Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Textbook<br />

Australian lncome Tax Assessment Aa 1936, 1993 ed. CCH Australia<br />

Ltd .<br />

1993 Australian Master Tax Guide. CCH Australia Ltd.<br />

Lehmann, G. and Coleman, C. Taxation Law in Australia. 2nd ed.,<br />

Sydney: Butterworths, 1991<br />

References<br />

Australian federal Tax Reporter. CCH Australia Ltd.<br />

O'Grady, G.W. and O'Rouke, K.J. Ryan's Manual <strong>of</strong> the law <strong>of</strong><br />

lncome Tax in Australia. 7th ed, Sydney: Law Book Company, 1989<br />

Topical Tax Cases for Australians. North Ryde, N.S.W.: CCH Australia<br />

Ltd.. 1991<br />

Australian Tax Handbook. Sydney: Buttemrths, 1993<br />

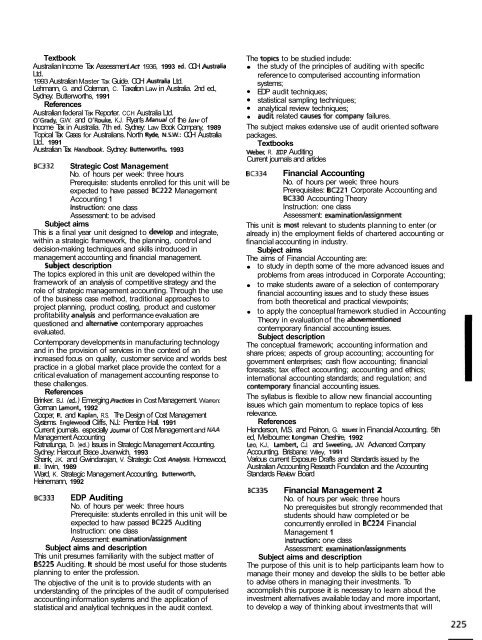

BC332 Strategic Cost Management<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: students enrolled for this unit will be<br />

expected to have passed BC222 Management<br />

Accounting 1<br />

Instruction: one class<br />

Assessment: to be advised<br />

Subject aims<br />

This is a final year unit designed to develop and integrate,<br />

within a strategic framework, the planning, control and<br />

decision-making techniques and skills introduced in<br />

management accounting and financial management.<br />

Subject description<br />

The topics explored in this unit are developed within the<br />

framework <strong>of</strong> an analysis <strong>of</strong> competitive strategy and the<br />

role <strong>of</strong> strategic management accounting. Through the use<br />

<strong>of</strong> the business case method, traditional approaches to<br />

project planning, product costing, product and customer<br />

pr<strong>of</strong>itability analpis and performance evaluation are<br />

questioned and alternatiw contemporary approaches<br />

evaluated.<br />

Contemporary developments in manufacturing technology<br />

and in the provision <strong>of</strong> services in the context <strong>of</strong> an<br />

increased focus on quality, customer service and worlds best<br />

practice in a global market place provide the context for a<br />

critical evaluation <strong>of</strong> management accounting response to<br />

these challenges.<br />

References<br />

Brinker. B.J. (ed.) Emerging Pmctices in Cost Management. Warren:<br />

Gorrnan Lamont. 1992<br />

Cooper, R. and Kaplan, R.S. The Design <strong>of</strong> Cost Management<br />

Systems. Englewood Cliffs, N.J.: Prentice Hall. 1991<br />

Current journals. especially Journal <strong>of</strong> Cost Management and NAA<br />

Management Accounting<br />

Ratnatunga, D. (4.) Issues in Strategic Management Accounting.<br />

Sydney: Harcourt Brace Jovanwich, 1993<br />

Shank, J.K. and Gwindarajan, V. Strategic Cost Analysis. Homewood,<br />

Ill.: Irwin, 1989<br />

Ward, K. Strategic Management Accounting. Buttewrth,<br />

Heinemann, 1992<br />

BC333 EDP Auditing<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: students enrolled in this unit will be<br />

expected to haw passed BC225 Auditing<br />

Instruction: one class<br />

Assessment: examination/assignment<br />

Subject aims and description<br />

This unit presumes familiarity with the subject matter <strong>of</strong><br />

85225 Auditing. R should be most useful for those students<br />

planning to enter the pr<strong>of</strong>ession.<br />

The objective <strong>of</strong> the unit is to provide students with an<br />

understanding <strong>of</strong> the principles <strong>of</strong> the audit <strong>of</strong> computerised<br />

accounting information systems and the application <strong>of</strong><br />

statistical and analytical techniques in the audit context.<br />

The topics to be studied include:<br />

the study <strong>of</strong> the principles <strong>of</strong> auditing with specific<br />

reference to computerised accounting information<br />

systems;<br />

EDP audit techniques;<br />

statistical sampling techniques;<br />

analytical review techniques;<br />

audit related causes for'company failures.<br />

The subject makes extensive use <strong>of</strong> audit oriented s<strong>of</strong>tware<br />

packages.<br />

Textbooks<br />

Weber, R. EDP Auditing<br />

Current journals and articles<br />

BC334 Financial Accounting<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisites: BC22l Corporate Accounting and<br />

BC330 Accounting Theory<br />

Instruction: one class<br />

Assessment: examination/assignment<br />

This unit is most relevant to students planning to enter (or<br />

already in) the employment fields <strong>of</strong> chartered accounting or<br />

financial accounting in industry.<br />

Subject aims<br />

The aims <strong>of</strong> Financial Accounting are:<br />

to study in depth some <strong>of</strong> the more advanced issues and<br />

problems from areas introduced in Corporate Accounting;<br />

to make students aware <strong>of</strong> a selection <strong>of</strong> contemporary<br />

financial accounting issues and to study these issues<br />

from both theoretical and practical viewpoints;<br />

to apply the conceptual framework studied in Accounting<br />

Theory in evaluation <strong>of</strong> the abovementioned<br />

contemporary financial accounting issues.<br />

Subject description<br />

The conceptual framework; accounting information and<br />

share prices; aspects <strong>of</strong> group accounting; accounting for<br />

government enterprises; cash flow accounting; financial<br />

forecasts; tax effect accounting; accounting and ethics;<br />

international accounting standards; and regulation; and<br />

contemporary financial accounting issues.<br />

The syllabus is flexible to allow new financial accounting<br />

issues which gain momentum to replace topics <strong>of</strong> less<br />

relevance.<br />

References<br />

Henderson, M.S. and Peinon, G. Issues in Financial Accounting. 5th<br />

ed, Melbourne: Longman Cheshire, 1992<br />

Leo. K.J., Lambert. C.J. and Sweeting, J.W. Advanced Company<br />

Accounting. Brisbane: Wiley, 1991<br />

Various current Exposure Drafts and Standards issued by the<br />

Australian Accounting Research Foundation and the Accounting<br />

Standards Review Board<br />

BC335 Financial Management 2<br />

No. <strong>of</strong> hours per week: three hours<br />

No prerequisites but strongly recommended that<br />

students should haw completed or be<br />

concurrently enrolled in BC224 Financial<br />

Management 1<br />

Instrudion: one class<br />

Assessment: examinationlassignmefrb<br />

Subject aims and description<br />

The purpose <strong>of</strong> this unit is to help participants learn how to<br />

manage their money and develop the skills to be better able<br />

to advise others in managing their investments. To<br />

accomplish this purpose it is necessary to learn about the<br />

investment alternatives available today and more important,<br />

to develop a way <strong>of</strong> thinking about investments that will