Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

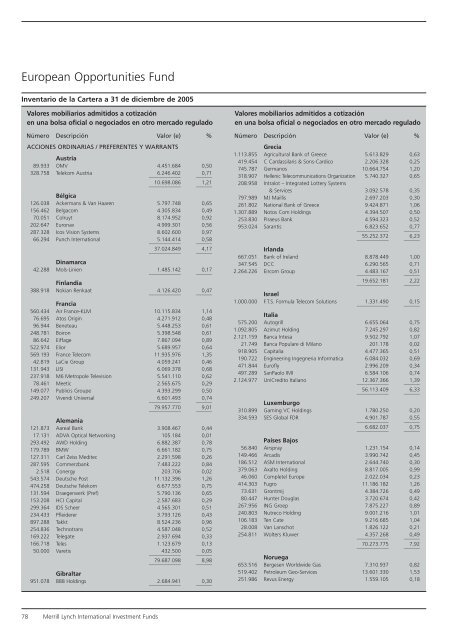

European Opportunities Fund<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (e) %<br />

ACCIONES ORDINARIAS / PREFERENTES Y WARRANTS<br />

Austria<br />

89.933 OMV 4.451.684 0,50<br />

328.758 Telekom Austria<br />

____________<br />

6.246.402<br />

______<br />

0,71<br />

____________<br />

10.698.086<br />

______<br />

1,21<br />

Bélgica<br />

126.038 Ackermans & Van Haaren 5.797.748 0,65<br />

156.462 Belgacom 4.305.834 0,49<br />

70.051 Colruyt 8.174.952 0,92<br />

202.647 Euronav 4.999.301 0,56<br />

287.328 Icos Vision Systems 8.602.600 0,97<br />

66.294 Punch International<br />

____________<br />

5.144.414<br />

______<br />

0,58<br />

____________<br />

37.024.849<br />

______<br />

4,17<br />

Dinamarca<br />

42.288 Mols-Linien<br />

____________<br />

1.485.142<br />

______<br />

0,17<br />

Finlandia<br />

388.918 Nokian Renkaat<br />

____________<br />

4.126.420<br />

______<br />

0,47<br />

Francia<br />

560.434 Air France-KLM 10.115.834 1,14<br />

76.695 Atos Origin 4.271.912 0,48<br />

96.944 Beneteau 5.448.253 0,61<br />

248.781 Boiron 5.398.548 0,61<br />

86.642 Eiffage 7.867.094 0,89<br />

522.974 Elior 5.689.957 0,64<br />

569.193 France Telecom 11.935.976 1,35<br />

42.819 LaCie Group 4.059.241 0,46<br />

131.943 LISI 6.069.378 0,68<br />

237.918 M6 Metropole Television 5.541.110 0,62<br />

78.461 Meetic 2.565.675 0,29<br />

149.077 Publicis Groupe 4.393.299 0,50<br />

249.207 Vivendi Universal<br />

____________<br />

6.601.493<br />

______<br />

0,74<br />

____________<br />

79.957.770<br />

______<br />

9,01<br />

Alemania<br />

121.873 Aareal Bank 3.908.467 0,44<br />

17.131 ADVA Optical Networking 105.184 0,01<br />

293.492 AWD Holding 6.882.387 0,78<br />

179.789 BMW 6.661.182 0,75<br />

127.311 Carl Zeiss Meditec 2.291.598 0,26<br />

287.595 Commerzbank 7.483.222 0,84<br />

2.518 Conergy 203.706 0,02<br />

543.574 Deutsche Post 11.132.396 1,26<br />

474.258 Deutsche Telekom 6.677.553 0,75<br />

131.594 Draegerwerk (Pref) 5.790.136 0,65<br />

153.208 HCI Capital 2.587.683 0,29<br />

299.364 IDS Scheer 4.565.301 0,51<br />

234.433 Pfleiderer 3.793.126 0,43<br />

897.288 Takkt 8.524.236 0,96<br />

254.836 Technotrans 4.587.048 0,52<br />

169.222 Telegate 2.937.694 0,33<br />

166.718 Teles 1.123.679 0,13<br />

50.000 Varetis<br />

____________<br />

432.500<br />

______<br />

0,05<br />

____________<br />

79.687.098<br />

______<br />

8,98<br />

Gibraltar<br />

951.078 888 Holdings<br />

____________<br />

2.684.941<br />

______<br />

0,30<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (e) %<br />

