Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

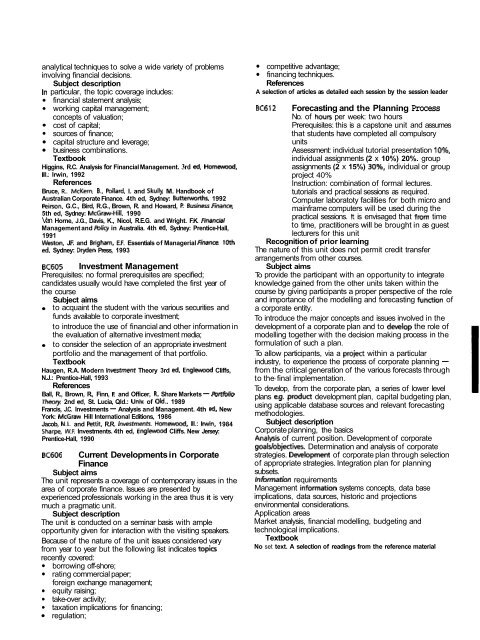

analytical techniques to solve a wide variety <strong>of</strong> problems<br />

involving financial decisions.<br />

Subject description<br />

In particular, the topic coverage includes:<br />

financial statement analysis;<br />

working capital management;<br />

concepts <strong>of</strong> valuation;<br />

cost <strong>of</strong> capital;<br />

sources <strong>of</strong> finance;<br />

capital structure and leverage;<br />

business combinations.<br />

Textbook<br />

Higgins, R.C. Analysis for Financial Management. 3rd ed, Homewood,<br />

Ill.: Irwin, 1992<br />

References<br />

Bruce, R.. McKern. 8.. Pollard, I. and Skully, M. Handbook <strong>of</strong><br />

Australian Corporate Finance. 4th ed, Sydney: Buttewrths, 1992<br />

Peirson, G.C., Bird, R.G., Brown, R. and Howard, P Businerr finance,<br />

5th ed, Sydney: McGraw-Hill, 1990<br />

Van Horne, J.G., Davis, K., Nicol, R.E.G. and Wright. F.K. FinancMl<br />

Management and blicy in Australia. 4th ed, Sydney: Prentice-Hall,<br />

1991<br />

Weston, J.F. and Brigham, E.F. Essentials <strong>of</strong> Managerial Fhance. 10th<br />

ed, Sydney: Dryden Press, 1993<br />

~ ~ 6 0 5 Investment Management<br />

Prerequisites: no formal prerequisites are specified;<br />

candidates usually would have completed the first year <strong>of</strong><br />

the course<br />

Subject aims<br />

to acquaint the student with the various securities and<br />

funds available to corporate investment;<br />

to introduce the use <strong>of</strong> financial and other information in<br />

the evaluation <strong>of</strong> alternative investment media;<br />

to consider the selection <strong>of</strong> an appropriate investment<br />

portfolio and the management <strong>of</strong> that portfolio.<br />

Textbook<br />

Haugen, R.A. Modern Investment Theory 3rd ed, EnglRNood Cliffs,<br />

N.J.: Prentice-Hall, 1993<br />

References<br />

Ball, R., Brown, R., Finn, F. and Officer, R. Share Markets - bmolio<br />

~heory. 2nd ed, St. Lucia, Qld.: Univ. <strong>of</strong> Qld., 1989<br />

Francis, J.C. Investments - Analysis and Management. 4th ed, New<br />

York: McGraw Hill International Editions, 1986<br />

Jacob, N.L. and Pettit, R.R. Investments. Homewood, Ill.: Irwin, 1984<br />

Sharpe, W.F. Investments. 4th ed, Englewood Cliffs. New Jersey:<br />

Prentice-Hall, 1990<br />

BC606 Current Developments in Corporate<br />

Finance<br />

Subject aims<br />

The unit represents a coverage <strong>of</strong> contemporary issues in the<br />

area <strong>of</strong> corporate finance. Issues are presented by<br />

experienced pr<strong>of</strong>essionals working in the area thus it is very<br />

much a pragmatic unit.<br />

Subject description<br />

The unit is conducted on a seminar basis with ample<br />

opportunity given for interaction with the visiting speakers.<br />

Because <strong>of</strong> the nature <strong>of</strong> the unit issues considered vary<br />

from year to year but the following list indicates topics<br />

recently covered:<br />

borrowing <strong>of</strong>f-shore;<br />

rating commercial paper;<br />

foreign exchange management;<br />

equity raising;<br />

take-over activity;<br />

taxation implications for financing;<br />

regulation;<br />

competitive advantage;<br />

financing techniques.<br />

References<br />

A selection <strong>of</strong> articles as detailed each session by the session leader<br />

BC612 Forecasting and the Planning Process<br />

No. <strong>of</strong> hours per week: two hours<br />

Prerequisites: this is a capstone unit and assumes<br />

that students have completed all compulsory<br />

units<br />

Assessment: individual tutorial presentation lo%,<br />

individual assignments (2 x 10%) 20%. group<br />

assignments (2 x 15%) 30%, individual or group<br />

project 40%<br />

Instruction: combination <strong>of</strong> formal lectures.<br />

tutorials and practical sessions as required.<br />

Computer laboratoty facilities for both micro and<br />

mainframe computers will be used during the<br />

practical sessions. R is envisaged that from time<br />

to time, practitioners will be brought in as guest<br />

lecturers for this unit<br />

Recognition <strong>of</strong> prior learning<br />

The nature <strong>of</strong> this unit does not permit credit transfer<br />

arrangements from other courses.<br />

Subject aims<br />

To provide the participant with an opportunity to integrate<br />

knowledge gained from the other units taken within the<br />

course by giving participants a proper perspective <strong>of</strong> the role<br />

and importance <strong>of</strong> the modelling and forecasting function <strong>of</strong><br />

a corporate entity.<br />

To introduce the major concepts and issues involved in the<br />

development <strong>of</strong> a corporate plan and to develop the role <strong>of</strong><br />

modelling together with the decision making process in the<br />

formulation <strong>of</strong> such a plan.<br />

To allow participants, via a project within a particular<br />

industry, to experience the process <strong>of</strong> corporate planning -<br />

from the critical generation <strong>of</strong> the various forecasts through<br />

to the- final implementation.<br />

To develop, from the corporate plan, a series <strong>of</strong> lower level<br />

plans e.g. product development plan, capital budgeting plan,<br />

using applicable database sources and relevant forecasting<br />

methodologies.<br />

Subject description<br />

Corporate planning, the basics<br />

Analysis <strong>of</strong> current position. Development <strong>of</strong> corporate<br />

goals/objectives. Determination and analysis <strong>of</strong> corporate<br />

strategies. Development <strong>of</strong> corporate plan through selection<br />

<strong>of</strong> appropriate strategies. Integration plan for planning<br />

subsets.<br />

InTormation requirements<br />

Management infomation systems concepts, data base<br />

implications, data sources, historic and projections<br />

environmental considerations.<br />

Application areas<br />

Market analysis, financial modelling, budgeting and<br />

technological implications.<br />

Textbook<br />

No set text. A selection <strong>of</strong> readings from the reference material