Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

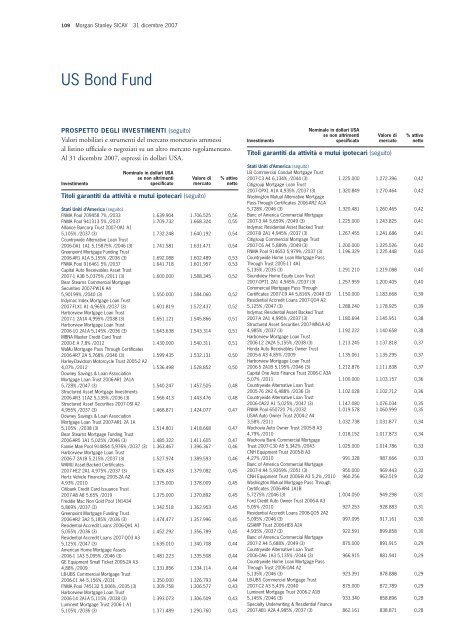

109 Morgan Stanley SICAV 31 dicembre 2007<br />

US Bond Fund<br />

PROSPETTO DEGLI INVESTIMENTI (seguito)<br />

Valori mobiliari e strumenti del mercato monetario ammessi<br />

al listino ufficiale o negoziati su un a<strong>lt</strong>ro mercato regolamentato.<br />

