Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Subject description<br />

No prior knowledge <strong>of</strong> accounting is assumed.<br />

Topics include:<br />

general purpose financial statements;<br />

financial statement analysis;<br />

cash flow statements;<br />

business finance and valuation;<br />

cost - volume - pr<strong>of</strong>it analysis;<br />

costing products and services;<br />

information analysis for decision making;<br />

segment performance evaluation;<br />

budgeting and pr<strong>of</strong>it planning.<br />

Textbook<br />

Gaffikin, M., Walgenbach, P. Dittrich, N. and Hanson, E. Principles <strong>of</strong><br />

Accounting. 3rd Australian ed, Sydney: Harcourt, Brace Jwanwich,<br />

1992<br />

References<br />

Bell, A. (ed) Introducto/y Accounting and Finance. Melbourne:<br />

Nelson, 1990<br />

Hoggett, J. and Edwards, L. Accounting in Australia. 2nd ed rev. and<br />

updated, Brisbane: John Wiley & Sons, 1992<br />

Homgren, CT and Foster, G. Cost Accounting: A Managerial<br />

Emphasis. 7th ed, Englewood Cliffs, N.J.: Prentice-Hall Inc., 1991<br />

McDonald, R.C., Cooper, R.G. and Astill. B.J. Accounting for the Non<br />

Finance Executive. 2nd ed, Auckland, N.Z.: longman Paul. 1983<br />

Smith, E. The Bottom Line. The Essential Guide for Non-Finance<br />

Executives. Ringwood: PPnguin, 1989<br />

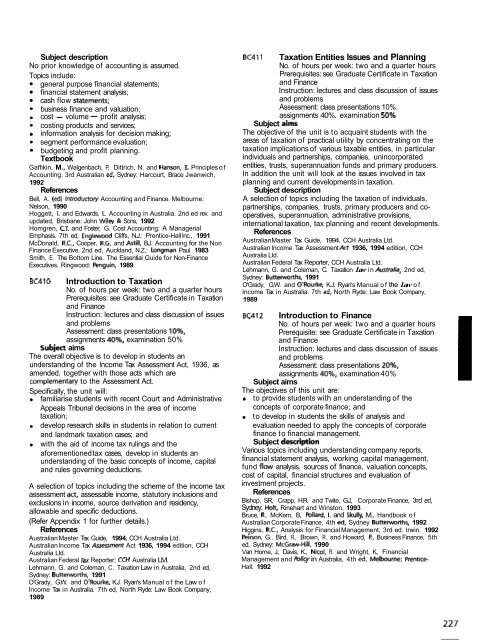

~ ~ 4 1 0 Introduction to Taxation<br />

No. <strong>of</strong> hours per week: two and a quarter hours<br />

Prerequisites: see Graduate Certificate in Taxation<br />

and Finance<br />

Instruction: lectures and class discussion <strong>of</strong> issues<br />

and problems<br />

Assessment: class presentations lo%,<br />

assignments 40%, examination 50%<br />

Subject aims<br />

The overall objective is to develop in students an<br />

understanding <strong>of</strong> the lncome Tax Assessment Act, 1936, as<br />

amended, together with those acts which are<br />

complementaty to the Assessment Act.<br />

Specifically, the unit will:<br />

familiarise students with recent Court and Administrative<br />

Appeals Tribunal decisions in the area <strong>of</strong> income<br />

taxation;<br />

develop research skills in students in relation to current<br />

and landmark taxation cases; and<br />

with the aid <strong>of</strong> income tax rulings and the<br />

aforementioned tax cases, develop in students an<br />

understanding <strong>of</strong> the basic concepts <strong>of</strong> income, capital<br />

and rules governing deductions.<br />

A selection <strong>of</strong> topics including the scheme <strong>of</strong> the income tax<br />

assessment ad, assessable income, statutory inclusions and<br />

exclusions in income, source derivation and residency,<br />

allowable and specific deductions.<br />

(Refer Appendix 1 for further details.)<br />

References<br />

Australian Master Tax Guide, 1994. CCH Australia Ltd.<br />

Australian Income Tax Azsezsment Act 1936, 1994 edition, CCH<br />

Australia Ltd.<br />

Australian Federal Tax Reporter; CCH Australia LM.<br />

Lehmann, G. and Coleman, C. Taxation Law in Australia, 2nd ed,<br />

Sydney: Butterworths, 1991<br />

O'Grady, G.W. and O'Rourke, K.J. Ryan's Manual <strong>of</strong> the Law <strong>of</strong><br />

