Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

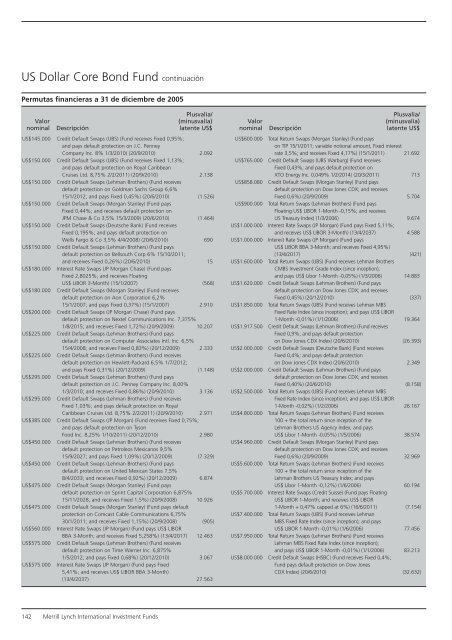

US Dollar Core Bond Fund continuación<br />

Permutas financieras a 31 de diciembre de 2005<br />

Valor<br />

nominal<br />

Descripción<br />

Plusvalía/<br />

(minusvalía)<br />

latente US$<br />

US$145.000 Credit Default Swaps (UBS) (Fund receives Fixed 0,95%;<br />

and pays default protection on J.C. Penney<br />

Company Inc. 8% 1/3/2010) (20/9/2010) 2.092<br />

US$150.000 Credit Default Swaps (UBS) (Fund receives Fixed 1,13%;<br />

and pays default protection on Royal Caribbean<br />

Cruises Ltd. 8,75% 2/2/2011) (20/9/2010) 2.138<br />

US$150.000 Credit Default Swaps (Lehman Brothers) (Fund receives<br />

default protection on Goldman Sachs Group 6,6%<br />

15/1/2012; and pays Fixed 0,45%) (20/6/2010) (1.526)<br />

US$150.000 Credit Default Swaps (Morgan Stanley) (Fund pays<br />

Fixed 0,44%; and receives default protection on<br />

JPM Chase & Co 3,5% 15/3/2009) (20/6/2010) (1.464)<br />

US$150.000 Credit Default Swaps (Deutsche Bank) (Fund receives<br />

Fixed 0,195%; and pays default protection on<br />

Wells Fargo & Co 3,5% 4/4/2008) (20/6/2010) 690<br />

US$150.000 Credit Default Swaps (Lehman Brothers) (Fund pays<br />

default protection on Bellsouth Corp 6% 15/10/2011;<br />

and receives Fixed 0,26%) (20/6/2010) 15<br />

US$180.000 Interest Rate Swaps (JP Morgan Chase) (Fund pays<br />

Fixed 2,8025%; and receives Floating<br />

US$ LIBOR 3-Month) (15/1/2007) (568)<br />

US$180.000 Credit Default Swaps (Morgan Stanley) (Fund receives<br />

default protection on Aon Corporation 6,2%<br />

15/1/2007; and pays Fixed 0,37%) (15/1/2007) 2.910<br />

US$200.000 Credit Default Swaps (JP Morgan Chase) (Fund pays<br />

default protection on Nextel Communications Inc. 7,375%<br />

1/8/2015; and receives Fixed 1,72%) (20/9/2009) 10.207<br />

US$225.000 Credit Default Swaps (Lehman Brothers) (Fund pays<br />

default protection on Computer Associates Intl. Inc. 6,5%<br />

15/4/2008; and receives Fixed 0,83%) (20/12/2009) 2.333<br />

US$225.000 Credit Default Swaps (Lehman Brothers) (Fund receives<br />

default protection on Hewlett-Packard 6,5% 1/7/2012;<br />

and pays Fixed 0,31%) (20/12/2009) (1.148)<br />

US$295.000 Credit Default Swaps (Lehman Brothers) (Fund pays<br />

default protection on J.C. Penney Company Inc. 8,00%<br />

1/3/2010; and receives Fixed 0,86%) (20/9/2010) 3.136<br />

US$295.000 Credit Default Swaps (Lehman Brothers) (Fund receives<br />

Fixed 1,03%; and pays default protection on Royal<br />

Caribbean Cruises Ltd. 8,75% 2/2/2011) (20/9/2010) 2.971<br />

US$385.000 Credit Default Swaps (JP Morgan) (Fund receives Fixed 0,75%;<br />

and pays default protection on Tyson<br />

Food Inc. 8,25% 1/10/2011) (20/12/2010) 2.980<br />

US$450.000 Credit Default Swaps (Lehman Brothers) (Fund receives<br />

default protection on Petroleos Mexicanos 9,5%<br />

15/9/2027; and pays Fixed 1,09%) (20/12/2009) (7.329)<br />

US$450.000 Credit Default Swaps (Lehman Brothers) (Fund pays<br />

default protection on United Mexican States 7,5%<br />

8/4/2033; and receives Fixed 0,92%) (20/12/2009) 6.874<br />

US$475.000 Credit Default Swaps (Morgan Stanley) (Fund pays<br />

default protection on Sprint Capital Corporation 6,875%<br />

15/11/2028; and receives Fixed 1,5%) (20/9/2008) 10.926<br />

US$475.000 Credit Default Swaps (Morgan Stanley) (Fund pays default<br />

protection on Comcast Cable Communications 6,75%<br />

30/1/2011; and receives Fixed 1,15%) (20/9/2008) (905)<br />

US$560.000 Interest Rate Swaps (JP Morgan) (Fund pays US$ LIBOR<br />

BBA 3-Month; and receives Fixed 5,258%) (13/4/2017) 12.463<br />

US$575.000 Credit Default Swaps (Lehman Brothers) (Fund receives<br />

default protection on Time Warner Inc. 6,875%<br />

