Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

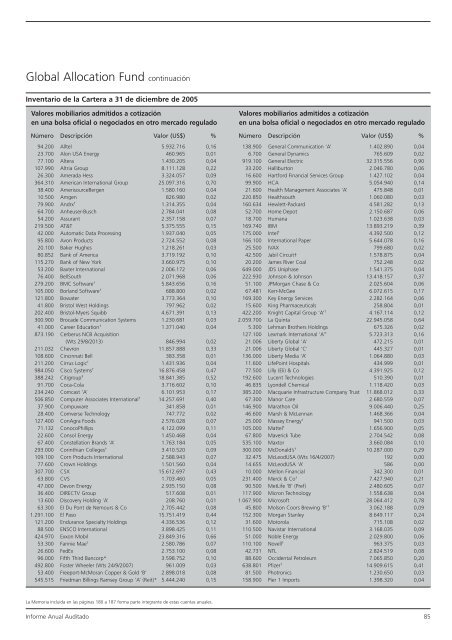

Global Allocation Fund continuación<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

94.200 Alltel 5.932.716 0,16<br />

23.700 Alon USA Energy 460.965 0,01<br />

77.100 Altera 1.430.205 0,04<br />

107.990 Altria Group 8.111.128 0,22<br />

26.300 Amerada Hess 3.324.057 0,09<br />

364.310 American International Group 25.097.316 0,70<br />

38.400 AmerisourceBergen 1.580.160 0,04<br />

10.500 Amgen 826.980 0,02<br />

79.900 Andrx † 1.314.355 0,04<br />

64.700 Anheuser-Busch 2.784.041 0,08<br />

54.200 Assurant 2.357.158 0,07<br />

219.500 AT&T 5.375.555 0,15<br />

42.000 Automatic Data Processing 1.937.040 0,05<br />

95.800 Avon Products 2.724.552 0,08<br />

20.100 Baker Hughes 1.218.261 0,03<br />

80.852 Bank of America 3.719.192 0,10<br />

115.270 Bank of New York 3.660.975 0,10<br />

53.200 Baxter International 2.006.172 0,06<br />

76.400 BellSouth 2.071.968 0,06<br />

279.200 BMC Software † 5.843.656 0,16<br />

105.000 Borland Software † 688.800 0,02<br />

121.800 Bowater 3.773.364 0,10<br />

41.800 Bristol West Holdings 797.962 0,02<br />

202.400 Bristol-Myers Squibb 4.671.391 0,13<br />

300.900 Brocade Communication Systems 1.230.681 0,03<br />

41.000 Career Education † 1.371.040 0,04<br />

873.190 Cerberus NCB Acquisition<br />

(Wts 29/8/2013) 846.994 0,02<br />

211.032 Chevron 11.857.888 0,33<br />

108.600 Cincinnati Bell 383.358 0,01<br />

211.200 Cirrus Logic † 1.431.936 0,04<br />

984.050 Cisco Systems † 16.876.458 0,47<br />

388.242 Citigroup ‡ 18.841.385 0,52<br />

91.700 Coca-Cola 3.716.602 0,10<br />

234.240 Comcast ‘A’ 6.101.953 0,17<br />

506.850 Computer Associates International † 14.257.691 0,40<br />

37.900 Compuware 341.858 0,01<br />

28.400 Comverse Technology 747.772 0,02<br />

127.400 ConAgra Foods 2.576.028 0,07<br />

71.132 ConocoPhillips 4.122.099 0,11<br />

22.600 Consol Energy 1.450.468 0,04<br />

67.400 Constellation Brands ‘A’ 1.763.184 0,05<br />

293.000 Corinthian Colleges † 3.410.520 0,09<br />

109.100 Corn Products International 2.588.943 0,07<br />

77.600 Crown Holdings 1.501.560 0,04<br />

307.700 CSX 15.612.697 0,43<br />

63.800 CVS 1.703.460 0,05<br />

47.000 Devon Energy 2.935.150 0,08<br />

36.400 DIRECTV Group 517.608 0,01<br />

13.600 Discovery Holding ‘A’ 208.760 0,01<br />

63.300 EI Du Pont de Nemours & Co 2.705.442 0,08<br />

1.291.100 El Paso 15.751.419 0,44<br />

121.200 Endurance Specialty Holdings 4.336.536 0,12<br />

88.500 ENSCO International 3.898.425 0,11<br />

424.970 Exxon Mobil 23.849.316 0,66<br />

53.300 Fannie Mae † 2.580.786 0,07<br />

26.600 FedEx 2.753.100 0,08<br />

96.000 Fifth Third Bancorp* 3.598.752 0,10<br />

492.800 Foster Wheeler (Wts 24/9/2007) 961.009 0,03<br />

53.400 Freeport-McMoran Copper & Gold ‘B’ 2.898.018 0,08<br />

545.515 Friedman Billings Ramsey Group ‘A’ (Reit)* 5.444.240 0,15<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

