Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

emain in the years ahead when new investment opportunities<br />

arise as a result <strong>of</strong> the inevitable changes to our<br />

financial system.<br />

More specifically, the course objectives are:<br />

to acquaint participants with the various avenues for the<br />

investment <strong>of</strong> funds, including shares, fixed-interest<br />

securities and property;<br />

to review the impact <strong>of</strong> taxation on investment planning;<br />

to consider the fundamental principles <strong>of</strong> modern<br />

portfolio theory;<br />

to consider the process <strong>of</strong> portfolio selection and<br />

ongoing investment strategies;<br />

to review the characteristics <strong>of</strong> financial futures and<br />

options and how they may be used to modify the riskreturn<br />

pr<strong>of</strong>ile <strong>of</strong> investment portfolios.<br />

References<br />

Carew, E. Fast Money 3. Sydney: Allen and Unwin, 1991<br />

Reilly, F.K. Investment Analysis and ~rtfolio Management 3rd ed,<br />

Chicago: Dtyden Press, 1989<br />

Sharpe, W.F. Investments. 3rd ed, Englewood Cliffs N.J.: Prentice-Hall,<br />

1985<br />

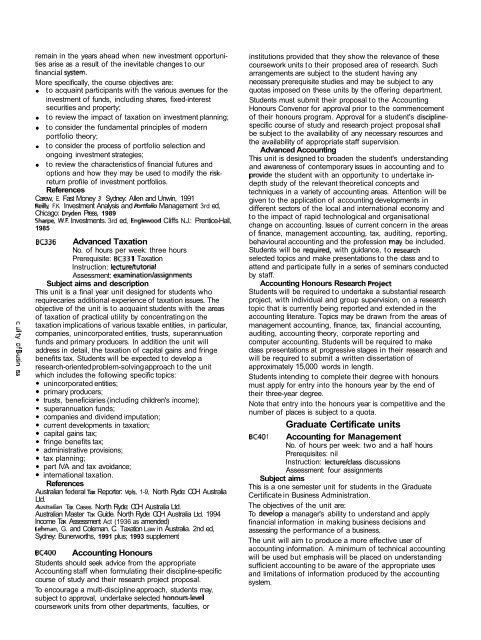

BC336 Advanced Taxation<br />

No. <strong>of</strong> hours per week: three hours<br />

Prerequisite: BC331 Taxation<br />

Instruction: lecture/tutorial<br />

Assessment: examinationlassignments<br />

Subject aims and description<br />

This unit is a final year unit designed for students who<br />

requirecaries additional experience <strong>of</strong> taxation issues. The<br />

objective <strong>of</strong> the unit is to acquaint students with the areas<br />

<strong>of</strong> taxation <strong>of</strong> practical utility by concentrating on the<br />

0 taxation implications <strong>of</strong> various taxable entities, in particular,<br />

r_<br />

q<br />

2<br />

companies, unincorporated entities, trusts, superannuation<br />

funds and primary producers. In addition the unit will<br />

address in detail, the taxation <strong>of</strong> capital gains and fringe<br />