1/5/2012; and pays Fixed 0,68%) (20/12/2010) 3.067<br />

US$575.000 Interest Rate Swaps (JP Morgan) (Fund pays Fixed<br />

5,41%; and receives US$ LIBOR BBA 3-Month)<br />

(13/4/2037) 27.563<br />

Valor<br />

nominal<br />

Descripción<br />

Plusvalía/<br />

(minusvalía)<br />

latente US$<br />

US$600.000 Total Return Swaps (Morgan Stanley) (Fund pays<br />

on TIP 15/1/2011; variable notional amount, Fixed interest<br />

rate 3,5%; and receives Fixed 4,17%) (15/1/2011) 21.692<br />

US$765.000 Credit Default Swaps (UBS Warburg) (Fund receives<br />

Fixed 0,43%; and pays default protection on<br />

XTO Energy Inc. 0,049% 1/2/2014) (20/3/2011) 713<br />

US$858.080 Credit Default Swaps (Morgan Stanley) (Fund pays<br />

default protection on Dow Jones CDX; and receives<br />

Fixed 0,6%) (20/9/2009) 5.704<br />

US$900.000 Total Return Swaps (Lehman Brothers) (Fund pays<br />

Floating US$ LIBOR 1-Month -0,15%; and receives<br />

US Treasury Index) (1/3/2006) 9.674<br />

US$1.000.000 Interest Rate Swaps (JP Morgan) (Fund pays Fixed 5,11%;<br />

and receives US$ LIBOR 3-Month) (13/4/2037) 4.588<br />

US$1.000.000 Interest Rate Swaps (JP Morgan) (Fund pays<br />

US$ LIBOR BBA 3-Month; and receives Fixed 4,95%)<br />

(13/4/2017) (421)<br />

US$1.600.000 Total Return Swaps (UBS) (Fund receives Lehman Brothers<br />

CMBS Investment Grade Index (since inception);<br />

and pays US$ Libor 1-Month -0,05%) (1/3/2006) 14.883<br />

US$1.620.000 Credit Default Swaps (Lehman Brothers) (Fund pays<br />

default protection on Dow Jones CDX; and receives<br />

Fixed 0,45%) (20/12/2010) (337)<br />

US$1.850.000 Total Return Swaps (UBS) (Fund receives Lehman MBS<br />

Fixed Rate Index (since inception); and pays US$ LIBOR<br />

1-Month -0,01%) (1/1/2006) 19.364<br />

US$1.917.500 Credit Default Swaps (Lehman Brothers) (Fund receives<br />

Fixed 0,9%; and pays default protection<br />

on Dow Jones CDX Index) (20/6/2010) (26.393)<br />

US$2.000.000 Credit Default Swaps (Deutsche Bank) (Fund receives<br />

Fixed 0,4%; and pays default protection<br />

on Dow Jones CDX Index) (20/6/2010) 2.349<br />

US$2.000.000 Credit Default Swaps (Lehman Brothers) (Fund pays<br />

default protection on Dow Jones CDX; and receives<br />

Fixed 0,40%) (20/6/2010) (8.158)<br />

US$2.500.000 Total Return Swaps (UBS) (Fund receives Lehman MBS<br />

Fixed Rate Index (since inception); and pays US$ LIBOR<br />

1-Month -0,02%) (1/2/2006) 26.167<br />

US$4.800.000 Total Return Swaps (Lehman Brothers) (Fund receives<br />

100 + the total return since inception of the<br />

Lehman Brothers US Agency Index; and pays<br />

US$ Libor 1-Month -0,05%) (1/5/2006) 38.574<br />

US$4.960.000 Credit Default Swaps (Morgan Stanley) (Fund pays<br />

default protection on Dow Jones CDX; and receives<br />

Fixed 0,6%) (20/9/2009) 32.969<br />

US$5.600.000 Total Return Swaps (Lehman Brothers) (Fund receives<br />

100 + the total return since inception of the<br />

Lehman Brothers US Treasury Index; and pays<br />

US$ Libor 1-Month -0,12%) (1/6/2006) 60.194<br />

US$5.700.000 Interest Rate Swaps (Credit Suisse) (Fund pays Floating<br />

US$ LIBOR 1-Month; and receives US$ LIBOR<br />

1-Month + 0,47% capped at 6%) (16/6/2011) (7.154)<br />

US$7.400.000 Total Return Swaps (UBS) (Fund receives Lehman<br />

MBS Fixed Rate Index (since inception); and pays<br />

US$ LIBOR 1-Month -0,01%) (1/6/2006) 77.456<br />

US$7.950.000 Total Return Swaps (Lehman Brothers) (Fund receives<br />

Lehman MBS Fixed Rate Index (since inception);<br />

and pays US$ LIBOR 1-Month -0,01%) (1/1/2006) 83.213<br />

US$8.000.000 Credit Default Swaps (HSBC) (Fund receives Fixed 0,4%;<br />

Fund pays default protection on Dow Jones<br />

CDX Index) (20/6/2010) (32.632)<br />

142 Merrill Lynch International Investment Funds