- Page 1 and 2:

T A B L E O F C O N T E N T S P ART

- Page 3 and 4:

Article XVIII Article XIX Article X

- Page 5 and 6:

CHAPTER T ABLE OF CONTENTS P AGE 10

- Page 7:

CHAPTER T ABLE OF CONTENTS P AGE 23

- Page 10 and 11:

BROOME COUNTY CHARTER AND CODE ARTI

- Page 12 and 13:

BROOME COUNTY CHARTER AND CODE ARTI

- Page 14 and 15:

§ C101 BROOME COUNTY CHARTER AND C

- Page 16 and 17:

§ C105 BROOME COUNTY CHARTER AND C

- Page 18 and 19:

§ C201 BROOME COUNTY CHARTER AND C

- Page 20 and 21:

§ C205 BROOME COUNTY CHARTER AND C

- Page 22 and 23:

§ C212 BROOME COUNTY CHARTER AND C

- Page 24 and 25:

§ C304 BROOME COUNTY CHARTER AND C

- Page 26 and 27:

§ C309 BROOME COUNTY CHARTER AND C

- Page 28 and 29:

§ C402 BROOME COUNTY CHARTER AND C

- Page 30 and 31:

§ C603 BROOME COUNTY CHARTER AND C

- Page 32 and 33:

§ C607 BROOME COUNTY CHARTER AND C

- Page 34 and 35:

§ C701 BROOME COUNTY CHARTER AND C

- Page 36 and 37:

§ C902 BROOME COUNTY CHARTER AND C

- Page 38 and 39:

§ C1004 BROOME COUNTY CHARTER AND

- Page 40 and 41:

§ C1201 BROOME COUNTY CHARTER AND

- Page 42 and 43:

§ C1405 BROOME COUNTY CHARTER AND

- Page 44 and 45:

§ C1703 BROOME COUNTY CHARTER AND

- Page 46 and 47:

§ C1906 BROOME COUNTY CHARTER AND

- Page 49 and 50:

§ C2301 BROOME COUNTY CHARTER § C

- Page 51 and 52:

§ C2302-A BROOME COUNTY CHARTER §

- Page 53 and 54:

§ C2401 BROOME COUNTY CHARTER § C

- Page 55 and 56:

§ C2409 BROOME COUNTY CHARTER § C

- Page 57 and 58:

§ C2501 BROOME COUNTY CHARTER § C

- Page 59 and 60:

§ C2608 BROOME COUNTY CHARTER § C

- Page 61 and 62:

Chapter A BROOME COUNTY ADMINISTRAT

- Page 63 and 64:

BROOME COUNTY ADMINISTRATIVE CODE A

- Page 65 and 66:

BROOME COUNTY ADMINISTRATIVE CODE

- Page 67 and 68:

§ A103 BROOME COUNTY ADMINISTRATIV

- Page 69 and 70:

§ A201 BROOME COUNTY ADMINISTRATIV

- Page 71 and 72:

§ A203 BROOME COUNTY ADMINISTRATIV

- Page 73 and 74:

§ A206 BROOME COUNTY ADMINISTRATIV

- Page 75 and 76:

§ A213 BROOME COUNTY ADMINISTRATIV

- Page 77 and 78:

§ A302 BROOME COUNTY ADMINISTRATIV

- Page 79 and 80:

§ A302 BROOME COUNTY ADMINISTRATIV

- Page 81 and 82:

§ A306 BROOME COUNTY ADMINISTRATIV

- Page 83 and 84:

§ A309 BROOME COUNTY ADMINISTRATIV

- Page 85:

§ A401 BROOME COUNTY ADMINISTRATIV

- Page 88 and 89:

§ A501 BROOME COUNTY CHARTER AND C

- Page 90 and 91:

§ A505 BROOME COUNTY CHARTER AND C

- Page 92 and 93:

§ A602 BROOME COUNTY CHARTER AND C

- Page 94 and 95:

§ A604 BROOME COUNTY CHARTER AND C

- Page 96 and 97:

§ A604 BROOME COUNTY CHARTER AND C

- Page 98 and 99:

§ A608 BROOME COUNTY CHARTER AND C

- Page 100 and 101:

§ A703 BROOME COUNTY CHARTER AND C

- Page 102 and 103:

§ A803 BROOME COUNTY CHARTER AND C

- Page 104 and 105:

