Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

n<br />

Textbook<br />

Rirson, G. et al. Business Finance. 5th ed, Sydney: McGraw-Hill,<br />

1990<br />

References<br />

Bishop, S.R., Crapp, H.R. and Twite, G.J. Corporate Finance. 2nd ed,<br />

Sydney: Holt. Rinehart and Winston. 1988<br />

Bruce, R., McKern, B., Pollard, I. and Skully, M. Handbook <strong>of</strong><br />

Australian Corporate Finance. 4th ed, Sydney: Bunelworths, 1991<br />

Van Horne. J., Davis, K., Nicol, R. and Wright, K. Financial<br />

Management and blicy in Aushalia. 3rd ed, Sydney: Prentice-Hall,<br />

1990<br />

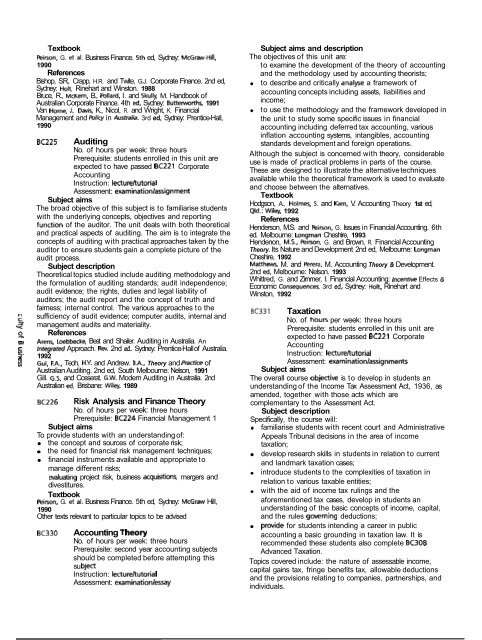

~ ~ 2 2 5 Auditing<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: students enrolled in this unit are<br />

expected to have passed BC221 Corporate<br />

Accounting<br />

Instruction: lectureltutorial<br />

Assessment: examination/assignment<br />

Subject aims<br />

The broad objective <strong>of</strong> this subject is to familiarise students<br />

with the underlying concepts, objectives and reporting<br />

function <strong>of</strong> the auditor. The unit deals with both theoretical<br />

and practical aspects <strong>of</strong> auditing. The aim is to integrate the<br />

concepts <strong>of</strong> auditing with practical approaches taken by the<br />

auditor to ensure students gain a complete picture <strong>of</strong> the<br />

audit process.<br />

Subject description<br />

Theoretical topics studied include auditing methodology and<br />

the formulation <strong>of</strong> auditing standards; audit independence;<br />

audit evidence; the rights, duties and legal liability <strong>of</strong><br />

auditors; the audit report and the concept <strong>of</strong> truth and<br />

fairness; internal control. The various approaches to the<br />

sufficiency <strong>of</strong> audit evidence; computer audits, internal and<br />

management audits and materiality.<br />

0, References<br />

Arens, Loebbecke, Best and Shailer. Auditing in Australia. An<br />

6, Integrated Approach. Rw. 2nd ed. Sydney: Prentice-Hall <strong>of</strong> Australia.<br />

1992<br />

Gul. F.A., Teoh, H.Y. and Andrew. B.A., Theory and Pmice <strong>of</strong><br />

Australian Auditing. 2nd ed, South Melbourne: Nelson, 1991<br />

Gill. G.S. and Cosserat. G.W. Modern Auditing in Australia. 2nd<br />

Australian ed, Brisbane: Wiley, 1989<br />

~ ~ 2 2 6 Risk Analysis and Finance Theory<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: BC224 Financial Management 1<br />

Subject aims<br />

To provide students with an understanding <strong>of</strong>:<br />

the concept and sources <strong>of</strong> corporate risk;<br />

the need for financial risk management techniques;<br />

financial instruments available and appropriate to<br />

manage different risks;<br />

wluating project risk, business acquisitions, mergers and<br />

divestitures.<br />

Textbook<br />

Rinon. G. et al. Business Finance. 5th ed, Sydney: McGraw Hill,<br />

1990<br />

Other texts relevant to particular topics to be advised<br />

BC330<br />

Accounting f heory<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: second year accounting subjects<br />

should be completed before attempting this<br />

su bject<br />

Instruction: lecturekutorial<br />

Assessment: examination/essay<br />

Subject aims and description<br />

The objectives <strong>of</strong> this unit are:<br />

to examine the development <strong>of</strong> the theory <strong>of</strong> accounting<br />

and the methodology used by accounting theorists;<br />

to describe and critically analyse a framework <strong>of</strong><br />

accounting concepts including assets, liabilities and<br />

income;<br />

to use the methodology and the framework developed in<br />

the unit to study some specific issues in financial<br />

accounting including deferred tax accounting, various<br />

inflation accounting systems, intangibles, accounting<br />

standards development and foreign operations.<br />

Although the subject is concerned with theory, considerable<br />

use is made <strong>of</strong> practical problems in parts <strong>of</strong> the course.<br />

These are designed to illustrate the alternative techniques<br />

available while the theoretical framework is used to evaluate<br />

and choose between the alternatives.<br />

Textbook<br />

Hodgson, A., Holmes. S. and Kam, V. Accounting Theory 1st ed,<br />

Qld.: Wiley, 1992<br />

References<br />

Henderson, M.S. and Peinon, G. Issues in Financial Accounting. 6th<br />

ed. Melbourne: Longman Cheshire, 1993<br />

Hendenon, MS., Peinon, G. and Brown, R. Financial Accounting<br />

Theory. Its Nature and Development 2nd ed, Melbourne: Longrnan<br />

Cheshire, 1992<br />

Manhews, M. and Perera, M. Accounting Theory & Development.<br />

2nd ed. Melbourne: Nelson. 1993<br />

Whittred, G. and Zirnrner, I. Financial Accounting: Incentiw Effects &<br />

Economic Consequences. 3rd ed, Sydney: Holt. Rinehart and<br />

Winston, 1992<br />

BC331 Taxation<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: students enrolled in this unit are<br />

expected to have passed BC221 Corporate<br />

Accounting<br />

Instruction: lectureltutorial<br />

Assessment: examination/assignments<br />

Subject aims<br />

The overall course objective is to develop in students an<br />

understanding <strong>of</strong> the Income Tax Assessment Act, 1936, as<br />

amended, together with those acts which are<br />

complementary to the Assessment Act.<br />

Subject description<br />

Specifically, the course will:<br />

familiarise students with recent court and Administrative<br />

Appeals Tribunal decisions in the area <strong>of</strong> income<br />

taxation;<br />

develop research skills in students in relation to current<br />

and landmark taxation cases;<br />

introduce students to the complexities <strong>of</strong> taxation in<br />

relation to various taxable entities;<br />

with the aid <strong>of</strong> income tax rulings and the<br />

aforementioned tax cases, develop in students an<br />

understanding <strong>of</strong> the basic concepts <strong>of</strong> income, capital,<br />

and the rules gwerning deductions;<br />

provide for students intending a career in public<br />

accounting a basic grounding in taxation law. It is<br />

recommended these students also complete BC308<br />

Advanced Taxation.<br />

Topics covered include: the nature <strong>of</strong> assessable income,<br />

capital gains tax, fringe benefits tax, allowable deductions<br />

and the provisions relating to companies, partnerships, and<br />

individuals.