Al 31 dicembre 2007, espressi in dollari USA.<br />

Investimento<br />

Nominale in dollari USA<br />

se non a<strong>lt</strong>rimenti<br />

specificato<br />

Valore di<br />

mercato<br />

Titoli garantiti da attività e mutui ipotecari (seguito)<br />

% attivo<br />

netto<br />

Stati Uniti d’America (seguito)<br />

FNMA Pool 709458 7% /2033 1.639.904 1.706.525 0,56<br />

FNMA Pool 941313 5% /2037 1.709.732 1.668.324 0,55<br />

Alliance Bancorp Trust 2007-OA1 A1<br />

5,105% /2037 (3) 1.732.248 1.640.192 0,54<br />

Countrywide A<strong>lt</strong>ernative Loan Trust<br />

2006-OA1 1A1 5,15875% /2046 (3) 1.741.581 1.631.471 0,54<br />

Greenpoint Mortgage Funding Trust<br />

2006-AR1 A1A 5,155% /2036 (3) 1.692.088 1.602.489 0,53<br />

FNMA Pool 916461 5% /2037 1.641.718 1.601.957 0,53<br />

Capital Auto Receivables Asset Trust<br />

2007-1 A3B 5,0375% /2011 (3) 1.600.000 1.588.345 0,52<br />

Bear Stearns Commercial Mortgage<br />

Securities 2007-PW16 A4<br />

5,90199% /2040 (3) 1.550.000 1.584.060 0,52<br />

Indymac Index Mortgage Loan Trust<br />

2007-FLX1 A1 4,965% /2037 (3) 1.601.819 1.572.437 0,52<br />

Harborview Mortgage Loan Trust<br />

2007-1 2A1A 4,995% /2038 (3) 1.651.121 1.545.866 0,51<br />

Harborview Mortgage Loan Trust<br />

2006-10 2A1A 5,145% /2036 (3) 1.643.638 1.543.314 0,51<br />

MBNA Master Credit Card Trust<br />

2000-E A 7,8% /2012 1.430.000 1.540.311 0,51<br />

WaMu Mortgage Pass Through Certificates<br />

2006-AR7 2A 5,768% /2046 (3) 1.599.435 1.532.131 0,50<br />

Harley-Davidson Motorcycle Trust 2005-2 A2<br />

4,07% /2012 1.536.498 1.528.852 0,50<br />

Downey Savings & Loan Association<br />

Mortgage Loan Trust 2006-AR1 2A1A<br />

5,728% /2047 (3) 1.540.247 1.457.505 0,48<br />

Structured Asset Mortgage Investments<br />

2006-AR3 11A2 5,135% /2036 (3) 1.566.413 1.443.476 0,48<br />

Structured Asset Securities 2007-OSI A2<br />

4,955% /2037 (3) 1.468.871 1.424.077 0,47<br />

Downey Savings & Loan Association<br />

Mortgage Loan Trust 2007-AR1 2A 1A<br />

5,105% /2038 (3) 1.514.801 1.418.668 0,47<br />

Bear Stearns Mortgage Funding Trust<br />

2006-AR5 1A1 5,025% /2046 (3) 1.485.322 1.411.605 0,47<br />

Fannie Mae Pool 914854 5,976% /2037 (3) 1.363.467 1.396.367 0,46<br />

Harborview Mortgage Loan Trust<br />

2006-7 2A1B 5,215% /2037 (3) 1.527.974 1.389.593 0,46<br />

WAMU Asset-Backed Certificates<br />

2007-HE2 2A1 4,975% /2037 (3) 1.426.433 1.379.082 0,45<br />

Hertz Vehicle Financing 2005-2A A2<br />

4,93% /2010 1.375.000 1.378.009 0,45<br />

Citibank Credit Card Issuance Trust<br />

2007-A8 A8 5,65% /2019 1.375.000 1.370.892 0,45<br />

Freddie Mac Non Gold Pool 1N1434<br />

5,869% /2037 (3) 1.342.518 1.362.953 0,45<br />

Greenpoint Mortgage Funding Trust<br />

2006-AR2 3A2 5,185% /2036 (3) 1.474.477 1.357.996 0,45<br />

Residential Accredit Loans 2006-QH1 A1<br />

5,055% /2036 (3) 1.452.292 1.356.789 0,45<br />

Residential Accredit Loans 2007-QO3 A3<br />

5,125% /2047 (3) 1.635.010 1.340.708 0,44<br />

American Home Mortgage Assets<br />

2006-1 1A3 5,095% /2046 (3) 1.481.223 1.335.508 0,44<br />

GE Equipment Small Ticket 2005-2A A3<br />

4,88% /2009 1.331.856 1.334.114 0,44<br />

LB-UBS Commercial Mortgage Trust<br />

2006-C1 A4 5,156% /2031 1.350.000 1.326.793 0,44<br />

FNMA Pool 745132 5,006% /2035 (3) 1.309.758 1.306.577 0,43<br />

Harborview Mortgage Loan Trust<br />

2006-14 2A1A 5,115% /2038 (3) 1.393.073 1.306.509 0,43<br />

Luminent Mortgage Trust 2006-1 A1<br />

5,105% /2036 (3) 1.371.489 1.290.760 0,43<br />

Investimento<br />

Nominale in dollari USA<br />

se non a<strong>lt</strong>rimenti<br />

specificato<br />

Valore di<br />

mercato<br />

