Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Informe anual (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

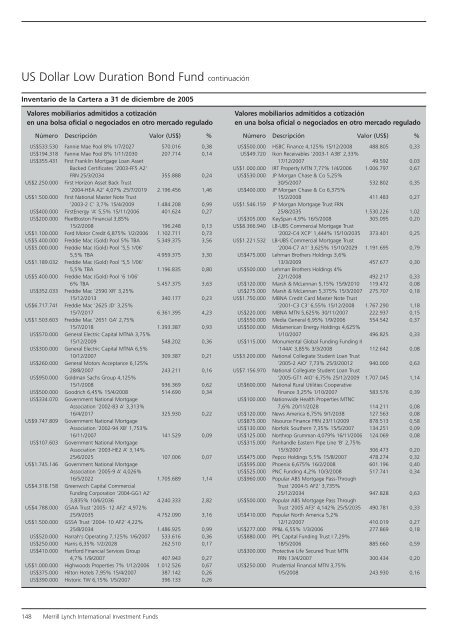

US Dollar Low Duration Bond Fund continuación<br />

Inventario de la Cartera a 31 de diciembre de 2005<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

US$533.530 Fannie Mae Pool 8% 1/7/2027 570.016 0,38<br />

US$194.318 Fannie Mae Pool 8% 1/11/2030 207.714 0,14<br />

US$355.431 First Franklin Mortgage Loan Asset<br />

Backed Certificates ‘2003-FF5 A2’<br />

FRN 25/3/2034 355.888 0,24<br />

US$2.250.000 First Horizon Asset Back Trust<br />

‘2004-HEA A2’ 4,07% 25/7/2019 2.196.456 1,46<br />

US$1.500.000 First National Master Note Trust<br />

‘2003-2 C’ 3,7% 15/4/2009 1.484.208 0,99<br />

US$400.000 FirstEnergy ‘A’ 5,5% 15/11/2006 401.624 0,27<br />

US$200.000 FleetBoston Financial 3,85%<br />

15/2/2008 196.248 0,13<br />

US$1.100.000 Ford Motor Credit 6,875% 1/2/2006 1.102.711 0,73<br />

US$5.400.000 Freddie Mac (Gold) Pool 5% TBA 5.349.375 3,56<br />

US$5.000.000 Freddie Mac (Gold) Pool ‘5,5 1/06’<br />

5,5% TBA 4.959.375 3,30<br />

US$1.189.032 Freddie Mac (Gold) Pool ‘5,5 1/06’<br />

5,5% TBA 1.196.835 0,80<br />

US$5.400.000 Freddie Mac (Gold) Pool ‘6 1/06’<br />

6% TBA 5.457.375 3,63<br />

US$352.033 Freddie Mac ‘2590 XR’ 3,25%<br />

15/12/2013 340.177 0,23<br />

US$6.717.741 Freddie Mac ‘2625 JD’ 3,25%<br />

15/7/2017 6.361.395 4,23<br />

US$1.503.603 Freddie Mac ‘2651 GA’ 2,75%<br />

15/7/2018 1.393.387 0,93<br />

US$570.000 General Electric Capital MTNA 3,75%<br />

15/12/2009 548.202 0,36<br />

US$300.000 General Electric Capital MTNA 6,5%<br />

10/12/2007 309.387 0,21<br />

US$260.000 General Motors Acceptance 6,125%<br />

28/8/2007 243.211 0,16<br />

US$950.000 Goldman Sachs Group 4,125%<br />

15/1/2008 936.369 0,62<br />

US$500.000 Goodrich 6,45% 15/4/2008 514.690 0,34<br />

US$334.070 Government National Mortgage<br />

Association ‘2002-83 A’ 3,313%<br />

16/4/2017 325.930 0,22<br />

US$9.747.809 Government National Mortgage<br />

Association ‘2002-94 XB’ 1,753%<br />

16/11/2007 141.529 0,09<br />

US$107.603 Government National Mortgage<br />

Association ‘2003-HE2 A’ 3,14%<br />

25/6/2025 107.006 0,07<br />

US$1.745.146 Government National Mortgage<br />

Association ‘2005-9 A’ 4,026%<br />

16/5/2022 1.705.689 1,14<br />

US$4.318.158 Greenwich Capital Commercial<br />

Funding Corporation ‘2004-GG1 A2’<br />

3,835% 10/6/2036 4.240.333 2,82<br />

US$4.788.000 GSAA Trust ‘2005- 12 AF2’ 4,972%<br />

25/9/2035 4.752.090 3,16<br />

US$1.500.000 GSSA Trust ‘2004- 10 AF2’ 4,22%<br />

25/8/2034 1.486.925 0,99<br />

US$520.000 Harrah‘s Operating 7,125% 1/6/2007 533.616 0,36<br />

US$250.000 Harris 6,35% 1/2/2028 262.510 0,17<br />

US$410.000 Hartford Financial Services Group<br />

4,7% 1/9/2007 407.943 0,27<br />

US$1.000.000 Highwoods Properties 7% 1/12/2006 1.012.526 0,67<br />

US$375.000 Hilton Hotels 7,95% 15/4/2007 387.142 0,26<br />

US$390.000 Historic TW 6,15% 1/5/2007 396.133 0,26<br />