§ A902 BROOME COUNTY CHARTER AND C

- Page 106 and 107:

§ A904 BROOME COUNTY CHARTER AND C

- Page 108 and 109:

§ A1001 BROOME COUNTY CHARTER AND

- Page 110 and 111:

§ A1003-A BROOME COUNTY CHARTER AN

- Page 112 and 113:

§ A1201 BROOME COUNTY CHARTER AND

- Page 114 and 115:

§ A1205 BROOME COUNTY CHARTER AND

- Page 116 and 117:

§ A1401 BROOME COUNTY CHARTER AND

- Page 118 and 119:

§ A1405 BROOME COUNTY CHARTER AND

- Page 120 and 121:

§ A1505 BROOME COUNTY CHARTER AND

- Page 122 and 123:

§ A1610 BROOME COUNTY CHARTER AND

- Page 124 and 125:

§ A1804 BROOME COUNTY CHARTER AND

- Page 126 and 127:

§ A1905 BROOME COUNTY CHARTER AND

- Page 128 and 129:

§ A2101 BROOME COUNTY CHARTER AND

- Page 130 and 131:

§ A2301 BROOME COUNTY CHARTER AND

- Page 132 and 133:

§ A2307 BROOME COUNTY CHARTER AND

- Page 134 and 135:

§ A2302-A BROOME COUNTY CHARTER AN

- Page 136 and 137:

§ A2303-A BROOME COUNTY CHARTER AN

- Page 138 and 139:

§ A2303-A BROOME COUNTY CHARTER AN

- Page 140 and 141:

§ A2304-A BROOME COUNTY CHARTER AN

- Page 142 and 143:

§ A2306-A BROOME COUNTY CHARTER AN

- Page 144 and 145:

§ A2404 BROOME COUNTY CHARTER AND

- Page 146 and 147:

§ A2408 BROOME COUNTY CHARTER AND

- Page 148 and 149:

§ A2601 BROOME COUNTY CHARTER AND

- Page 150 and 151:

§ A2610 BROOME COUNTY CHARTER AND

- Page 153 and 154:

Chapter 1 GENERAL PROVISIONS ARTICL

- Page 155 and 156:

§ 1-4 GENERAL PROVISIONS § 1-7 E.

- Page 157:

§ 1-12 GENERAL PROVISIONS were mad

- Page 160 and 161:

§ 5-5 BROOME COUNTY CODE § 5-9 §

- Page 162 and 163:

§ 10-2 BROOME COUNTY CODE § 10-2

- Page 165 and 166:

Chapter 19 ETHICS ARTICLE I Code of

- Page 167 and 168:

§ 19-3 ETHICS § 19-3 A. Gifts. No

- Page 169 and 170:

§ 19-4 ETHICS § 19-6 A statement

- Page 171 and 172:

§ 19-6 ETHICS § 19-6 Director of

- Page 173 and 174:

§ 19-6 ETHICS § 19-6 (e) (f) (g)

- Page 175 and 176:

§ 19-11 ETHICS § 19-14 Codes of E

- Page 177 and 178:

§ 19-16 ETHICS § 19-18 H. Permit

- Page 179 and 180:

§ 19-21 ETHICS § 19-24 § 19-21.

- Page 181 and 182:

§ 19-26 ETHICS § 19-30 (4) Engage

- Page 183:

§ 19-33 ETHICS § 19-33 § 19-33.

- Page 187 and 188:

Chapter 28 LEASE OR SALE OF COUNTY

- Page 189:

§ 31-1. Payment or reimbursement t

- Page 193:

§ 38-1. Payments into credit union

- Page 196 and 197:

§ 48-2 BROOME COUNTY CODE § 48-5

- Page 199 and 200:

Chapter 52 RESERVE FUNDS ARTICLE I

- Page 201 and 202:

§ 52-4 RESERVE FUNDS § 52-8 D. Th

- Page 203:

§ 52-13 RESERVE FUNDS § 52-17 §

- Page 207:

Chapter 58 SALARIES AND COMPENSATIO

- Page 210 and 211:

§ 60-2 BROOME COUNTY CODE § 60-5

- Page 212 and 213:

§ 60-9 BROOME COUNTY CODE § 60-12

- Page 214 and 215:

§ 60-13 BROOME COUNTY CODE § 60-1

- Page 216 and 217:

§ 60-15 BROOME COUNTY CODE § 60-1

- Page 219 and 220:

Chapter 68 TRANSPORTATION SERVICES

- Page 221 and 222:

Chapter 72 TRAVEL EXPENSES ARTICLE

- Page 223 and 224:

§ 72-6 TRAVEL EXPENSES § 72-10 B.