Titoli garantiti da attività e mutui ipotecari (seguito)<br />

% attivo<br />

netto<br />

Stati Uniti d’America (seguito)<br />

LB Commercial Conduit Mortgage Trust<br />

2007-C3 A4 6,134% /2044 (3) 1.225.000 1.272.396 0,42<br />

Citigroup Mortgage Loan Trust<br />

2007-OPX1 A1A 4,935% /2037 (3) 1.320.849 1.270.464 0,42<br />

Washin<strong>gt</strong>on Mutual A<strong>lt</strong>ernative Mortgage<br />

Pass-Through Certificates 2006-AR2 A1A<br />

5,728% /2046 (3) 1.320.481 1.260.465 0,42<br />

Banc of America Commercial Mortgage<br />

2007-3 A4 5,659% /2049 (3) 1.225.000 1.243.825 0,41<br />

Indymac Residential Asset Backed Trust<br />

2007-B 2A1 4,945% /2037 (3) 1.267.455 1.241.686 0,41<br />

Citigroup Commercial Mortgage Trust<br />

2007-C6 A4 5,889% /2049 (3) 1.200.000 1.225.526 0,40<br />

FNMA Pool 914653 5,979% /2037 (3) 1.196.329 1.225.448 0,40<br />

Countrywide Home Loan Mortgage Pass<br />

Through Trust 2005-11 4A1<br />

5,135% /2035 (3) 1.291.210 1.219.088 0,40<br />

Soundview Home Equity Loan Trust<br />

2007-OPT1 2A1 4,945% /2037 (3) 1.257.959 1.200.405 0,40<br />

Commercial Mortgage Pass Through<br />

Certificates 2007-C9 A4 5,816% /2049 (3) 1.150.000 1.183.668 0,39<br />

Residential Accredit Loans 2007-QO4 A2<br />

5,125% /2047 (3) 1.288.240 1.178.925 0,39<br />

Indymac Residential Asset Backed Trust<br />

2007-A 2A1 4,995% /2037 (3) 1.180.694 1.145.951 0,38<br />

Structured Asset Securities 2007-MN1A A2<br />

4,985% /2037 (3) 1.192.222 1.140.658 0,38<br />

Harborview Mortgage Loan Trust<br />

2006-12 2A2A 5,155% /2038 (3) 1.213.245 1.137.818 0,37<br />

Honda Auto Receivables Owner Trust<br />

2005-6 A3 4,85% /2009 1.135.061 1.135.295 0,37<br />

Harborview Mortgage Loan Trust<br />

2006-5 2A1B 5,195% /2046 (3) 1.212.876 1.111.838 0,37<br />

Capital One Auto Finance Trust 2006-C A3A<br />

5,07% /2011 1.100.000 1.103.157 0,36<br />

Countrywide A<strong>lt</strong>ernative Loan Trust<br />

2005-76 2A2 6,488% /2036 (3) 1.102.028 1.102.712 0,36<br />

Countrywide A<strong>lt</strong>ernative Loan Trust<br />

2006-OA22 A1 5,025% /2047 (3) 1.147.080 1.076.034 0,35<br />

FNMA Pool 650720 7% /2032 1.019.578 1.060.999 0,35<br />

USAA Auto Owner Trust 2004-2 A4<br />

3,58% /2011 1.032.738 1.031.877 0,34<br />

Wachovia Auto Owner Trust 2005-B A3<br />

4,79% /2010 1.018.152 1.017.873 0,34<br />

Wachovia Bank Commercial Mortgage<br />

Trust 2007-C30 A5 5,342% /2043 1.025.000 1.014.786 0,33<br />

CNH Equipment Trust 2005-B A3<br />

4,27% /2010 991.328 987.666 0,33<br />

Banc of America Commercial Mortgage<br />

2007-4 A4 5,9359% /2051 (3) 950.000 969.443 0,32<br />

CNH Equipment Trust 2006-B A3 5,2% /2010 960.256 963.519 0,32<br />

Washin<strong>gt</strong>on Mutual Mortgage Pass Through<br />

Certificates 2006-AR4 1A1B<br />

5,7275% /2046 (3) 1.004.050 949.298 0,31<br />

Ford Credit Auto Owner Trust 2006-A A3<br />

5,05% /2010 927.253 928.883 0,31<br />

Residential Accredit Loans 2006-QO5 2A2<br />

5,095% /2046 (3) 997.095 917.161 0,30<br />

GSAMP Trust 2006-HE8 A2A<br />

4,935% /2037 (3) 922.591 899.858 0,30<br />

Banc of America Commercial Mortgage<br />

2007-2 A4 5,688% /2049 (3) 875.000 891.915 0,29<br />

Countrywide A<strong>lt</strong>ernative Loan Trust<br />

2006-OA6 1A3 5,135% /2046 (3) 966.915 881.941 0,29<br />

Countrywide Home Loan Mortgage Pass<br />

Through Trust 2006-OA4 A2<br />

5,135% /2046 (3) 923.391 878.888 0,29<br />

LB-UBS Commercial Mortgage Trust<br />

2007-C2 A3 5,43% /2040 875.000 872.789 0,29<br />

Luminent Mortgage Trust 2006-2 A1B<br />

5,145% /2046 (3) 933.340 858.896 0,28<br />

Specia<strong>lt</strong>y Underwriting & Residential Finance<br />

2007-AB1 A2A 4,985% /2037 (3) 862.161 838.871 0,28