Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

z n<br />

Q L<br />

2<br />

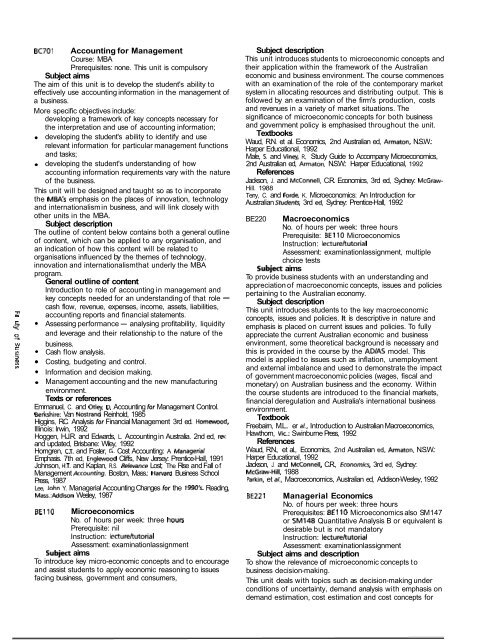

~ ~ 7 0 1 Accounting for Management<br />

Course: MBA<br />

Prerequisites: none. This unit is compulsory<br />

Subject aims<br />

The aim <strong>of</strong> this unit is to develop the student's ability to<br />

effectively use accounting information in the management <strong>of</strong><br />

a business.<br />

More specific objectives include:<br />

developing a framework <strong>of</strong> key concepts necessary for<br />

the interpretation and use <strong>of</strong> accounting information;<br />

developing the student's ability to identify and use<br />

relevant information for particular management functions<br />

and tasks;<br />

developing the student's understanding <strong>of</strong> how<br />

accounting information requirements vary with the nature<br />

<strong>of</strong> the business.<br />

This unit will be designed and taught so as to incorporate<br />

the MBA's emphasis on the places <strong>of</strong> innovation, technology<br />

and internationalism in business, and will link closely with<br />

other units in the MBA.<br />

Subject description<br />

The outline <strong>of</strong> content below contains both a general outline<br />

<strong>of</strong> content, which can be applied to any organisation, and<br />

an indication <strong>of</strong> how this content will be related to<br />

organisations influenced by the themes <strong>of</strong> technology,<br />

innovation and internationalism that underly the MBA<br />

program.<br />

General outline <strong>of</strong> content<br />

lntroduction to role <strong>of</strong> accounting in management and<br />

key concepts needed for an understanding <strong>of</strong> that role -<br />

cash flow, revenue, expenses, income, assets, liabilities,<br />

accounting reports and financial statements.<br />

Assessing performance - analysing pr<strong>of</strong>itability, liquidity<br />

and leverage and their relationship to the nature <strong>of</strong> the<br />

w business.<br />

c<br />

r. Cash flow analysis.<br />

3<br />

Costing, budgeting and control.<br />

V)<br />

Information and decision making.<br />

Management accounting and the new manufacturing<br />

environment.<br />

Texts or references<br />

Emmanuel, C. and Otley. D. Accounting for Management Control.<br />

Berkshire: Van Nostrand Reinhold, 1985<br />

Higgins, R.C. Analysis for Financial Management 3rd ed. Homewood,<br />

Illinois: Irwin, 1992<br />

Hoggen, H.J.R. and Edwards, L. Accounting in Australia. 2nd ed, rev.<br />

and updated, Brisbane: Wiley, 1992<br />

Horngren, C.T. and Foster, G. Cost Accounting: A Managerial<br />

Emphasis. 7th ed, Englewood Cliffs, New Jersey: Prentice-Hall, 1991<br />

Johnson, H.T. and Kaplan, R.S. Relevance Lost; The Rise and Fall <strong>of</strong><br />

