- Page 4:

MAKINGSENSE OFCHANGEMANAGEMENTiii

- Page 7 and 8:

Publisher’s noteEvery possible ef

- Page 9 and 10:

Contents2 Team change 62Introductio

- Page 11 and 12:

AcknowledgementsWe want to start by

- Page 13 and 14:

xiiTHIS PAGE IS INTENTIONALLY LEFT

- Page 15 and 16:

Making sense of change managementne

- Page 18:

Introductiondiscarding those you do

- Page 21 and 22:

Making sense of change managementma

- Page 23 and 24:

The underpinning theoryWe divided t

- Page 25 and 26:

1Individual changeINTRODUCTIONThis

- Page 27 and 28:

The underpinning theoryBehaviouralC

- Page 29 and 30:

The underpinning theoryConscious an

- Page 31 and 32:

The underpinning theorybehaviour’

- Page 33 and 34:

The underpinning theoryway they beh

- Page 35 and 36:

The underpinning theoryReinforcemen

- Page 37 and 38:

The underpinning theoryclose superv

- Page 39 and 40:

The underpinning theoryMuch groundb

- Page 41 and 42:

The underpinning theoryHowever, res

- Page 43 and 44:

The underpinning theoryand what wou

- Page 45 and 46:

The underpinning theoryTHE PSYCHODY

- Page 47 and 48:

The underpinning theorykicks in. Ho

- Page 49 and 50:

The underpinning theoryVirginia Sat

- Page 52 and 53:

Individual changeOld status quoFore

- Page 54 and 55:

Individual changeTable 1.4The psych

- Page 58 and 59:

Individual changeare going on insid

- Page 60 and 61:

Individual change• Given this fac

- Page 62 and 63:

Individual changeAlthough your awar

- Page 64 and 65:

The most effective tool for identif

- Page 66 and 67:

Individual changeTable 1.5Myers-Bri

- Page 68 and 69:

Individual change• The consequenc

- Page 70 and 71:

Individual change• Fear of punish

- Page 72 and 73:

Individual changeTable 1.6Behaviour

- Page 74 and 75:

Individual change• There are four

- Page 76 and 77:

Team changedevelop strategies for m

- Page 78 and 79:

The team members work together on c

- Page 80 and 81:

Team changeTable 2.2Types of teamTe

- Page 82 and 83:

Team changeis responsible for deliv

- Page 84 and 85:

Team changeMatrix teamMatrix teams

- Page 86 and 87:

Team changeThe senior management te

- Page 88 and 89:

Team changeTeam rolesThe best way f

- Page 90 and 91:

Table 2.3Effective and ineffective

- Page 92 and 93:

Table 2.4Key attributes in the stag

- Page 94 and 95:

Team change• How can we achieve o

- Page 96 and 97:

Team changeusually some highly indi

- Page 98 and 99:

Team changeleader to encourage the

- Page 100 and 101:

Team changeit comes to change, peop

- Page 102 and 103:

Team changeTable 2.5Complementarity

- Page 104 and 105:

STOP AND THINK!Q 2.8Q 2.9What team

- Page 106 and 107:

Table 2.7Teams going through change

- Page 108 and 109:

Team changeSUMMARY AND CONCLUSIONS

- Page 110 and 111:

3Organizational changeThis chapter

- Page 112 and 113:

Organizational changeMorgan identif

- Page 114 and 115:

Organizational change• each indiv

- Page 116 and 117:

Organizations as organismsOrganizat

- Page 118 and 119:

This metaphor is the only one thatb

- Page 120 and 121:

Organizational changeTable 3.1conti

- Page 122 and 123:

MODELS OF AND APPROACHES TOORGANIZA

- Page 124 and 125:

Organizational changedefining the c

- Page 126 and 127:

Organizational changegroups of peop

- Page 128 and 129:

Organizational changeKOTTER’S EIG

- Page 130 and 131:

Organizational changeC = [ABD] > XC

- Page 132 and 133:

Organizational change• practical

- Page 134 and 135:

Organizational changeThis model pro

- Page 136 and 137:

William Bridges, managing the trans

- Page 138 and 139:

Organizational changeNew beginningB

- Page 140 and 141:

Organizational change• managing t

- Page 142 and 143:

Organizational changeSenge et al sa

- Page 144 and 145:

Organizational change• ‘We keep

- Page 146 and 147:

Organizational changeno use at all.

