 21/8/2007<br />

____________<br />

698.084<br />

______<br />

0,44<br />

____________<br />

2.829.134<br />

______<br />

1,79<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (e) %<br />

Reino Unido<br />

e2.770.000 British Telecommunications 6,375%<br />

15/2/2006 2.781.911 1,76<br />

US$1.850.000 Credit Suisse First Boston/London<br />

7,9% 1/5/2007 (Perpetual) 1.617.748 1,02<br />

£550.000 MBNA Europe Funding EMTN 6%<br />

12/11/2010 844.778 0,53<br />

e1.000.000 mmO2 EMTN 6,375% 25/1/2007 1.035.233 0,66<br />

£1.960.000 UK Treasury 4,25% 7/6/2032 2.969.662 1,88<br />

£2.047.000 UK Treasury 5% 7/9/2014<br />

____________<br />

3.169.990<br />

______<br />

2,01<br />

____________<br />

12.419.322<br />

______<br />

7,86<br />

EE.UU.<br />

US$3.200.000 ASIF Global Financing XVIII 3,85%<br />

26/11/2007 2.655.156 1,68<br />

US$520.000 Raytheon 6,75% 15/8/2007 451.430 0,29<br />

US$5.516.000 US Treasury 3,125% 15/4/2009 4.487.991 2,84<br />

US$1.145.000 US Treasury 3,375% 15/2/2008 948.654 0,60<br />

US$560.000 US Treasury 3,5% 15/2/2010 458.129 0,29<br />

US$2.940.000 US Treasury 4,125% 15/5/2015 2.433.710 1,54<br />

US$1.790.000 US Treasury 4,875% 15/2/2012 1.557.614 0,99<br />

US$380.000 US Treasury 6,125% 15/8/2029 394.587 0,25<br />

US$2.755.000 US Treasury 6,5% 15/2/2010 2.516.645 1,60<br />

US$2.200.000 US Treasury 6,5% 15/11/2026 2.328.606 1,48<br />

US$2.496.000 US Treasury 8% 15/11/2021 2.925.989 1,85<br />

US$1.915.000 US Treasury 8,875% 15/8/2017 2.259.944 1,43<br />

US$1.935.000 US Treasury 9,125% 15/5/2018 2.343.010 1,48<br />

US$6.000.000 US Treasury Bill 0% 2/2/2006 5.053.425 3,20<br />

US$23.000.000 US Treasury Bill 0% 5/1/2006 19.427.508 12,30<br />

US$1.600.000 Washington Mutual 4,375%<br />

15/1/2008 1.339.924 0,85<br />

US$710.000 Yum! Brands 7,65% 15/5/2008<br />

____________<br />

633.919<br />

______<br />

0,40<br />

____________<br />

52.216.241<br />

______<br />

33,07<br />

Total valores mobiliarios admitidos<br />

a cotización en una bolsa oficial o negociados<br />

en otro mercado regulado<br />

____________<br />

147.861.511<br />

______<br />

93,63<br />

Valores no cotizados<br />

VALORES DE RENTA FIJA<br />

EE.UU.<br />

US$2.570.000 ABN Amro Bank/Chicago 7,3%<br />

1/12/2026 2.200.167 1,39<br />

US$1.260.000 Socgen Real Estate ‘144A’ 7,64%<br />

30/9/2007 (Perpetual)<br />

____________<br />

1.108.827<br />

______<br />

0,70<br />

Total valores no cotizados<br />

____________<br />

3.308.994<br />

______<br />

2,09<br />

Total cartera de valores 151.170.505 95,72<br />

Otros activos netos<br />

____________<br />

6.754.317<br />

______<br />

4,28<br />

Patrimonio neto total (e)<br />

____________<br />

157.924.822 100,00<br />

______<br />

92 Merrill Lynch International Investment Funds