Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A<br />

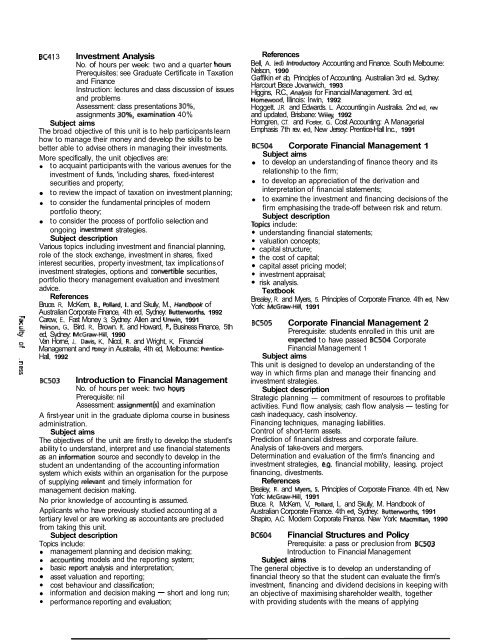

BC~I 3 Investment Analysis<br />

No. <strong>of</strong> hours per week: two and a quarter hours<br />

Prerequisites: see Graduate Certificate in Taxation<br />

and Finance<br />

Instruction: lectures and class discussion <strong>of</strong> issues<br />

and problems<br />

Assessment: class presentations 30%,<br />

assignments 30%, examination 40%<br />

Subject aims<br />

The broad objective <strong>of</strong> this unit is to help participants learn<br />

how to manage their money and develop the skills to be<br />

better able to advise others in managing their investments.<br />

More specifically, the unit objectives are:<br />

to acquaint participants with the various avenues for the<br />

investment <strong>of</strong> funds, 'including shares, fixed-interest<br />

securities and property;<br />

to review the impact <strong>of</strong> taxation on investment planning;<br />

to consider the fundamental principles <strong>of</strong> modern<br />

portfolio theory;<br />

to consider the process <strong>of</strong> portfolio selection and<br />

ongoing inwstment strategies.<br />

Subject description<br />

Various topics including investment and financial planning,<br />

role <strong>of</strong> the stock exchange, investment in shares, fixed<br />

interest securities, property investment, tax implications <strong>of</strong><br />

investment strategies, options and conwrtible securities,<br />

portfolio theory management evaluation and investment<br />

advice.<br />

References<br />

Bruce. R., McKern, 8.. Pallard, I. and Skully, M., Handbook <strong>of</strong><br />

Australian Corporate Finance, 4th ed, Sydney: Butterworths, 1992<br />

Carew, E., Fast Money 3, Sydney: Allen and Unwin, 1991<br />

Peirson, G., Bird. R., Brown. R: and Howard, P., Business Finance, 5th<br />

u ed, Sydney: McGraw-Hill, 1990<br />

2 Van Horne, J., Davis, K., Nicol, R. and Wright, K., Financial<br />

Management and fblicy in Australia, 4th ed, Melbourne: Prentice-<br />

--1<br />

, Hall, 1992<br />

8<br />

~ ~ 5 0 3 Introduction to Financial Management<br />

No. <strong>of</strong> hours per week: two hours<br />

Prerequisite: nil<br />

Assessment: assignment(s) and examination<br />

A first-year unit in the graduate diploma course in business<br />

administration.<br />

Subject aims<br />

The objectives <strong>of</strong> the unit are firstly to develop the student's<br />