- Page 148 and 149:

Organizational change• There are

- Page 150 and 151:

STOP AND THINK!Q 3.7Q 3.8Q 3.9Organ

- Page 152 and 153:

Leading change• different leaders

- Page 154 and 155:

Leading changethe harsh reality of

- Page 156 and 157:

Leading changevisionary leadership

- Page 158 and 159:

Leading changeVISIONARY LEADERSHIPW

- Page 160 and 161:

Leading changeBass: proof that visi

- Page 162 and 163:

Leading changeHeifetz and Laurie: v

- Page 164 and 165:

Leading changeAs we write this book

- Page 166 and 167:

Leading changeROLES THAT LEADERS PL

- Page 168 and 169:

Leading changeDifferent types of le

- Page 170 and 171:

Leading changeTable 4.4Roles in a c

- Page 172 and 173:

STOP AND THINK!Q 4.5Leading changeU

- Page 174 and 175:

Leading changeTHE COERCIVE-AFFILIAT

- Page 176 and 177:

Goleman: the importance of emotiona

- Page 178 and 179:

Leading changea leader, the chance

- Page 180 and 181:

Leading changeTable 4.6Leadership o

- Page 182 and 183:

Leading changeRosabeth Moss Kanter:

- Page 184 and 185:

Leading changeLeadership for the en

- Page 186 and 187:

Leading change• Help people to di

- Page 188 and 189:

