Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

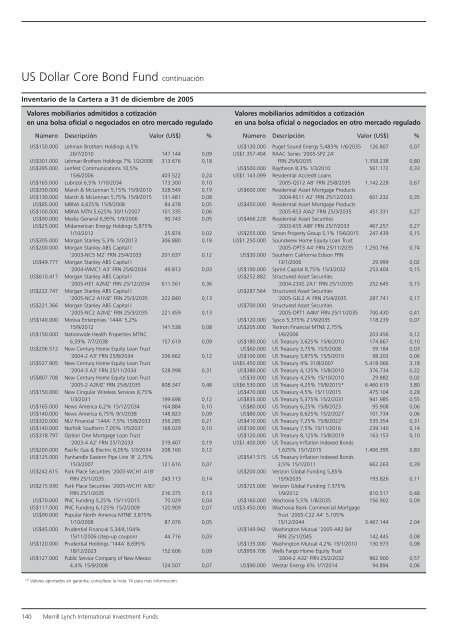

US Dollar Core Bond Fund continuación<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

US$150.000 Lehman Brothers Holdings 4,5%<br />

26/7/2010 147.144 0,09<br />

US$301.000 Lehman Brothers Holdings 7% 1/2/2008 313.676 0,18<br />

US$395.000 Lenfest Communications 10,5%<br />

15/6/2006 403.522 0,24<br />

US$165.000 Lubrizol 6,5% 1/10/2034 173.300 0,10<br />

US$330.000 Marsh & McLennan 5,15% 15/9/2010 328.549 0,19<br />

US$130.000 Marsh & McLennan 5,75% 15/9/2015 131.481 0,08<br />

US$85.000 MBNA 4,625% 15/9/2008 84.478 0,05<br />

US$100.000 MBNA MTN 5,625% 30/11/2007 101.335 0,06<br />

US$90.000 Media General 6,95% 1/9/2006 90.743 0,05<br />

US$25.000 Midamerican Energy Holdings 5,875%<br />

1/10/2012 25.874 0,02<br />

US$305.000 Morgan Stanley 5,3% 1/3/2013 306.880 0,18<br />

US$200.000 Morgan Stanley ABS Capital I<br />

‘2003-NC5 M2’ FRN 25/4/2033 201.637 0,12<br />

US$49.777 Morgan Stanley ABS Capital I<br />

‘2004-WMC1 A3’ FRN 25/6/2034 49.813 0,03<br />

US$610.417 Morgan Stanley ABS Capital I<br />

‘2005-HE1 A2MZ’ FRN 25/12/2034 611.561 0,36<br />

US$222.747 Morgan Stanley ABS Capital I<br />

‘2005-NC2 A1MZ’ FRN 25/3/2035 222.840 0,13<br />

US$221.366 Morgan Stanley ABS Capital I<br />

‘2005-NC2 A2MZ’ FRN 25/3/2035 221.459 0,13<br />

US$140.000 Motiva Enterprises ‘144A’ 5,2%<br />

15/9/2012 141.538 0,08<br />

US$150.000 Nationwide Health Properties MTNC<br />

6,59% 7/7/2038 157.619 0,09<br />

US$206.512 New Century Home Equity Loan Trust<br />

‘2004-2 A3’ FRN 25/8/2034 206.662 0,12<br />

US$527.905 New Century Home Equity Loan Trust<br />

‘2004-3 A3’ FRN 25/11/2034 528.998 0,31<br />

US$807.708 New Century Home Equity Loan Trust<br />

‘2005-2 A2MZ’ FRN 25/6/2035 808.347 0,48<br />

US$150.000 New Cingular Wireless Services 8,75%<br />

1/3/2031 199.698 0,12<br />

US$165.000 News America 6,2% 15/12/2034 164.884 0,10<br />

US$140.000 News America 6,75% 9/1/2038 148.823 0,09<br />

US$320.000 NLV Financial ‘144A’ 7,5% 15/8/2033 356.285 0,21<br />

US$140.000 Norfolk Southern 7,05% 1/5/2037 168.029 0,10<br />

US$318.797 Option One Mortgage Loan Trust<br />

‘2003-4 A2’ FRN 25/7/2033 319.407 0,19<br />

US$200.000 Pacific Gas & Electric 6,05% 1/3/2034 208.160 0,12<br />

US$125.000 Panhandle Eastern Pipe Line ‘B’ 2,75%<br />

15/3/2007 121.616 0,07<br />

US$242.615 Park Place Securities ‘2005-WCH1 A1B’<br />

FRN 25/1/2035 243.113 0,14<br />

US$215.930 Park Place Securities ‘2005-WCH1 A3D’<br />

FRN 25/1/2035 216.375 0,13<br />

US$70.000 PNC Funding 5,25% 15/11/2015 70.029 0,04<br />

US$117.000 PNC Funding 6,125% 15/2/2009 120.909 0,07<br />

US$90.000 Popular North America MTNE 3,875%<br />

1/10/2008 87.076 0,05<br />

US$45.000 Prudential Financial 5,34/4,104%<br />

15/11/2006 (step-up coupon) 44.716 0,03<br />

US$120.000 Prudential Holdings ‘144A’ 8,695%<br />

18/12/2023 152.606 0,09<br />

US$127.000 Public Service Company of New Mexico<br />

4,4% 15/9/2008 124.507 0,07<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

