Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

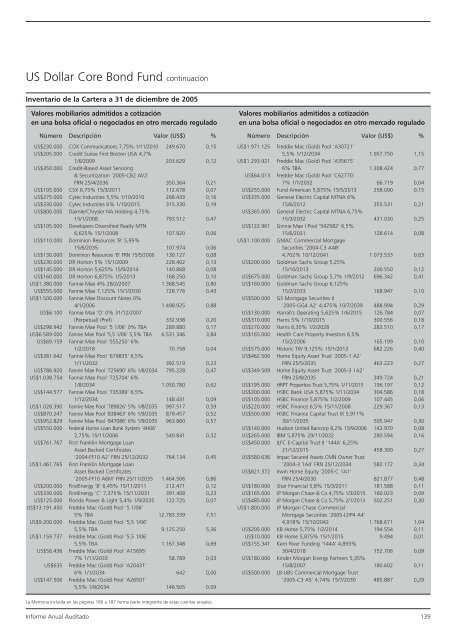

US Dollar Core Bond Fund continuación<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

US$230.000 COX Communications 7,75% 1/11/2010 249.670 0,15<br />

US$205.000 Credit Suisse First Boston USA 4,7%<br />

1/6/2009 203.629 0,12<br />

US$350.000 Credit-Based Asset Servicing<br />

& Securitization ‘2005-CB2 AV2’<br />

FRN 25/4/2036 350.364 0,21<br />

US$105.000 CSX 6,75% 15/3/2011 112.678 0,07<br />

US$275.000 Cytec Industries 5,5% 1/10/2010 268.433 0,16<br />

US$330.000 Cytec Industries 6% 1/10/2015 315.330 0,19<br />

US$800.000 DaimlerChrysler NA Holding 4,75%<br />

15/1/2008 793.512 0,47<br />

US$105.000 Developers Diversified Realty MTN<br />

6,625% 15/1/2008 107.920 0,06<br />

US$110.000 Dominion Resources ‘B’ 5,95%<br />

15/6/2035 107.974 0,06<br />

US$130.000 Dominion Resources ‘B’ FRN 15/5/2006 130.127 0,08<br />

US$230.000 DR Horton 5% 15/1/2009 228.402 0,13<br />

US$145.000 DR Horton 5,625% 15/9/2014 140.868 0,08<br />

US$160.000 DR Horton 6,875% 1/5/2013 168.250 0,10<br />

US$1.380.000 Fannie Mae 4% 28/2/2007 1.368.545 0,80<br />

US$555.000 Fannie Mae 7,125% 15/1/2030 728.776 0,43<br />

US$1.500.000 Fannie Mae Discount Notes 0%<br />

4/1/2006 1.498.925 0,88<br />

US$6.100 Fannie Mae ‘O’ 0% 31/12/2007<br />

(Perpetual) (Pref) 332.938 0,20<br />

US$298.942 Fannie Mae Pool ‘5 1/06’ 0% TBA 289.880 0,17<br />

US$6.589.000 Fannie Mae Pool ‘5,5 1/06’ 5,5% TBA 6.531.346 3,84<br />

US$69.159 Fannie Mae Pool ‘555250’ 6%<br />

1/2/2018 70.758 0,04<br />

US$381.642 Fannie Mae Pool ‘679835’ 6,5%<br />

1/11/2032 392.519 0,23<br />

US$786.920 Fannie Mae Pool ‘725690’ 6% 1/8/2034 795.228 0,47<br />

US$1.038.754 Fannie Mae Pool ‘725704’ 6%<br />

1/8/2034 1.050.780 0,62<br />

US$144.577 Fannie Mae Pool ‘735389’ 6,5%<br />

1/12/2034 148.431 0,09<br />

US$1.028.390 Fannie Mae Pool ‘789826’ 5% 1/8/2035 997.517 0,59<br />

US$870.247 Fannie Mae Pool ‘838463’ 6% 1/9/2035 879.457 0,52<br />

US$952.829 Fannie Mae Pool ‘847086’ 6% 1/9/2035 963.860 0,57<br />

US$550.000 Federal Home Loan Bank System ‘4H06’<br />

2,75% 15/11/2006 540.841 0,32<br />

US$761.767 First Franklin Mortgage Loan<br />

Asset Backed Certificates<br />

‘2004-FF10 A2’ FRN 25/12/2032 764.134 0,45<br />

US$1.461.765 First Franklin Mortgage Loan<br />

Asset Backed Certificates<br />

‘2005-FF10 A6M’ FRN 25/11/2035 1.464.506 0,86<br />

US$200.000 FirstEnergy ‘B’ 6,45% 15/11/2011 212.471 0,12<br />

US$330.000 FirstEnergy ‘C’ 7,375% 15/11/2031 391.408 0,23<br />

US$125.000 Florida Power & Light 5,4% 1/9/2035 122.725 0,07<br />

US$13.191.450 Freddie Mac (Gold) Pool ‘5 1/06’<br />

5% TBA 12.783.339 7,51<br />

US$9.200.000 Freddie Mac (Gold) Pool ‘5,5 1/06’<br />

5,5% TBA 9.125.250 5,36<br />

US$1.159.737 Freddie Mac (Gold) Pool ‘5,5 1/06’<br />

5,5% TBA 1.167.348 0,69<br />

US$56.436 Freddie Mac (Gold) Pool ‘A15695’<br />

7% 1/11/2033 58.789 0,03<br />

US$635 Freddie Mac (Gold) Pool ‘A20431’<br />

6% 1/1/2034 642 0,00<br />

US$147.506 Freddie Mac (Gold) Pool ‘A26501’<br />