Management Accounting. Boston, Mass.: Haward Business School<br />

Press, 1987<br />

Lee, John Y. Managerial Accounting Changes for the 1990% Reading,<br />

Mass.:Addison Wesley, 1987<br />

BEI 10 Microeconomics<br />

No. <strong>of</strong> hours per week: three houa<br />

Prerequisite: nil<br />

Instruction: lecture/tutorial<br />

Assessment: examinationlassignment<br />

Subjea aims<br />

To introduce key micro-economic concepts and to encourage<br />

and assist students to apply economic reasoning to issues<br />

facing business, government and consumers,<br />

Subject description<br />

This unit introduces students to microeconomic concepts and<br />

their application within the framework <strong>of</strong> the Australian<br />

economic and business environment. The course commences<br />

with an examination <strong>of</strong> the role <strong>of</strong> the contemporary market<br />

system in allocating resources and distributing output. This is<br />

followed by an examination <strong>of</strong> the firm's production, costs<br />

and revenues in a variety <strong>of</strong> market situations. The<br />

significance <strong>of</strong> microeconomic concepts for both business<br />

and government policy is emphasised throughout the unit.<br />

Textbooks<br />

Waud, R.N. et al. Economics, 2nd Australian ed, Armaton, N.S.W.:<br />

Harper Educational, 1992<br />

Male, S. and Viney, R., Study Guide to Accompany Microeconomics,<br />

2nd Australian ed, Armaton, N.S.W.: Harper Educational, 1992<br />

References<br />

Jackson, J. and McConnell. C.R. Economics, 3rd ed, Sydney: McGraw-<br />

Hill. 1988<br />

Terry, C. and Forde, K. Microeconomics: An Introduction for<br />

Australian Stvdentr, 3rd ed, Sydney: Prentice-Hall, 1992<br />

BE220 Macroeconomics<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: BE1 10 Microeconomics<br />

Instruction: lecture/tutorial<br />

Assessment: examinationlassignment, multiple<br />

choice tests<br />

Subject aims<br />

To provide business students with an understanding and<br />

appreciation <strong>of</strong> macroeconomic concepts, issues and policies<br />

pertaining to the Australian economy.<br />

Subject description<br />

This unit introduces students to the key macroeconomic<br />

concepts, issues and policies. It is descriptive in nature and<br />

emphasis is placed on current issues and policies. To fully<br />

appreciate the current Australian economic and business<br />

environment, some theoretical background is necessary and<br />

this is provided in the course by the ADIAS model. This<br />

model is applied to issues such as inflation, unemployment<br />

and external imbalance and used to demonstrate the impact<br />

<strong>of</strong> government macroeconomic policies (wages, fiscal and<br />

monetary) on Australian business and the economy. Within<br />

the course students are introduced to the financial markets,<br />

financial deregulation and Australia's international business<br />

environment.<br />

Textbook<br />

Freebairn, M.L.. er al., Introduction to Australian Macroeconomics,<br />

Hawthorn, Vic.: <strong>Swinburne</strong> Press, 1992<br />

References<br />

Waud, R.N., et al., Economics, 2nd Australian ed, Armaton, N.S.W.:<br />

Harper Educational, 1992<br />

Jackson, J. and McConnell. C.R., Economia, 3rd ed, Sydney:<br />

McGraw-Hill, 1988<br />

Parkin, et a/., Macroeconomics, Australian ed, Addison-Wesley, 1992<br />

BE221 Managerial Economics<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisites: BE1 10 Microeconomics also SM 147<br />

or SM148 Quantitative Analysis B or equivalent is<br />

desirable but is not mandatory<br />

Instruction: lecturehutorial<br />

Assessment: examinationlassignment<br />

Subject aims and description<br />

To show the relevance <strong>of</strong> microeconomic concepts to<br />

business decision-making.<br />

This unit deals with topics such as decision-making under<br />

conditions <strong>of</strong> uncertainty, demand analysis with emphasis on<br />

demand estimation, cost estimation and cost concepts for