Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

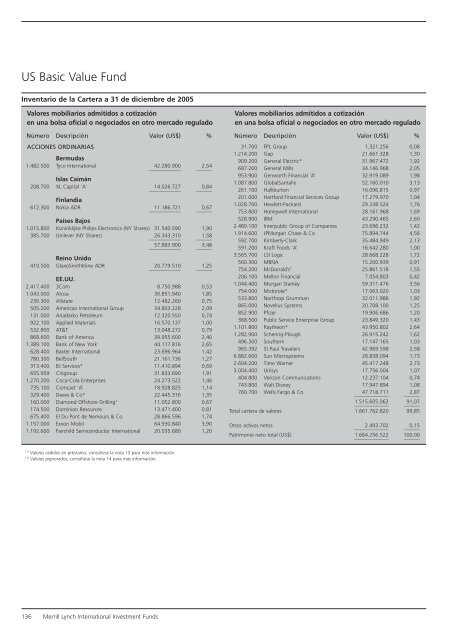

US Basic Value Fund<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

ACCIONES ORDINARIAS<br />

Bermudas<br />

1.482.500 Tyco International<br />

____________<br />

42.280.900<br />

______<br />

2,54<br />

Islas Caimán<br />

208.700 XL Capital ‘A’<br />

____________<br />

14.026.727<br />

______<br />

0,84<br />

Finlandia<br />

612.300 Nokia ADR<br />

____________<br />

11.186.721<br />

______<br />

0,67<br />

Países Bajos<br />

1.015.800 Koninklijke Philips Electronics (NY Shares) 31.540.590 1,90<br />

385.700 Unilever (NY Shares)<br />

____________<br />

26.343.310<br />

______<br />

1,58<br />

____________<br />

57.883.900<br />

______<br />

3,48<br />

Reino Unido<br />

410.500 GlaxoSmithKline ADR<br />

____________<br />

20.779.510<br />

______<br />

1,25<br />

EE.UU.<br />

2.417.400 3Com 8.750.988 0,53<br />

1.043.000 Alcoa 30.851.940 1,85<br />

230.300 Allstate 12.482.260 0,75<br />

505.200 American International Group 34.803.228 2,09<br />

131.000 Anadarko Petroleum 12.320.550 0,74<br />

922.100 Applied Materials 16.570.137 1,00<br />

532.800 AT&T 13.048.272 0,79<br />

868.600 Bank of America 39.955.600 2,40<br />

1.389.100 Bank of New York 44.117.816 2,65<br />

628.400 Baxter International 23.696.964 1,42<br />

780.300 BellSouth 21.161.736 1,27<br />

313.400 BJ Services* 11.410.894 0,69<br />

655.959 Citigroup 31.833.690 1,91<br />

1.270.200 Coca-Cola Enterprises 24.273.522 1,46<br />

735.100 Comcast ‘A’ 18.928.825 1,14<br />

329.400 Deere & Co* 22.445.316 1,35<br />

160.000 Diamond Offshore Drilling † 11.052.800 0,67<br />

174.500 Dominion Resources 13.471.400 0,81<br />

675.400 EI Du Pont de Nemours & Co 28.866.596 1,74<br />

1.157.000 Exxon Mobil 64.930.840 3,90<br />

1.192.600 Fairchild Semiconductor International 20.035.680 1,20<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

31.700 FPL Group 1.321.256 0,08<br />

1.214.200 Gap 21.661.328 1,30<br />

909.200 General Electric* 31.967.472 1,92<br />

687.200 General Mills 34.146.968 2,05<br />

953.900 Genworth Financial ‘A’ 32.919.089 1,98<br />

1.087.800 GlobalSantaFe 52.160.010 3,13<br />

261.100 Halliburton 16.096.815 0,97<br />

201.000 Hartford Financial Services Group 17.279.970 1,04<br />

1.028.700 Hewlett-Packard 29.338.524 1,76<br />

753.800 Honeywell International 28.161.968 1,69<br />

528.900 IBM 43.290.465 2,60<br />

2.489.100 Interpublic Group of Companies 23.696.232 1,42<br />

1.914.600 JPMorgan Chase & Co 75.894.744 4,56<br />

592.700 Kimberly-Clark 35.484.949 2,13<br />

591.200 Kraft Foods ‘A’ 16.642.280 1,00<br />

3.565.700 LSI Logic 28.668.228 1,72<br />

560.300 MBNA 15.200.939 0,91<br />

754.200 McDonald’s † 25.861.518 1,55<br />

206.100 Mellon Financial 7.054.803 0,42<br />

1.044.400 Morgan Stanley 59.311.476 3,56<br />

754.000 Motorola* 17.063.020 1,03<br />

533.800 Northrop Grumman 32.011.986 1,92<br />

865.000 Novellus Systems 20.708.100 1,25<br />

852.900 Pfizer 19.906.686 1,20<br />

368.500 Public Service Enterprise Group 23.849.320 1,43<br />

1.101.800 Raytheon* 43.950.802 2,64<br />

1.282.900 Schering-Plough 26.915.242 1,62<br />

496.300 Southern 17.147.165 1,03<br />

965.392 St Paul Travelers 42.969.598 2,58<br />

6.882.600 Sun Microsystems 28.838.094 1,73<br />

2.604.200 Time Warner 45.417.248 2,73<br />

3.004.400 Unisys 17.756.004 1,07<br />

404.800 Verizon Communications 12.237.104 0,74<br />

743.800 Walt Disney 17.947.894 1,08<br />

760.700 Wells Fargo & Co<br />

_____________<br />

47.718.711<br />

______<br />

2,87<br />

_____________<br />

1.515.605.062<br />

______<br />

91,07<br />

Total cartera de valores 1.661.762.820 99,85<br />

Otros activos netos<br />

_____________<br />

2.493.702<br />

______<br />

0,15<br />

Patrimonio neto total (US$)<br />

_____________<br />

1.664.256.522 100,00<br />

______<br />

(*)<br />

Valores cedidos en préstamo; consúltese la nota 13 para más información.<br />

(†) Valores pignorados; consúltese la nota 14 para más información.<br />

136 Merrill Lynch International Investment Funds