138.900 General Communication ‘A’ 1.402.890 0,04<br />

6.700 General Dynamics 765.609 0,02<br />

919.100 General Electric 32.315.556 0,90<br />

33.200 Halliburton 2.046.780 0,06<br />

16.600 Hartford Financial Services Group 1.427.102 0,04<br />

99.900 HCA 5.054.940 0,14<br />

21.600 Health Management Associates ‘A’ 475.848 0,01<br />

220.850 Healthsouth 1.060.080 0,03<br />

160.634 Hewlett-Packard 4.581.282 0,13<br />

52.700 Home Depot 2.150.687 0,06<br />

18.700 Humana 1.023.638 0,03<br />

169.740 IBM 13.893.219 0,39<br />

175.000 Intel † 4.392.500 0,12<br />

166.100 International Paper 5.644.078 0,16<br />

25.500 IVAX 799.680 0,02<br />

42.500 Jabil Circuit† 1.578.875 0,04<br />

20.200 James River Coal 752.248 0,02<br />

649.000 JDS Uniphase 1.541.375 0,04<br />

222.930 Johnson & Johnson 13.418.157 0,37<br />

51.100 JPMorgan Chase & Co 2.025.604 0,06<br />

67.481 Kerr-McGee 6.072.615 0,17<br />

169.300 Key Energy Services 2.282.164 0,06<br />

15.600 King Pharmaceuticals 258.804 0,01<br />

422.200 Knight Capital Group ‘A’ † 4.167.114 0,12<br />

2.059.700 La Quinta 22.945.058 0,64<br />

5.300 Lehman Brothers Holdings 675.326 0,02<br />

127.100 Lexmark International ‘A’ † 5.723.313 0,16<br />

21.006 Liberty Global ‘A’ 472.215 0,01<br />

21.006 Liberty Global ‘C’ 445.327 0,01<br />

136.000 Liberty Media ‘A’ 1.064.880 0,03<br />

11.600 LifePoint Hospitals 434.999 0,01<br />

77.500 Lilly (Eli) & Co 4.391.925 0,12<br />

192.600 Lucent Technologies 510.390 0,01<br />

46.835 Lyondell Chemical 1.118.420 0,03<br />

385.200 Macquarie Infrastructure Company Trust 11.868.012 0,33<br />

67.300 Manor Care 2.680.559 0,07<br />

146.900 Marathon Oil 9.006.440 0,25<br />

46.600 Marsh & McLennan 1.468.366 0,04<br />

25.000 Massey Energy † 941.500 0,03<br />

105.000 Mattel † 1.656.900 0,05<br />

67.800 Maverick Tube 2.704.542 0,08<br />

535.100 Maxtor 3.660.084 0,10<br />

300.000 McDonald’s † 10.287.000 0,29<br />

32.475 McLeodUSA (Wts 16/4/2007) 192 0,00<br />

14.655 McLeodUSA ‘A’ 586 0,00<br />

10.000 Mellon Financial 342.300 0,01<br />

231.400 Merck & Co † 7.427.940 0,21<br />

90.500 MetLife ‘B’ (Pref) 2.480.605 0,07<br />

117.900 Micron Technology 1.558.638 0,04<br />

1.067.900 Microsoft 28.064.412 0,78<br />

45.800 Molson Coors Brewing ‘B’ † 3.062.188 0,09<br />

152.300 Morgan Stanley 8.649.117 0,24<br />

31.600 Motorola 715.108 0,02<br />

110.500 Navistar International 3.168.035 0,09<br />

51.000 Noble Energy 2.029.800 0,06<br />

110.100 Novell † 963.375 0,03<br />

42.731 NTL 2.824.519 0,08<br />

88.600 Occidental Petroleum 7.065.850 0,20<br />

638.801 Pfizer † 14.909.615 0,41<br />

81.500 Photronics 1.230.650 0,03<br />

158.900 Pier 1 Imports 1.398.320 0,04<br />

La Memoria incluida en las páginas 180 a 187 forma parte integrante de estas cuentas <strong>anual</strong>es.<br />

<strong>Informe</strong> Anual Auditado 85