- Page 225 and 226:

Chapter 76 WORKERS' COMPENSATION SE

- Page 227 and 228:

WORKERS' COMPENSATION SELF-INSURANC

- Page 229:

WORKERS' COMPENSATION SELF-INSURANC

- Page 232 and 233:

§ 84-1 BROOME COUNTY CHARTER AND C

- Page 234 and 235:

§ 84-3 BROOME COUNTY CHARTER AND C

- Page 237 and 238:

Chapter 85 AIRPORT: GROUND TRANSPOR

- Page 239 and 240:

§ 85-2 AIRPORT: GROUND TRANSPORTAT

- Page 241 and 242:

§ 85-3 AIRPORT: GROUND TRANSPORTAT

- Page 243 and 244:

§ 85-8 AIRPORT: GROUND TRANSPORTAT

- Page 245 and 246:

§ 85-11 AIRPORT: GROUND TRANSPORTA

- Page 247 and 248:

§ 85-16 AIRPORT: GROUND TRANSPORTA

- Page 249 and 250:

§ 85-23 AIRPORT: GROUND TRANSPORTA

- Page 251 and 252:

§ 85-31 AIRPORT: GROUND TRANSPORTA

- Page 253 and 254:

§ 85-33 AIRPORT: GROUND TRANSPORTA

- Page 255:

AIRPORT: GROUND TRANSPORTATION SERV

- Page 258 and 259:

§ 86-2 BROOME COUNTY CODE § 86-4

- Page 260 and 261:

§ 98-1 BROOME COUNTY CODE § 98-2

- Page 262 and 263:

§ 98-2 BROOME COUNTY CODE § 98-3

- Page 264 and 265:

§ 98-4 BROOME COUNTY CODE § 98-6

- Page 266 and 267:

§ 98-7 BROOME COUNTY CODE § 98-7

- Page 269 and 270:

Chapter 102 CONSUMER PROTECTION §

- Page 271 and 272:

§ 102-5 CONSUMER PROTECTION § 102

- Page 273 and 274:

§ 102-5 CONSUMER PROTECTION § 102

- Page 275 and 276:

§ 102-5 CONSUMER PROTECTION § 102

- Page 277 and 278:

§ 102-9 CONSUMER PROTECTION § 102

- Page 279 and 280:

§ 102-10 CONSUMER PROTECTION § 10

- Page 281 and 282:

Chapter 106 COUNTY PROPERTY, USE OF

- Page 283 and 284:

§ 106-4 COUNTY PROPERTY, USE OF §

- Page 285 and 286:

§ 106-4 COUNTY PROPERTY, USE OF §

- Page 287 and 288:

§ 106-4 COUNTY PROPERTY, USE OF §

- Page 289:

§ 106-4 COUNTY PROPERTY, USE OF §

- Page 293 and 294:

Chapter 115 DOGS AND OTHER ANIMALS

- Page 295 and 296:

§ 115-3 DOGS AND OTHER ANIMALS §

- Page 297:

§ 115-10 DOGS AND OTHER ANIMALS §

- Page 300 and 301:

§ 120-3 BROOME COUNTY CODE § 120-

- Page 302 and 303:

§ 120-13 BROOME COUNTY CODE § 120

- Page 304 and 305:

§ 125-1 BROOME COUNTY CHARTER AND

- Page 307 and 308:

§ 125-1 FEES AND CHARGES § 125-4

- Page 309 and 310:

§ 125-9 FEES AND CHARGES § 125-10

- Page 311 and 312:

§ 125-14 FEES AND CHARGES § 125-2

- Page 313 and 314:

§ 125-26 FEES AND CHARGES § 125-2

- Page 315 and 316:

§ 125-32 FEES AND CHARGES § 125-3

- Page 317 and 318:

§ 125-38 FEES AND CHARGES § 125-4

- Page 319:

§ 125-46 FEES AND CHARGES § 125-4

- Page 323 and 324:

Chapter 158 PARKS AND RECREATION AR

- Page 325 and 326:

