You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

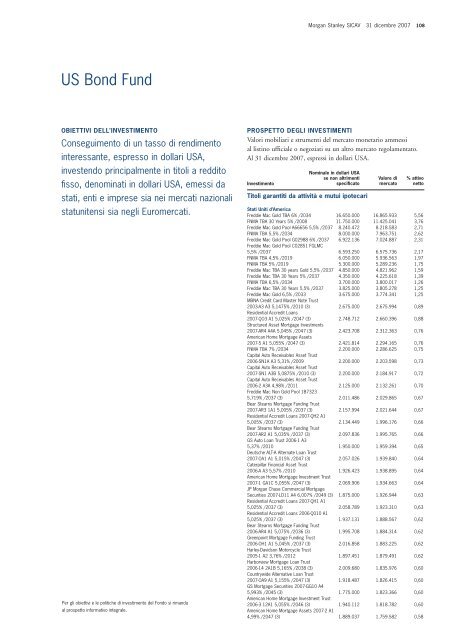

Morgan Stanley SICAV 31 dicembre 2007 108<br />

US Bond Fund<br />

OBIETTIVI DELL’INVESTIMENTO<br />

Conseguimento di un tasso di rendimento<br />

interessante, espresso in dollari USA,<br />

investendo principalmente in titoli a reddito<br />

fisso, denominati in dollari USA, emessi da<br />

stati, enti e imprese sia nei mercati nazionali<br />

statunitensi sia negli Euromercati.<br />

Per gli obiettivi e le politiche di investimento del Fondo si rimanda<br />

al prospetto informativo integrale.<br />

PROSPETTO DEGLI INVESTIMENTI<br />

Valori mobiliari e strumenti del mercato monetario ammessi<br />

al listino ufficiale o negoziati su un a<strong>lt</strong>ro mercato regolamentato.<br />

Al 31 dicembre 2007, espressi in dollari USA.<br />

Investimento<br />

Nominale in dollari USA<br />

se non a<strong>lt</strong>rimenti<br />

specificato<br />

Titoli garantiti da attività e mutui ipotecari<br />

Valore di<br />

mercato<br />

% attivo<br />

netto<br />

Stati Uniti d’America<br />

Freddie Mac Gold TBA 6% /2034 16.650.000 16.865.933 5,56<br />

FNMA TBA 30 Years 5% /2008 11.750.000 11.425.041 3,76<br />

Freddie Mac Gold Pool A66656 5,5% /2037 8.240.472 8.218.583 2,71<br />

FNMA TBA 5,5% /2034 8.000.000 7.963.751 2,62<br />

Freddie Mac Gold Pool G02988 6% /2037 6.922.136 7.024.887 2,31<br />

Freddie Mac Gold Pool C02851 FGLMC<br />

5,5% /2037 6.593.250 6.575.736 2,17<br />

FNMA TBA 4,5% /2019 6.050.000 5.936.563 1,97<br />

FNMA TBA 5% /2019 5.300.000 5.289.236 1,75<br />

Freddie Mac TBA 30 years Gold 5,5% /2037 4.850.000 4.821.962 1,59<br />

Freddie Mac TBA 30 Years 5% /2037 4.350.000 4.225.618 1,39<br />

FNMA TBA 6,5% /2034 3.700.000 3.800.017 1,26<br />

Freddie Mac TBA 30 Years 5,5% /2037 3.825.000 3.805.278 1,25<br />

Freddie Mac Gold 6,5% /2033 3.675.000 3.774.341 1,25<br />

MBNA Credit Card Master Note Trust<br />

2003-A3 A3 5,1475% /2010 (3) 2.675.000 2.675.994 0,89<br />

Residential Accredit Loans<br />

2007-QO3 A1 5,025% /2047 (3) 2.748.712 2.660.396 0,88<br />

Structured Asset Mortgage Investments<br />

2007-AR4 A4A 5,045% /2047 (3) 2.423.708 2.312.363 0,76<br />

American Home Mortgage Assets<br />

2007-5 A1 5,055% /2047 (3) 2.421.814 2.294.165 0,76<br />

FNMA TBA 7% /2034 2.200.000 2.286.625 0,75<br />

Capital Auto Receivables Asset Trust<br />

2006-SN1A A3 5,31% /2009 2.200.000 2.203.598 0,73<br />

Capital Auto Receivables Asset Trust<br />

2007-SN1 A3B 5,0875% /2010 (3) 2.200.000 2.184.917 0,72<br />

Capital Auto Receivables Asset Trust<br />

2006-2 A3A 4,98% /2011 2.125.000 2.132.261 0,70<br />

Freddie Mac Non Gold Pool 1B7323<br />

5,719% /2037 (3) 2.011.486 2.029.865 0,67<br />

Bear Stearns Mortgage Funding Trust<br />

2007-AR3 1A1 5,005% /2037 (3) 2.157.994 2.021.644 0,67<br />

Residential Accredit Loans 2007-QH2 A1<br />

5,005% /2037 (3) 2.134.449 1.996.176 0,66<br />

Bear Stearns Mortgage Funding Trust<br />

2007-AR2 A1 5,035% /2037 (3) 2.097.836 1.995.765 0,66<br />

GS Auto Loan Trust 2006-1 A3<br />

5,37% /2010 1.950.000 1.959.394 0,65<br />

Deutsche ALT-A A<strong>lt</strong>ernate Loan Trust<br />

2007-OA1 A1 5,015% /2047 (3) 2.057.026 1.939.840 0,64<br />

Caterpillar Financial Asset Trust<br />

2006-A A3 5,57% /2010 1.926.423 1.938.895 0,64<br />

American Home Mortgage Investment Trust<br />

2007-1 GA1C 5,055% /2047 (3) 2.069.906 1.934.663 0,64<br />

JP Morgan Chase Commercial Mortgage<br />

Securities 2007-LD11 A4 6,007% /2049 (3) 1.875.000 1.926.944 0,63<br />

Residential Accredit Loans 2007-QH1 A1<br />

5,025% /2037 (3) 2.058.789 1.923.310 0,63<br />

Residential Accredit Loans 2006-Q010 A1<br />

5,025% /2037 (3) 1.937.131 1.888.567 0,62<br />

Bear Stearns Mortgage Funding Trust<br />

2006-AR4 A1 5,075% /2036 (3) 1.995.708 1.884.314 0,62<br />

Greenpoint Mortgage Funding Trust<br />

2006-OH1 A1 5,045% /2037 (3) 2.016.858 1.883.225 0,62<br />

Harley-Davidson Motorcycle Trust<br />

2005-1 A2 3,76% /2012 1.897.451 1.879.491 0,62<br />

Harborview Mortgage Loan Trust<br />

2006-14 2A1B 5,165% /2038 (3) 2.009.680 1.835.976 0,60<br />

Countrywide A<strong>lt</strong>ernative Loan Trust<br />

2007-OA9 A1 5,155% /2047 (3) 1.918.487 1.826.415 0,60<br />

GS Mortgage Securities 2007-GG10 A4<br />

5,993% /2045 (3) 1.775.000 1.823.366 0,60<br />

American Home Mortgage Investment Trust<br />

2006-3 12A1 5,055% /2046 (3) 1.940.112 1.818.782 0,60<br />

American Home Mortgage Assets 2007-2 A1<br />

4,99% /2047 (3) 1.889.037 1.759.582 0,58