Grecia<br />

1.113.855 Agricultural Bank of Greece 5.613.829 0,63<br />

419.454 C Cardassilaris & Sons-Cardico 2.206.328 0,25<br />

745.787 Germanos 10.664.754 1,20<br />

318.907 Hellenic Telecommunications Organization 5.740.327 0,65<br />

208.958 Intralot – Integrated Lottery Systems<br />

& Services 3.092.578 0,35<br />

797.989 MJ Maillis 2.697.203 0,30<br />

261.802 National Bank of Greece 9.424.871 1,06<br />

1.307.889 Notos Com Holdings 4.394.507 0,50<br />

253.830 Piraeus Bank 4.594.323 0,52<br />

953.024 Sarantis<br />

____________<br />

6.823.652<br />

______<br />

0,77<br />

____________<br />

55.252.372<br />

______<br />

6,23<br />

Irlanda<br />

667.051 Bank of Ireland 8.878.449 1,00<br />

347.545 DCC 6.290.565 0,71<br />

2.264.226 Eircom Group<br />

____________<br />

4.483.167<br />

______<br />

0,51<br />

____________<br />

19.652.181<br />

______<br />

2,22<br />

Israel<br />

1.000.000 F.T.S. Formula Telecom Solutions<br />

____________<br />

1.331.490<br />

______<br />

0,15<br />

Italia<br />

575.200 Autogrill 6.655.064 0,75<br />

1.092.805 Azimut Holding 7.245.297 0,82<br />

2.121.159 Banca Intesa 9.502.792 1,07<br />

21.749 Banca Populare di Milano 201.178 0,02<br />

918.905 Capitalia 4.477.365 0,51<br />

190.722 Engineering Ingegneria Informatica 6.084.032 0,69<br />

471.844 Eurofly 2.996.209 0,34<br />

497.289 SanPaolo IMI 6.584.106 0,74<br />

2.124.977 UniCredito Italiano<br />

____________<br />

12.367.366<br />

______<br />

1,39<br />

____________<br />

56.113.409<br />

______<br />

6,33<br />

Luxemburgo<br />

310.899 Gaming VC Holdings 1.780.250 0,20<br />

334.593 SES Global FDR<br />

____________<br />

4.901.787<br />

______<br />

0,55<br />

____________<br />

6.682.037<br />

______<br />

0,75<br />

Países Bajos<br />

56.840 Airspray 1.231.154 0,14<br />

149.466 Arcadis 3.990.742 0,45<br />

186.512 ASM International 2.644.740 0,30<br />

379.063 Axalto Holding 8.817.005 0,99<br />

46.060 Completel Europe 2.022.034 0,23<br />

414.303 Fugro 11.186.182 1,26<br />

73.631 Grontmij 4.384.726 0,49<br />

80.447 Hunter Douglas 3.720.674 0,42<br />

267.956 ING Groep 7.875.227 0,89<br />

240.803 Nutreco Holding 9.001.216 1,01<br />

106.183 Ten Cate 9.216.685 1,04<br />

28.008 Van Lanschot 1.826.122 0,21<br />

254.811 Wolters Kluwer<br />

____________<br />

4.357.268<br />

______<br />

0,49<br />

____________<br />

70.273.775<br />

______<br />

7,92<br />

Noruega<br />

653.516 Bergesen Worldwide Gas 7.310.937 0,82<br />

519.402 Petroleum Geo-Services 13.601.330 1,53<br />

251.986 Revus Energy 1.559.105 0,18<br />

78 Merrill Lynch International Investment Funds