§ 158-3 PARKS AND RECREATION AREAS

- Page 327 and 328:

§ 158-3 PARKS AND RECREATION AREAS

- Page 329 and 330:

§ 158-3 PARKS AND RECREATION AREAS

- Page 331 and 332:

§ 158-3 PARKS AND RECREATION AREAS

- Page 333 and 334:

§ 158-4 PARKS AND RECREATION AREAS

- Page 335:

§ 158-4 PARKS AND RECREATION AREAS

- Page 338 and 339:

§ 168-1 BROOME COUNTY CHARTER AND

- Page 340 and 341:

§ 168-4 BROOME COUNTY CHARTER AND

- Page 342 and 343:

§ 168-5 BROOME COUNTY CHARTER AND

- Page 344 and 345:

§ 168-9 BROOME COUNTY CHARTER AND

- Page 346 and 347:

§ 168-13 BROOME COUNTY CHARTER AND

- Page 348 and 349:

§ 168-15 BROOME COUNTY CHARTER AND

- Page 350 and 351:

§ 168-20 BROOME COUNTY CHARTER AND

- Page 352 and 353:

§ 168-22 BROOME COUNTY CHARTER AND

- Page 354 and 355:

§ 168-22 BROOME COUNTY CHARTER AND

- Page 356 and 357:

§ 168-23 BROOME COUNTY CHARTER AND

- Page 358 and 359:

§ 168-25 BROOME COUNTY CHARTER AND

- Page 360 and 361:

§ 168-30 BROOME COUNTY CHARTER AND

- Page 362 and 363:

§ 168-34 BROOME COUNTY CHARTER AND

- Page 364 and 365:

§ 168-41 BROOME COUNTY CHARTER AND

- Page 366 and 367:

§ 168-45 BROOME COUNTY CHARTER AND

- Page 368 and 369:

§ 168-51 BROOME COUNTY CHARTER AND

- Page 370 and 371:

§ 170-3 BROOME COUNTY CHARTER AND

- Page 373 and 374:

Chapter 175 SOLICITING ARTICLE I §

- Page 375 and 376:

§ 175-4 SOLICITING § 175-5 (6) Th

- Page 377:

§ 175-8 SOLICITING § 175-10 § 17

- Page 380 and 381:

§ 179-1 BROOME COUNTY CHARTER AND

- Page 382 and 383:

§ 179-5 BROOME COUNTY CHARTER AND

- Page 385 and 386:

§ 179-5 SOLID WASTE § 179-6 of up

- Page 387 and 388:

§ 179-6 SOLID WASTE § 179-9 (1) L

- Page 389:

§ 179-9 SOLID WASTE § 179-9 and t

- Page 392 and 393: § 179-9 BROOME COUNTY CHARTER AND

- Page 395 and 396: § 179-9 SOLID WASTE § 179-11 (2)

- Page 397 and 398: § 179-13 SOLID WASTE § 179-14 RES

- Page 399 and 400: § 179-14 SOLID WASTE § 179-16 (d)

- Page 401 and 402: § 179-20 SOLID WASTE § 179-22 com

- Page 403 and 404: § 179-24 SOLID WASTE § 179-26 lon

- Page 405 and 406: § 179-27 SOLID WASTE § 179-30 res

- Page 407 and 408: § 179-32 SOLID WASTE § 179-34 C.