US$130.000 Puget Sound Energy 5,483% 1/6/2035 126.807 0,07<br />

US$1.357.404 RAAC Series ‘2005-SP2 2A’<br />

FRN 25/6/2035 1.358.238 0,80<br />

US$500.000 Raytheon 8,3% 1/3/2010 561.172 0,33<br />

US$1.143.099 Residential Accredit Loans<br />

‘2005-QS12 A8’ FRN 25/8/2035 1.142.228 0,67<br />

US$600.000 Residential Asset Mortgage Products<br />

‘2004-RS11 A2’ FRN 25/12/2033 601.232 0,35<br />

US$450.000 Residential Asset Mortgage Products<br />

‘2005-RS3 AIA2’ FRN 25/3/2035 451.331 0,27<br />

US$466.228 Residential Asset Securities<br />

‘2003-KS5 AIIB’ FRN 25/7/2033 467.257 0,27<br />

US$255.000 Simon Property Group 5,1% 15/6/2015 247.439 0,15<br />

US$1.250.000 Soundview Home Equity Loan Trust<br />

‘2005-OPT3 A4’ FRN 25/11/2035 1.250.766 0,74<br />

US$30.000 Southern California Edison FRN<br />

13/1/2006 29.999 0,02<br />

US$190.000 Sprint Capital 8,75% 15/3/2032 253.404 0,15<br />

US$252.882 Structured Asset Securities<br />

‘2004-23XS 2A1’ FRN 25/1/2035 252.645 0,15<br />

US$287.564 Structured Asset Securities<br />

‘2005-GEL2 A’ FRN 25/4/2035 287.741 0,17<br />

US$700.000 Structured Asset Securities<br />

‘2005-OPT1 A4M’ FRN 25/11/2035 700.430 0,41<br />

US$120.000 Sysco 5,375% 21/9/2035 118.239 0,07<br />

US$205.000 Textron Financial MTNE 2,75%<br />

1/6/2006 203.456 0,12<br />

US$180.000 US Treasury 3,625% 15/6/2010 174.867 0,10<br />

US$60.000 US Treasury 3,75% 15/5/2008 59.184 0,03<br />

US$100.000 US Treasury 3,875% 15/5/2010 98.203 0,06<br />

US$5.450.000 US Treasury 4% 31/8/2007 5.418.066 3,18<br />

US$380.000 US Treasury 4,125% 15/8/2010 376.734 0,22<br />

US$30.000 US Treasury 4,25% 15/10/2010 29.882 0,02<br />

US$6.530.000 US Treasury 4,25% 15/8/2015* 6.460.619 3,80<br />

US$470.000 US Treasury 4,5% 15/11/2015 475.104 0,28<br />

US$835.000 US Treasury 5,375% 15/2/2031 941.985 0,55<br />

US$80.000 US Treasury 6,25% 15/8/2023 95.908 0,06<br />

US$80.000 US Treasury 6,625% 15/2/2027 101.734 0,06<br />

US$410.000 US Treasury 7,25% 15/8/2022 ‡ 535.354 0,31<br />

US$190.000 US Treasury 7,5% 15/11/2016 239.140 0,14<br />

US$120.000 US Treasury 8,125% 15/8/2019 163.153 0,10<br />

US$1.400.000 US Treasury Inflation Indexed Bonds<br />

1,625% 15/1/2015 1.406.395 0,83<br />

US$541.515 US Treasury Inflation Indexed Bonds<br />

3,5% 15/1/2011 662.263 0,39<br />

US$200.000 Verizon Global Funding 5,85%<br />

15/9/2035 193.826 0,11<br />

US$725.000 Verizon Global Funding 7,375%<br />

1/9/2012 810.517 0,48<br />

US$160.000 Wachovia 5,5% 1/8/2035 156.902 0,09<br />

US$3.450.000 Wachovia Bank Commercial Mortgage<br />

Trust ‘2005-C22 A4’ 5,105%<br />

15/12/2044 3.467.144 2,04<br />

US$149.942 Washington Mutual ‘2005-AR2 B4’<br />

FRN 25/1/2045 142.445 0,08<br />

US$135.000 Washington Mutual 4,2% 15/1/2010 130.973 0,08<br />

US$959.706 Wells Fargo Home Equity Trust<br />

‘2004-2 A32’ FRN 25/2/2032 962.900 0,57<br />

US$90.000 Westar Energy 6% 1/7/2014 94.894 0,06<br />

(‡)<br />

Valores aportados en garantía; consúltese la nota 14 para más información.<br />

140 Merrill Lynch International Investment Funds