ability to understand, interpret and use financial statements<br />

as an information source and secondly to develop in the<br />

student an undentanding <strong>of</strong> the accounting information<br />

system which exists within an organisation for the purpose<br />

<strong>of</strong> supplying relevant and timely information for<br />

management decision making.<br />

No prior knowledge <strong>of</strong> accounting is assumed.<br />

Applicants who have previously studied accounting at a<br />

tertiary level or are working as accountants are precluded<br />

from taking this unit.<br />

Subject description<br />

Topics include:<br />

management planning and decision making;<br />

accountins models and the reporting system;<br />

basic rep& analysis and interpretation;<br />

asset valuation and reporting;<br />

cost behaviour and classification;<br />

information and decision making - short and long run;<br />

performance reporting and evaluation;<br />

References<br />

Bell, A. (ed) lnhoduaory Accounting and Finance. South Melbourne:<br />

Nelson, 1990<br />

Gaffikin et ab, Principles <strong>of</strong> Accounting. Australian 3rd ed, Sydney:<br />

Harcourt Brace Jovanwich, 1993<br />

Higgins, R.C., Analysis for Financial Management. 3rd ed,<br />

Homewood. Illinois: Irwin, 1992<br />

Hoggett. J.R. and Edwards. L. Accounting in Australia. 2nd ed, rw.<br />

and updated, Brisbane: Wiley, 1992<br />

Horngren, C.T. and Foster, G. Cost Accounting: A Managerial<br />

Emphasis 7th rev. ed, New Jersey: Prentice-Hall Inc., 1991<br />

BC504 Corporate Financial Management 1<br />

Subject aims<br />

to develop an understanding <strong>of</strong> finance theory and its<br />

relationship to the firm;<br />

to develop an appreciation <strong>of</strong> the derivation and<br />

interpretation <strong>of</strong> financial statements;<br />

to examine the investment and financing decisions <strong>of</strong> the<br />

firm emphasising the trade-<strong>of</strong>f between risk and return.<br />

Subject description<br />

Topics include:<br />

understanding financial statements;<br />

valuation concepts;<br />

capital structure;<br />

the cost <strong>of</strong> capital;<br />

capital asset pricing model;<br />

investrnent appraisal;<br />

risk analysis.<br />

Textbook<br />

Brealey, R. and Myers, 5. Principles <strong>of</strong> Corporate Finance. 4th ed, New<br />

York: McGraw-Hill, 1991<br />

BC505 Corporate Financial Management 2<br />

Prerequisite: students enrolled in this unit are<br />

expected to have passed BC504 Corporate<br />

Financial Management 1<br />

Subject aims<br />

This unit is designed to develop an understanding <strong>of</strong> the<br />

way in which firms plan and manage their financing and<br />

investment strategies.<br />

Subject description<br />

Strategic planning - commitment <strong>of</strong> resources to pr<strong>of</strong>itable<br />

activities. Fund flow analysis; cash flow analysis - testing for<br />

cash inadequacy, cash insolvency.<br />

Financing techniques, managing liabilities.<br />

Control <strong>of</strong> short-term assets.<br />

Prediction <strong>of</strong> financial distress and corporate failure.<br />

Analysis <strong>of</strong> take-overs and mergers.<br />

Determination and evaluation <strong>of</strong> the firm's financing and<br />

investment strategies, e.g. financial mobility, leasing. project<br />

financing, divestments.<br />

References<br />

Brealey, R. and Myers, 5. Principles <strong>of</strong> Corporate Finance. 4th ed, New<br />

York: McGraw-Hill, 1991<br />

Bruce. R., McKern, V., Pbllard, I., and Skully, M. Handbook <strong>of</strong><br />

Australian Corporate Finance. 4th ed, Sydney: Butterworths, 1991<br />

Shapiro, A.C. Modern Corporate Finance. New York: Macmillan, 1990<br />

BC604 Financial Structures and Policy<br />

Prerequisite: a pass or preclusion from BC503<br />

Introduction to Financial Management<br />

Subject aims<br />

The general objective is to develop an understanding <strong>of</strong><br />

financial theory so that the student can evaluate the firm's<br />

investment, financing and dividend decisions in keeping with<br />

an objective <strong>of</strong> maximising shareholder wealth, together<br />

with providing students with the means <strong>of</strong> applying