Valores mobiliarios admitidos a cotización<br />

en una bolsa oficial o negociados en otro mercado regulado<br />

Número Descripción Valor (US$) %<br />

US$500.000 HSBC Finance 4,125% 15/12/2008 488.805 0,33<br />

US$49.720 Ikon Receivables ‘2003-1 A3B’ 2,33%<br />

17/12/2007 49.592 0,03<br />

US$1.000.000 IRT Property MTN 7,77% 1/4/2006 1.006.797 0,67<br />

US$530.000 JP Morgan Chase & Co 5,25%<br />

30/5/2007 532.802 0,35<br />

US$400.000 JP Morgan Chase & Co 6,375%<br />

15/2/2008 411.483 0,27<br />

US$1.546.159 JP Morgan Mortgage Trust FRN<br />

25/8/2035 1.530.226 1,02<br />

US$305.000 KeySpan 4,9% 16/5/2008 305.095 0,20<br />

US$8.366.940 LB-UBS Commercial Mortgage Trust<br />

‘2002-C4 XCP’ 1,444% 15/10/2035 373.401 0,25<br />

US$1.221.532 LB-UBS Commercial Mortgage Trust<br />

‘2004-C7 A1’ 3,625% 15/10/2029 1.191.695 0,79<br />

US$475.000 Lehman Brothers Holdings 3,6%<br />

13/3/2009 457.677 0,30<br />

US$500.000 Lehman Brothers Holdings 4%<br />

22/1/2008 492.217 0,33<br />

US$120.000 Marsh & McLennan 5,15% 15/9/2010 119.472 0,08<br />

US$275.000 Marsh & McLennan 5,375% 15/3/2007 275.707 0,18<br />

US$1.750.000 MBNA Credit Card Master Note Trust<br />

‘2001-C3 C3’ 6,55% 15/12/2008 1.767.290 1,18<br />

US$220.000 MBNA MTN 5,625% 30/11/2007 222.937 0,15<br />

US$550.000 Media General 6,95% 1/9/2006 554.542 0,37<br />

US$500.000 Midamerican Energy Holdings 4,625%<br />

1/10/2007 496.825 0,33<br />

US$115.000 Monumental Global Funding Funding II<br />

‘144A’ 3,85% 3/3/2008 112.642 0,08<br />

US$3.200.000 National Collegiate Student Loan Trust<br />

‘2005-2 AIO’ 7,73% 25/3/20012 940.000 0,63<br />

US$7.156.970 National Collegiate Student Loan Trust<br />

‘2005-GT1 AIO’ 6,75% 25/12/2009 1.707.045 1,14<br />

US$600.000 National Rural Utilities Cooperative<br />

Finance 3,25% 1/10/2007 583.576 0,39<br />

US$100.000 Nationwide Health Properties MTNC<br />

7,6% 20/11/2028 114.211 0,08<br />

US$120.000 News America 6,75% 9/1/2038 127.563 0,08<br />

US$875.000 Nisource Finance FRN 23/11/2009 878.513 0,58<br />

US$130.000 Norfolk Southern 7,35% 15/5/2007 134.251 0,09<br />

US$125.000 Northrop Grumman 4,079% 16/11/2006 124.069 0,08<br />

US$315.000 Panhandle Eastern Pipe Line ‘B’ 2,75%<br />

15/3/2007 306.473 0,20<br />

US$475.000 Pepco Holdings 5,5% 15/8/2007 478.274 0,32<br />

US$595.000 Phoenix 6,675% 16/2/2008 601.196 0,40<br />

US$525.000 PNC Funding 4,2% 10/3/2008 517.741 0,34<br />

US$960.000 Popular ABS Mortgage Pass-Through<br />

Trust ‘2004-5 AF2’ 3,735%<br />

25/12/2034 947.828 0,63<br />

US$500.000 Popular ABS Mortgage Pass Through<br />

Trust ‘2005 AF3’ 4,142% 25/5/2035 490.781 0,33<br />

US$410.000 Popular North America 5,2%<br />

12/12/2007 410.019 0,27<br />

US$277.000 PP&L 6,55% 1/3/2006 277.869 0,18<br />

US$880.000 PPL Capital Funding Trust I 7,29%<br />

18/5/2006 885.660 0,59<br />

US$300.000 Protective Life Secured Trust MTN<br />

FRN 13/4/2007 300.434 0,20<br />

US$250.000 Prudential Financial MTN 3,75%<br />

1/5/2008 243.930 0,16<br />

148 Merrill Lynch International Investment Funds