Income Tax in Australia. 7th ed, North Ryde: Law Book Company,<br />

1989<br />

Taxation Entities Issues and Planning<br />

No. <strong>of</strong> hours per week: two and a quarter hours<br />

Prerequisites: see Graduate Certificate in Taxation<br />

and Finance<br />

Instruction: lectures and class discussion <strong>of</strong> issues<br />

and problems<br />

Assessment: class presentations 10%.<br />

assignments 40%. examination 50%<br />

Subject aims<br />

BC411<br />

The objective <strong>of</strong> the unit is to acquaint students with the<br />

areas <strong>of</strong> taxation <strong>of</strong> practical utility by concentrating on the<br />

taxation implications <strong>of</strong> various taxable entities, in particular<br />

individuals and partnerships, companies, unincorporated<br />

entities, trusts, superannuation funds and primary producers.<br />

In addition the unit will look at the issues involved in tax<br />

planning and current developments in taxation.<br />

Subject description<br />

A selection <strong>of</strong> topics including the taxation <strong>of</strong> individuals,<br />

partnerships, companies, trusts, primary producers and cooperatives,<br />

superannuation, administrative provisions,<br />

international taxation, tax planning and recent developments.<br />

References<br />

Australian Master Tax Guide, 1994. CCH Australia Ltd.<br />

Australian lncome Tax Assessment Act 1936, 1994 edition, CCH<br />

Australia Ltd.<br />

Australian Federal Tax Reporter, CCH Australia Ltd.<br />

Lehmann, G. and Coleman, C. Taxation Law in Australia, 2nd ed,<br />

Sydney: Buttewrths, 1991<br />

O'Grady, G.W. and O'Rourke, K.J. Ryan's Manual <strong>of</strong> the Law <strong>of</strong><br />

Income Tax in Australia. 7th ed, North Ryde: Law Book Company,<br />

1989<br />

BC412 Introduction to Finance<br />

No. <strong>of</strong> hours per week: two and a quarter hours<br />

Prerequisite: see Graduate Certificate in Taxation<br />

and Finance<br />

Instruction: lectures and class discussion <strong>of</strong> issues<br />

and problems<br />

Assessment: class presentations 20°h,<br />

assignments 40%, examination 40%<br />

Subject aims<br />

The objectives <strong>of</strong> this unit are:<br />

to provide students with an understanding <strong>of</strong> the<br />

concepts <strong>of</strong> corporate finance; and<br />

to develop in students the skills <strong>of</strong> analysis and<br />

evaluation needed to apply the concepts <strong>of</strong> corporate<br />

finance to financial management.<br />

Subject description<br />

Various topics including understanding company reports,<br />

financial statement analysis, working capital management,<br />

fund flow analysis, sources <strong>of</strong> finance, valuation concepts,<br />

cost <strong>of</strong> capital, financial structures and evaluation <strong>of</strong><br />

investment projects.<br />

References<br />

Bishop, S.R., Crapp, H.R. and Twite, G.J., Corporate Finance, 3rd ed,<br />

Sydney: Holt, Rinehart and Winston, 1993<br />

Bruce, R.. McKern, B., Pollard, I. and Skully, M., Handbook <strong>of</strong><br />

Australian Corporate Finance, 4th ed, Sydney Buttewrths, 1992<br />

Higgins, R.C., Analysis for Financial Management, 3rd ed. Irwin. 1992<br />

Peirson, G.. Bird. R., Brown, R. and Howard, P., Business Finance, 5th<br />

ed, Sydney: McGraw-Hill. 1990<br />

Van Horne, J., Davis, K., Nicol, R. and Wright, K., Financial<br />

Management and mlicy in Australia, 4th ed. Melbourne: Prentice-<br />

Hall. 1992