Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

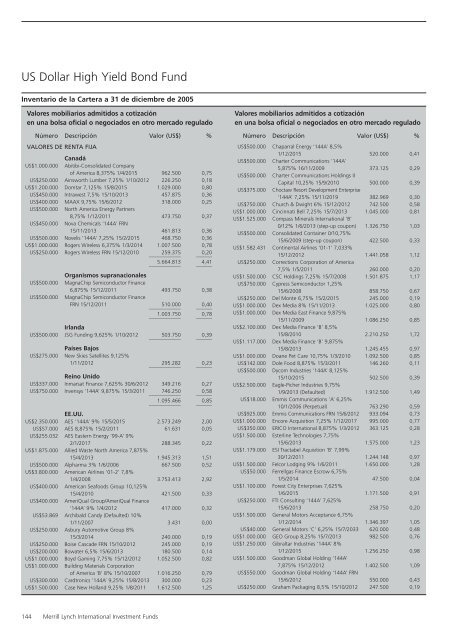

US Dollar High Yield Bond Fund<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

VALORES DE RENTA FIJA<br />

Canadá<br />

US$1.000.000 Abitibi-Consolidated Company<br />

of America 8,375% 1/4/2015 962.500 0,75<br />

US$250.000 Ainsworth Lumber 7,25% 1/10/2012 226.250 0,18<br />

US$1.200.000 Domtar 7,125% 15/8/2015 1.029.000 0,80<br />

US$450.000 Intrawest 7,5% 15/10/2013 457.875 0,36<br />

US$400.000 MAAX 9,75% 15/6/2012 318.000 0,25<br />

US$500.000 North America Energy Partners<br />

8,75% 1/12/2011 473.750 0,37<br />

US$450.000 Nova Chemicals ‘144A’ FRN<br />

15/11/2013 461.813 0,36<br />

US$500.000 Novelis ‘144A’ 7,25% 15/2/2015 468.750 0,36<br />

US$1.000.000 Rogers Wireless 6,375% 1/3/2014 1.007.500 0,78<br />

US$250.000 Rogers Wireless FRN 15/12/2010<br />

____________<br />

259.375<br />

______<br />

0,20<br />

____________<br />

5.664.813<br />

______<br />

4,41<br />

US$500.000<br />

US$500.000<br />

Organismos supranacionales<br />

MagnaChip Semiconductor Finance<br />

6,875% 15/12/2011 493.750 0,38<br />

MagnaChip Semiconductor Finance<br />

FRN 15/12/2011<br />

____________<br />

510.000<br />

______<br />

0,40<br />

____________<br />

1.003.750<br />

______<br />

0,78<br />

Irlanda<br />

US$500.000 JSG Funding 9,625% 1/10/2012<br />

____________<br />

503.750<br />

______<br />

0,39<br />

Países Bajos<br />

US$275.000 New Skies Satellites 9,125%<br />

1/11/2012<br />

____________<br />

295.282<br />

______<br />

0,23<br />

Reino Unido<br />

US$337.000 Inmarsat Finance 7,625% 30/6/2012 349.216 0,27<br />

US$750.000 Invensys ‘144A’ 9,875% 15/3/2011<br />

____________<br />

746.250<br />

______<br />

0,58<br />

____________<br />

1.095.466<br />

______<br />

0,85<br />

EE.UU.<br />

US$2.350.000 AES ‘144A’ 9% 15/5/2015 2.573.249 2,00<br />

US$57.000 AES 8,875% 15/2/2011 61.631 0,05<br />

US$255.032 AES Eastern Energy ‘99-A’ 9%<br />

2/1/2017 288.345 0,22<br />

US$1.875.000 Allied Waste North America 7,875%<br />

15/4/2013 1.945.313 1,51<br />

US$500.000 Alpharma 3% 1/6/2006 667.500 0,52<br />

US$3.800.000 American Airlines ‘01-2’ 7,8%<br />

1/4/2008 3.753.413 2,92<br />

US$400.000 American Seafoods Group 10,125%<br />

15/4/2010 421.500 0,33<br />

US$400.000 AmeriQual Group/AmeriQual Finance<br />

‘144A’ 9% 1/4/2012 417.000 0,32<br />

US$53.869 Archibald Candy (Defaulted) 10%<br />

1/11/2007 3.431 0,00<br />

US$250.000 Asbury Automotive Group 8%<br />

15/3/2014 240.000 0,19<br />

US$250.000 Boise Cascade FRN 15/10/2012 245.000 0,19<br />

US$200.000 Bowater 6,5% 15/6/2013 180.500 0,14<br />

US$1.000.000 Boyd Gaming 7,75% 15/12/2012 1.052.500 0,82<br />

US$1.000.000 Building Materials Corporation<br />

of America ‘B’ 8% 15/10/2007 1.016.250 0,79<br />

US$300.000 Cardtronics ‘144A’ 9,25% 15/8/2013 300.000 0,23<br />

US$1.500.000 Case New Holland 9,25% 1/8/2011 1.612.500 1,25<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

