Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

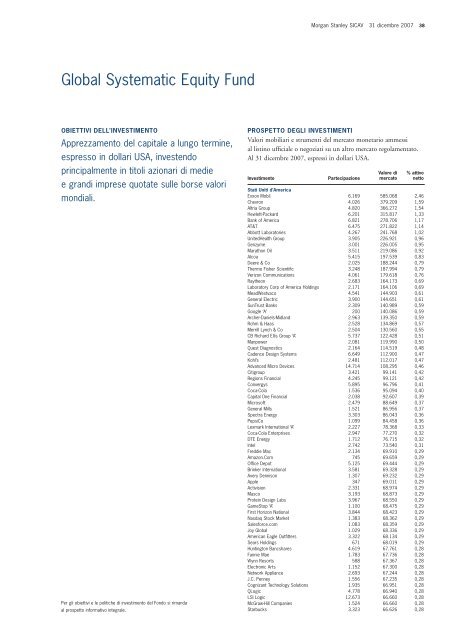

Morgan Stanley SICAV 31 dicembre 2007 38<br />

Global Systematic Equity Fund<br />

OBIETTIVI DELL’INVESTIMENTO<br />

Apprezzamento del capitale a lungo termine,<br />

espresso in dollari USA, investendo<br />

principalmente in titoli azionari di medie<br />

e grandi imprese quotate sulle borse valori<br />

mondiali.<br />

Per gli obiettivi e le politiche di investimento del Fondo si rimanda<br />

al prospetto informativo integrale.<br />

PROSPETTO DEGLI INVESTIMENTI<br />

Valori mobiliari e strumenti del mercato monetario ammessi<br />

al listino ufficiale o negoziati su un a<strong>lt</strong>ro mercato regolamentato.<br />

Al 31 dicembre 2007, espressi in dollari USA.<br />

Investimento<br />

Partecipazione<br />

Valore di<br />

mercato<br />

% attivo<br />

netto<br />

Stati Uniti d’America<br />

Exxon Mobil 6.169 585.068 2,46<br />

Chevron 4.026 379.209 1,59<br />

A<strong>lt</strong>ria Group 4.820 366.272 1,54<br />

Hewlett-Packard 6.201 315.817 1,33<br />

Bank of America 6.821 278.706 1,17<br />

AT&T 6.475 271.822 1,14<br />

Abbott Laboratories 4.267 241.768 1,02<br />

UnitedHea<strong>lt</strong>h Group 3.905 226.921 0,96<br />

Genzyme 3.001 226.005 0,95<br />

Marathon Oil 3.511 219.086 0,92<br />

Alcoa 5.415 197.539 0,83<br />

Deere & Co 2.025 188.244 0,79<br />

Thermo Fisher Scientific 3.248 187.994 0,79<br />

Verizon Communications 4.061 179.618 0,76<br />

Raytheon 2.683 164.173 0,69<br />

Laboratory Corp of America Holdings 2.171 164.106 0,69<br />

MeadWestvaco 4.541 144.903 0,61<br />

General Electric 3.900 144.651 0,61<br />

SunTrust Banks 2.309 140.989 0,59<br />

Google ‘A’ 200 140.086 0,59<br />

Archer-Daniels-Midland 2.963 139.350 0,59<br />

Rohm & Haas 2.528 134.869 0,57<br />

Merrill Lynch & Co 2.504 130.560 0,55<br />

CB Richard Ellis Group ‘A’ 5.737 122.428 0,51<br />

Manpower 2.081 119.990 0,50<br />

Quest Diagnostics 2.164 114.519 0,48<br />

Cadence Design Systems 6.649 112.900 0,47<br />

Kohl’s 2.481 112.017 0,47<br />

Advanced Micro Devices 14.714 108.295 0,46<br />

Citigroup 3.421 99.141 0,42<br />

Regions Financial 4.245 99.121 0,42<br />

Convergys 5.895 96.796 0,41<br />

Coca-Cola 1.536 95.094 0,40<br />

Capital One Financial 2.038 92.607 0,39<br />

Microsoft 2.479 88.649 0,37<br />

General Mills 1.521 86.956 0,37<br />

Spectra Energy 3.303 86.043 0,36<br />

PepsiCo 1.099 84.458 0,36<br />

Lexmark International ‘A’ 2.227 78.368 0,33<br />

Coca-Cola Enterprises 2.947 77.270 0,32<br />

DTE Energy 1.712 76.715 0,32<br />

Intel 2.742 73.540 0,31<br />

Freddie Mac 2.134 69.910 0,29<br />

Amazon.Com 745 69.659 0,29<br />

Office Depot 5.125 69.444 0,29<br />

Brinker International 3.581 69.328 0,29<br />

Avery Dennison 1.307 69.232 0,29<br />

Apple 347 69.011 0,29<br />

Activision 2.331 68.974 0,29<br />

Masco 3.193 68.873 0,29<br />

Protein Design Labs 3.967 68.550 0,29<br />

GameStop ‘A’ 1.100 68.475 0,29<br />

First Horizon National 3.844 68.423 0,29<br />

Nasdaq Stock Market 1.383 68.362 0,29<br />

Salesforce.com 1.083 68.359 0,29<br />

Joy Global 1.029 68.336 0,29<br />

American Eagle Outfitters 3.322 68.134 0,29<br />

Sears Holdings 671 68.019 0,29<br />

Huntin<strong>gt</strong>on Bancshares 4.619 67.761 0,28<br />

Fannie Mae 1.783 67.736 0,28<br />

Wynn Resorts 588 67.367 0,28<br />

Electronic Arts 1.152 67.300 0,28<br />

Network Appliance 2.693 67.244 0,28<br />

J.C. Penney 1.556 67.235 0,28<br />

Cognizant Technology Solutions 1.935 66.951 0,28<br />

QLogic 4.778 66.940 0,28<br />

LSI Logic 12.673 66.660 0,28<br />

McGraw-Hill Companies 1.524 66.660 0,28<br />

Starbucks 3.323 66.626 0,28