Zbornik radova Koridor 10 - Kirilo SaviÄ

Zbornik radova Koridor 10 - Kirilo SaviÄ

Zbornik radova Koridor 10 - Kirilo SaviÄ

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3rd International Scientific and Professional Conference<br />

CORRIDOR <strong>10</strong> - a sustainable way of integrations<br />

When using the 7 % discount rate the economic net present value was negative, but nevertheless the<br />

results are acceptable, as it would have a positive NPV when using 4.5 % discount rate.<br />

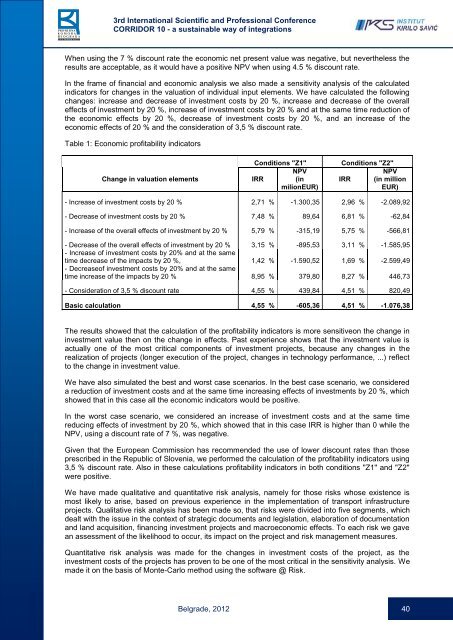

In the frame of financial and economic analysis we also made a sensitivity analysis of the calculated<br />

indicators for changes in the valuation of individual input elements. We have calculated the following<br />

changes: increase and decrease of investment costs by 20 %, increase and decrease of the overall<br />

effects of investment by 20 %, increase of investment costs by 20 % and at the same time reduction of<br />

the economic effects by 20 %, decrease of investment costs by 20 %, and an increase of the<br />

economic effects of 20 % and the consideration of 3,5 % discount rate.<br />

Table 1: Economic profitability indicators<br />

Change in valuation elements<br />

Conditions "Z1"<br />

NPV<br />

IRR (in<br />

milionEUR)<br />

Conditions "Z2"<br />

NPV<br />

IRR (in million<br />

EUR)<br />

- Increase of investment costs by 20 % 2,71 % -1.300,35 2,96 % -2.089,92<br />

- Decrease of investment costs by 20 % 7,48 % 89,64 6,81 % -62,84<br />

- Increase of the overall effects of investment by 20 % 5,79 % -315,19 5,75 % -566,81<br />

- Decrease of the overall effects of investment by 20 % 3,15 % -895,53 3,11 % -1.585,95<br />

- Increase of investment costs by 20% and at the same<br />

time decrease of the impacts by 20 %, 1,42 % -1.590,52 1,69 % -2.599,49<br />

- Decreaseof investment costs by 20% and at the same<br />

time increase of the impacts by 20 % 8,95 % 379,80 8,27 % 446,73<br />

- Consideration of 3,5 % discount rate 4,55 % 439,84 4,51 % 820,49<br />

Basic calculation 4,55 % -605,36 4,51 % -1.076,38<br />

The results showed that the calculation of the profitability indicators is more sensitiveon the change in<br />

investment value then on the change in effects. Past experience shows that the investment value is<br />

actually one of the most critical components of investment projects, because any changes in the<br />

realization of projects (longer execution of the project, changes in technology performance, ...) reflect<br />

to the change in investment value.<br />

We have also simulated the best and worst case scenarios. In the best case scenario, we considered<br />

a reduction of investment costs and at the same time increasing effects of investments by 20 %, which<br />

showed that in this case all the economic indicators would be positive.<br />

In the worst case scenario, we considered an increase of investment costs and at the same time<br />

reducing effects of investment by 20 %, which showed that in this case IRR is higher than 0 while the<br />

NPV, using a discount rate of 7 %, was negative.<br />

Given that the European Commission has recommended the use of lower discount rates than those<br />

prescribed in the Republic of Slovenia, we performed the calculation of the profitability indicators using<br />

3,5 % discount rate. Also in these calculations profitability indicators in both conditions "Z1" and "Z2"<br />

were positive.<br />

We have made qualitative and quantitative risk analysis, namely for those risks whose existence is<br />

most likely to arise, based on previous experience in the implementation of transport infrastructure<br />

projects. Qualitative risk analysis has been made so, that risks were divided into five segments, which<br />

dealt with the issue in the context of strategic documents and legislation, elaboration of documentation<br />

and land acquisition, financing investment projects and macroeconomic effects. To each risk we gave<br />

an assessment of the likelihood to occur, its impact on the project and risk management measures.<br />

Quantitative risk analysis was made for the changes in investment costs of the project, as the<br />

investment costs of the projects has proven to be one of the most critical in the sensitivity analysis. We<br />

made it on the basis of Monte-Carlo method using the software @ Risk.<br />

Belgrade, 2012 40