US$500.000 Chaparral Energy ‘144A’ 8,5%<br />

1/12/2015 520.000 0,41<br />

US$500.000 Charter Communications ‘144A’<br />

5,875% 16/11/2009 373.125 0,29<br />

US$500.000 Charter Communications Holdings II<br />

Capital 10,25% 15/9/2010 500.000 0,39<br />

US$375.000 Choctaw Resort Development Enterprise<br />

‘144A’ 7,25% 15/11/2019 382.969 0,30<br />

US$750.000 Church & Dwight 6% 15/12/2012 742.500 0,58<br />

US$1.000.000 Cincinnati Bell 7,25% 15/7/2013 1.045.000 0,81<br />

US$1.525.000 Compass Minerals International ‘B’<br />

0/12% 1/6/2013 (step-up coupon) 1.326.750 1,03<br />

US$500.000 Consolidated Container 0/10,75%<br />

15/6/2009 (step-up coupon) 422.500 0,33<br />

US$1.582.431 Continental Airlines ‘01-1’ 7,033%<br />

15/12/2012 1.441.058 1,12<br />

US$250.000 Corrections Corporation of America<br />

7,5% 1/5/2011 260.000 0,20<br />

US$1.500.000 CSC Holdings 7,25% 15/7/2008 1.501.875 1,17<br />

US$750.000 Cypress Semiconductor 1,25%<br />

15/6/2008 858.750 0,67<br />

US$250.000 Del Monte 6,75% 15/2/2015 245.000 0,19<br />

US$1.000.000 Dex Media 8% 15/11/2013 1.025.000 0,80<br />

US$1.000.000 Dex Media East Finance 9,875%<br />

15/11/2009 1.086.250 0,85<br />

US$2.100.000 Dex Media Finance ‘B’ 8,5%<br />

15/8/2010 2.210.250 1,72<br />

US$1.117.000 Dex Media Finance ‘B’ 9,875%<br />

15/8/2013 1.245.455 0,97<br />

US$1.000.000 Doane Pet Care 10,75% 1/3/2010 1.092.500 0,85<br />

US$142.000 Dole Food 8,875% 15/3/2011 146.260 0,11<br />

US$500.000 Dycom Industries ‘144A’ 8,125%<br />

15/10/2015 502.500 0,39<br />

US$2.500.000 Eagle-Picher Industries 9,75%<br />

1/9/2013 (Defaulted) 1.912.500 1,49<br />

US$18.000 Emmis Communications ‘A’ 6,25%<br />

10/1/2006 (Perpetual) 763.290 0,59<br />

US$925.000 Emmis Communications FRN 15/6/2012 933.094 0,73<br />

US$1.000.000 Encore Acquisition 7,25% 1/12/2017 995.000 0,77<br />

US$350.000 ERICO International 8,875% 1/3/2012 363.125 0,28<br />

US$1.500.000 Esterline Technologies 7,75%<br />

15/6/2013 1.575.000 1,23<br />

US$1.179.000 ESI Tractabel Aquisition ‘B’ 7,99%<br />

30/12/2011 1.244.148 0,97<br />

US$1.500.000 Felcor Lodging 9% 1/6/2011 1.650.000 1,28<br />

US$50.000 Ferrellgas Finance Escrow 6,75%<br />

1/5/2014 47.500 0,04<br />

US$1.100.000 Forest City Enterprises 7,625%<br />

1/6/2015 1.171.500 0,91<br />

US$250.000 FTI Consulting ‘144A’ 7,625%<br />

15/6/2013 258.750 0,20<br />

US$1.500.000 General Motors Acceptance 6,75%<br />

1/12/2014 1.346.397 1,05<br />

US$40.000 General Motors ‘C’ 6,25% 15/7/2033 620.000 0,48<br />

US$1.000.000 GEO Group 8,25% 15/7/2013 982.500 0,76<br />

US$1.250.000 Gibraltar Industries ‘144A’ 8%<br />

1/12/2015 1.256.250 0,98<br />

US$1.500.000 Goodman Global Holding ‘144A’<br />

7,875% 15/12/2012 1.402.500 1,09<br />

US$550.000 Goodman Global Holding ‘144A’ FRN<br />

15/6/2012 550.000 0,43<br />

US$250.000 Graham Packaging 8,5% 15/10/2012 247.500 0,19<br />

144 Merrill Lynch International Investment Funds