Leading changeTable 4.8Development

- Page 190 and 191: Leading change• Habit 4: Think wi

- Page 192 and 193: Leading change• Inner leadership

- Page 194 and 195: Part TwoThe applicationsStrategy is

- Page 196 and 197: The applicationsInternal and/or ext

- Page 198 and 199: The applicationstackle cultural cha

- Page 200 and 201: 5RestructuringWe trained hard. But

- Page 202 and 203: Restructuring[W]hen DuPont announce

- Page 204 and 205: RestructuringThis leads to the foll

- Page 206 and 207: Restructuringmade very clear. Secon

- Page 208 and 209: RestructuringNew working relationsh

- Page 210 and 211: RestructuringRISKS OF NEW STRUCTURE

- Page 212 and 213: Advantages Enables the Controlled b

- Page 214 and 215: RestructuringLearning from previous

- Page 216 and 217: Project planning and project implem

- Page 218 and 219: RestructuringFuture direction and s

- Page 220 and 221: RestructuringTo prevent the rumour

- Page 222 and 223: Restructuringorganizations are not

- Page 224 and 225: RestructuringTable 5.3Disclosed and

- Page 226 and 227: Restructuringregaining their self-w

- Page 228 and 229: RestructuringTeams need to develop

- Page 230 and 231: Team relations Highlight the need f

- Page 232 and 233: Inter-team Review level of Review l

- Page 234 and 235: RestructuringCONCLUSIONRestructurin

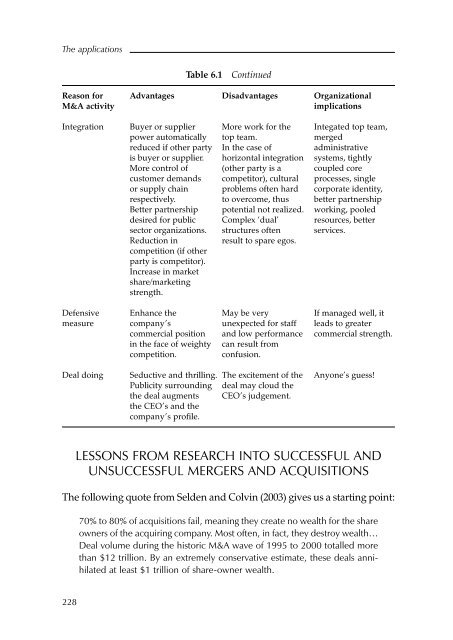

- Page 236 and 237: Mergers and acquisitionsThe chapter

- Page 238 and 239: Mergers and acquisitions• cost re

- Page 242 and 243: Mergers and acquisitionsSelden and

- Page 244 and 245: Mergers and acquisitions• company

- Page 246 and 247: Mergers and acquisitionsGet the str

- Page 248 and 249: Mergers and acquisitionsside of the

- Page 250 and 251: Mergers and acquisitionsNew culture

- Page 252 and 253: Mergers and acquisitionsKeep custom

- Page 254 and 255: Mergers and acquisitionsUse a clear

- Page 256 and 257: their personal style, personal hist

- Page 258 and 259: Mergers and acquisitionsStageTable

- Page 260 and 261: Mergers and acquisitionsTable 6.4Ho

- Page 262 and 263: Mergers and acquisitions• Get inf

- Page 264 and 265: Mergers and acquisitionsguide the i

- Page 266 and 267: Mergers and acquisitionsSUMMARYTher

- Page 268 and 269: 7Cultural changeIf you were asked t

- Page 270 and 271: Cultural change• a guided evoluti

- Page 272 and 273: GUIDELINES FOR ACHIEVING SUCCESSFUL

- Page 274 and 275: Cultural changeAct as role modelsMa

- Page 276 and 277: Cultural changedo these changes hav

- Page 278 and 279: Clarity and impact of core values a

- Page 280 and 281: experiment with a development proce

- Page 282 and 283: Cultural change• Breaking the mou

- Page 284 and 285: Cultural changeHighShow it to me!Pr

- Page 286 and 287: Gaining commitmentCultural changeIt

- Page 288 and 289: Cultural changeSupporting individua

- Page 290 and 291:

Cultural changeThe concept of the b

- Page 292 and 293:

Cultural changeValue: learningBehav

- Page 294 and 295:

8IT-based process changeIT has beco

- Page 296 and 297:

IT-based process change• enable c

- Page 298 and 299:

IT-based process changegauge how mu

- Page 300 and 301:

IT-based process changeThe IS manag

- Page 302 and 303:

IT-based process change• Process

- Page 304 and 305:

IT-based process change• External

- Page 306 and 307:

The emergence of rapid development

- Page 308 and 309:

IT-based process changeWhat skills

- Page 310 and 311:

IT-based process changeAN EXAMPLE O

- Page 312 and 313:

IT-based process changeprocesses, w

- Page 314 and 315:

IT-based process changeStep oneStep

- Page 316 and 317:

IT-based process changeCHANGING THE

- Page 318 and 319:

IT-based process change• Since pe

- Page 320 and 321:

IT-based process changedecision-mak

- Page 322 and 323:

Part ThreeEmerging inquiriesYou can

- Page 324 and 325:

Complex change• when is change co

- Page 326 and 327:

Complex change• the system is non

- Page 328 and 329:

There are some important principles

- Page 330 and 331:

Complex changethis thinking to larg

- Page 332 and 333:

Complex changeemerges, that is, the

- Page 334 and 335:

Complex changeFeedbackOne of the ch

- Page 336 and 337:

Complex changethese ideas and pract

- Page 338 and 339:

Complex changeare not really what m

- Page 340 and 341:

Complex changeThe final stage invol

- Page 342 and 343:

on ordinary conversation that sits

- Page 344 and 345:

10The right way to managechange?INT

- Page 346 and 347:

Miller (2002) summarized the findin

- Page 348 and 349:

in the change and also their line m

- Page 350 and 351:

The right way to manage change?Unde

- Page 352 and 353:

The right way to manage change?100

- Page 354 and 355:

The right way to manage change?Ther

- Page 356 and 357:

LEADING CHANGEThe right way to mana

- Page 358 and 359:

The right way to manage change?•

- Page 360 and 361:

The right way to manage change?appr

- Page 362 and 363:

create the right conditions for cha

- Page 364 and 365:

ConclusionSo what did we set out to

- Page 366 and 367:

HOW TO GET IN TOUCH WITH THE AUTHOR

- Page 368 and 369:

ReferencesBell, B and Kozlowski, S

- Page 370 and 371:

ReferencesGoleman, D (2000) Leaders

- Page 372 and 373:

ReferencesMaslow, A (1970) Motivati

- Page 374 and 375:

ReferencesSchein, E and Bennis, W (

- Page 376 and 377:

Index(italics indicate figures or t

- Page 378 and 379:

Indexprinciples 315tools to support

- Page 380 and 381:

Indexoutcomes 5outer leadership 165

- Page 382 and 383:

Indexproject sponsor 70project team

- Page 384 and 385:

www.koganpage.comOne website.A thou