6. benefits tax. Students will be expected to develop a<br />

3<br />

2 research-oriented problem-solving approach to the unit<br />

L"<br />

which includes the following specific topics:<br />

unincorporated entities;<br />

primary producers;<br />

trusts, beneficiaries (including children's income);<br />

superannuation funds;<br />

companies and dividend imputation;<br />

current developments in taxation;<br />

capital gains tax;<br />

fringe benefits tax;<br />

administrative provisions;<br />

tax planning;<br />

part IVA and tax avoidance;<br />

international taxation.<br />

References<br />

Australian federal Tax Reporter: Vols. 1-9, North Ryde: CCH Australia<br />

Ltd.<br />

AusTmlian Tax Cases. North Ryde: CCH Australia Ltd.<br />

Australian Master Tax Guide. North Ryde: CCH Australia Ltd. 1994<br />

Income Tax Assessment Act (1936 as amended)<br />

Lehrnan, G. and Coleman. C. Taxation Law in Australia. 2nd ed,<br />

Sydney: Bunerworths, 1991 plus; 1993 supplement<br />

BC400 Accounting Honours<br />

Students should seek advice from the appropriate<br />

Accounting staff when formulating their discipline-specific<br />

course <strong>of</strong> study and their research project proposal.<br />

To encourage a multi-discipline approach, students may,<br />

subject to approval, undertake selected honours-lewl<br />

coursework units from other departments, faculties, or<br />

institutions provided that they show the relevance <strong>of</strong> these<br />

coursework units to their proposed area <strong>of</strong> research. Such<br />

arrangements are subject to the student having any<br />

necessary prerequisite studies and may be subject to any<br />

quotas imposed on these units by the <strong>of</strong>fering department.<br />

Students must submit their proposal to the Accounting<br />

Honours Convenor for approval prior to the commencement<br />

<strong>of</strong> their honours program. Approval for a student's disciplinespecific<br />

course <strong>of</strong> study and research project proposal shall<br />

be subject to the availability <strong>of</strong> any necessary resources and<br />

the availability <strong>of</strong> appropriate staff supervision.<br />

Advanced Accounting<br />

This unit is designed to broaden the student's understanding<br />

and awareness <strong>of</strong> contemporary issues in accounting and to<br />

provide the student with an opportunity to undertake indepth<br />

study <strong>of</strong> the relevant theoretical concepts and<br />

techniques in a variety <strong>of</strong> accounting areas. Attention will be<br />

given to the application <strong>of</strong> accounting developments in<br />

different sectors <strong>of</strong> the local and international economy and<br />

to the impact <strong>of</strong> rapid technological and organisational<br />

change on accounting. Issues <strong>of</strong> current concern in the areas<br />

<strong>of</strong> finance, management accounting, tax, auditing, reporting,<br />

behavioural accounting and the pr<strong>of</strong>ession may be included.<br />

Students will be required, with guidance, to ksearch<br />

selected topics and make presentations to the class and to<br />

attend and participate fully in a series <strong>of</strong> seminars conducted<br />

by staff.<br />

Accounting Honours Research Pmject<br />

Students will be required to undertake a substantial research<br />

project, with individual and group supervision, on a research<br />

topic that is currently being reported and extended in the<br />

accounting literature. Topics may be drawn from the areas <strong>of</strong><br />

management accounting, finance, tax, financial accounting,<br />

auditing, accounting theory, corporate reporting and<br />

computer accounting. Students will be required to make<br />

class presentations at progressive stages in their research and<br />

will be required to submit a written dissertation <strong>of</strong><br />

approximately 15,000 words in length.<br />

Students intending to complete their degree with honours<br />

must apply for entry into the honours year by the end <strong>of</strong><br />

their three-year degree.<br />

Note that entry into the honours year is competitive and the<br />

number <strong>of</strong> places is subject to a quota.<br />

Graduate Certificate units<br />

BC401 Accounting for Management<br />

No. <strong>of</strong> hours per week: two and a half hours<br />

Prerequisites: nil<br />

Instruction: lecturelclass discussions<br />

Assessment: four assignments<br />

Subject aims<br />

This is a one semester unit for students in the Graduate<br />

Certificate in Business Administration.<br />

The objectives <strong>of</strong> the unit are:<br />

To dwelop a manager's ability to understand and apply<br />

financial information in making business decisions and<br />

assessing the performance <strong>of</strong> a business.<br />

The unit will aim to produce a more effective user <strong>of</strong><br />

accounting information. A minimum <strong>of</strong> technical accounting<br />

will be used but emphasis will be placed on understanding<br />

sufficient accounting to be aware <strong>of</strong> the appropriate uses<br />

and limitations <strong>of</strong> information produced by the accounting<br />

system.