- Page 409: § 179-38 SOLID WASTE § 179-38 §

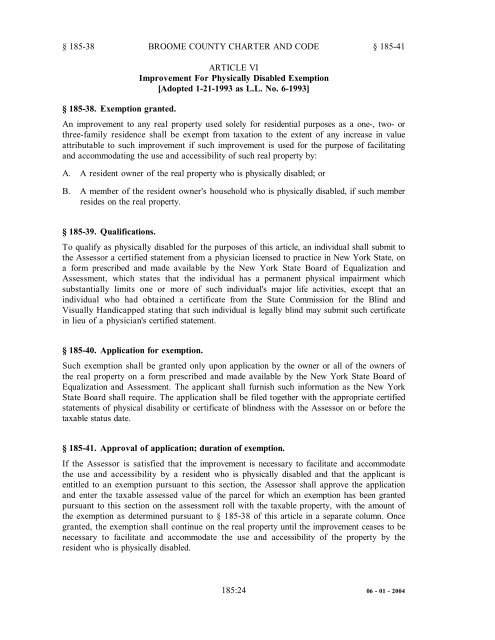

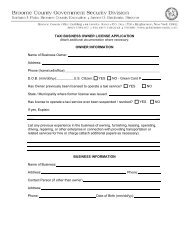

- Page 413 and 414: Chapter 185 TAXATION ARTICLE I Coll

- Page 415 and 416: § 185-1 TAXATION § 185-1 § 185-8

- Page 417: § 185-6 TAXATION § 185-7 business

- Page 420 and 421: § 185-10 BROOME COUNTY CHARTER AND

- Page 422 and 423: § 185-15 BROOME COUNTY CHARTER AND

- Page 424 and 425: § 185-19 BROOME COUNTY CHARTER AND

- Page 427 and 428: § 185-21 TAXATION § 185-23 collec

- Page 429 and 430: § 185-24 TAXATION § 185-25 or ope

- Page 431 and 432: § 185-26 TAXATION § 185-28 occupa

- Page 433 and 434: § 185-29 TAXATION § 185-31 amount

- Page 435 and 436: § 185-32 TAXATION § 185-32 B. No

- Page 437 and 438: § 185-32 TAXATION § 185-32 their

- Page 439: § 185-33 TAXATION § 185-33 requir

- Page 444 and 445: § 185-44 BROOME COUNTY CHARTER AND

- Page 446 and 447: § 185-50 BROOME COUNTY CHARTER AND

- Page 448 and 449: § 185-52 BROOME COUNTY CHARTER AND

- Page 450 and 451: § 185-55 BROOME COUNTY CHARTER AND

- Page 452 and 453: § 185-61 BROOME COUNTY CHARTER AND

- Page 454 and 455: § 185-63 BROOME COUNTY CHARTER AND

- Page 456 and 457: § 185-67 BROOME COUNTY CHARTER AND

- Page 458 and 459: § 185-72 BROOME COUNTY CHARTER AND

- Page 460 and 461: § 185-81 BROOME COUNTY CHARTER AND

- Page 462 and 463: § 185-84 BROOME COUNTY CHARTER AND

- Page 464 and 465: § 185-92 BROOME COUNTY CHARTER AND

- Page 466 and 467: § 185-101 BROOME COUNTY CHARTER AN

- Page 468 and 469: § 187-4 BROOME COUNTY CHARTER AND

- Page 470 and 471: § 187-5 BROOME COUNTY CHARTER AND

- Page 473 and 474: Chapter 189 VEHICLES AND TRAFFIC AR

- Page 475: Chapter 190 TEXT MESSAGING [In May

- Page 479 and 480: Chapter 203 ARCHITECTURAL AND ENGIN

- Page 481 and 482: ARCHITECTURAL AND ENGINEERING SERVI

- Page 483: Chapter 206 DEFENSE AND INDEMNIFICA

- Page 486 and 487: § 207-5 BROOME COUNTY CODE § 207-

- Page 488 and 489: § 209-2 BROOME COUNTY CODE § 209-

- Page 490 and 491: § 209-3 BROOME COUNTY CODE § 209-

- Page 492 and 493:

§ 209-6 BROOME COUNTY CODE § 209-

- Page 494 and 495:

§ 210-1 BROOME COUNTY CODE § 210-

- Page 496 and 497:

§ 210-5 BROOME COUNTY CODE § 210-

- Page 498 and 499:

§ 210-8 BROOME COUNTY CODE § 210-

- Page 500 and 501:

§ 210-19 BROOME COUNTY CODE § 210

- Page 502 and 503:

§ 210-34 BROOME COUNTY CODE § 210

- Page 505:

Chapter 214 FEES AND CHARGES ARTICL

- Page 508 and 509:

§ 225-2 BROOME COUNTY CHARTER AND

- Page 510 and 511:

§ 225-3 BROOME COUNTY CHARTER AND

- Page 512 and 513:

§ 225-7 BROOME COUNTY CHARTER AND

- Page 515 and 516:

Chapter 235 TAXATION ARTICLE I § 2

- Page 517 and 518:

Chapter 240 INFORMATION TECHNOLOGY

- Page 519:

§ 240-4 INFORMATION TECHNOLOGY §

- Page 522 and 523:

§ DL-1 BROOME COUNTY CHARTER AND C