5,5% 1/9/2034 146.505 0,09<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

US$1.971.125 Freddie Mac (Gold) Pool ‘A30721’<br />

5,5% 1/12/2034 1.957.750 1,15<br />

US$1.293.921 Freddie Mac (Gold) Pool ‘A35615’<br />

6% TBA 1.308.424 0,77<br />

US$64.013 Freddie Mac (Gold) Pool ‘C62770’<br />

7% 1/1/2032 66.719 0,04<br />

US$255.000 Fund American 5,875% 15/5/2013 258.090 0,15<br />

US$335.000 General Electric Capital MTNA 6%<br />

15/6/2012 355.531 0,21<br />

US$365.000 General Electric Capital MTNA 6,75%<br />

15/3/2032 431.030 0,25<br />

US$122.961 Ginnie Mae I Pool ‘542582’ 6,5%<br />

15/6/2031 128.614 0,08<br />

US$1.100.000 GMAC Commercial Mortgage<br />

Securities ‘2004-C3 AAB’<br />

4,702% 10/12/2041 1.073.533 0,63<br />

US$200.000 Goldman Sachs Group 5,25%<br />

15/10/2013 200.550 0,12<br />

US$675.000 Goldman Sachs Group 5,7% 1/9/2012 696.342 0,41<br />

US$160.000 Goldman Sachs Group 6,125%<br />

15/2/2033 168.947 0,10<br />

US$500.000 GS Mortgage Securities II<br />

‘2005-GG4 A2’ 4,475% 10/7/2039 488.994 0,29<br />

US$130.000 Harrah’s Operating 5,625% 1/6/2015 126.784 0,07<br />

US$310.000 Harris 5% 1/10/2015 300.556 0,18<br />

US$270.000 Harris 6,35% 1/2/2028 283.510 0,17<br />

US$165.000 Health Care Property Investors 6,5%<br />

15/2/2006 165.199 0,10<br />

US$575.000 Historic TW 9,125% 15/1/2013 682.226 0,40<br />

US$462.500 Home Equity Asset Trust ‘2005-1 A2’<br />

FRN 25/5/2035 463.223 0,27<br />

US$349.509 Home Equity Asset Trust ‘2005-3 1A2’<br />

FRN 25/8/2035 349.724 0,21<br />

US$195.000 HRPT Properties Trust 5,75% 1/11/2015 196.197 0,12<br />

US$300.000 HSBC Bank USA 5,875% 1/11/2034 304.586 0,18<br />

US$105.000 HSBC Finance 5,875% 1/2/2009 107.445 0,06<br />

US$220.000 HSBC Finance 6,5% 15/11/2008 229.367 0,13<br />

US$500.000 HSBC Finance Capital Trust IX 5,911%<br />

30/11/2035 505.947 0,30<br />

US$140.000 Hudson United Bancorp 8,2% 15/9/2006 142.970 0,08<br />

US$265.000 IBM 5,875% 29/11/2032 280.594 0,16<br />

US$450.000 ILFC E-Capital Trust II ‘144A’ 6,25%<br />

21/12/2015 458.300 0,27<br />

US$580.636 Impac Secured Assets CMN Owner Trust<br />

‘2004-3 1A4’ FRN 25/12/2034 582.172 0,34<br />

US$821.372 Irwin Home Equity ‘2005-C 1A1’<br />

FRN 25/4/2030 821.877 0,48<br />

US$180.000 iStar Financial 5,8% 15/3/2011 181.588 0,11<br />

US$165.000 JP Morgan Chase & Co 4,75% 1/3/2015 160.023 0,09<br />

US$485.000 JP Morgan Chase & Co 5,75% 2/1/2013 502.251 0,30<br />

US$1.800.000 JP Morgan Chase Commercial<br />

Mortgage Securities ‘2005-LDP4 A4’<br />

4,918% 15/10/2042 1.768.671 1,04<br />

US$205.000 KB Home 5,75% 1/2/2014 194.554 0,11<br />

US$10.000 KB Home 5,875% 15/1/2015 9.494 0,01<br />

US$155.341 Kern River Funding ‘144A’ 4,893%<br />

30/4/2018 152.706 0,09<br />

US$180.000 Kinder Morgan Energy Partners 5,35%<br />

15/8/2007 180.602 0,11<br />

US$500.000 LB-UBS Commercial Mortgage Trust<br />

‘2005-C3 A5’ 4,74% 15/7/2030 485.887 0,29<br />

La Memoria incluida en las páginas 180 a 187 forma parte integrante de estas cuentas <strong>anual</strong>es.<br />

<strong>Informe</strong> Anual Auditado 139