Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

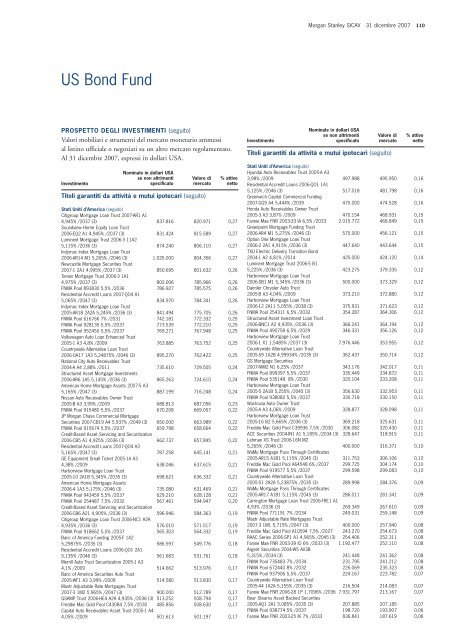

Morgan Stanley SICAV 31 dicembre 2007 110<br />

US Bond Fund<br />

PROSPETTO DEGLI INVESTIMENTI (seguito)<br />

Valori mobiliari e strumenti del mercato monetario ammessi<br />

al listino ufficiale o negoziati su un a<strong>lt</strong>ro mercato regolamentato.<br />

Al 31 dicembre 2007, espressi in dollari USA.<br />

Investimento<br />

Nominale in dollari USA<br />

se non a<strong>lt</strong>rimenti<br />

specificato<br />

Valore di<br />

mercato<br />

Titoli garantiti da attività e mutui ipotecari (seguito)<br />

% attivo<br />

netto<br />

Stati Uniti d’America (seguito)<br />

Citigroup Mortgage Loan Trust 2007-AR1 A1<br />

4,945% /2037 (3) 837.816 820.971 0,27<br />

Soundview Home Equity Loan Trust<br />

2006-EQ2 A1 4,945% /2037 (3) 831.424 815.589 0,27<br />

Luminent Mortgage Trust 2006-3 11A2<br />

5,115% /2036 (3) 874.240 806.110 0,27<br />

Indymac Index Mortgage Loan Trust<br />

2006-AR14 M1 5,265% /2046 (3) 1.025.000 804.356 0,27<br />

Newcastle Mortgage Securities Trust<br />

2007-1 2A1 4,995% /2037 (3) 850.695 801.632 0,26<br />

Terwin Mortgage Trust 2006-3 1A1<br />

4,975% /2037 (3) 802.006 785.966 0,26<br />

FNMA Pool 893830 5,5% /2036 786.927 785.575 0,26<br />

Residential Accredit Loans 2007-QO4 A1<br />

5,065% /2047 (3) 834.970 784.341 0,26<br />

Indymac Index Mortgage Loan Trust<br />

2005-AR18 2A2A 5,245% /2036 (3) 841.494 775.705 0,26<br />

FNMA Pool 616766 7% /2031 742.181 772.332 0,25<br />

FNMA Pool 928135 5,5% /2037 773.539 772.210 0,25<br />

FNMA Pool 952450 5,5% /2037 769.271 767.948 0,25<br />

Volkswagen Auto Loan Enhanced Trust<br />

2005-1 A3 4,8% /2009 763.885 763.752 0,25<br />

Countrywide A<strong>lt</strong>ernative Loan Trust<br />

2006-OA17 1A3 5,24875% /2046 (3) 895.270 762.422 0,25<br />

National City Auto Receivables Trust<br />

2004-A A4 2,88% /2011 735.610 729.505 0,24<br />

Structured Asset Mortgage Investments<br />

2006-AR6 1A5 5,145% /2036 (3) 865.263 724.610 0,24<br />

American Home Mortgage Assets 2007-5 A3<br />

5,165% /2047 (3) 887.199 716.248 0,24<br />

Nissan Auto Receivables Owner Trust<br />

2005-B A3 3,99% /2009 688.813 687.056 0,23<br />

FNMA Pool 915480 5,5% /2037 670.208 669.057 0,22<br />

JP Morgan Chase Commercial Mortgage<br />

Securities 2007-CB19 A4 5,937% /2049 (3) 650.000 663.989 0,22<br />

FNMA Pool 915674 5,5% /2037 659.798 658.664 0,22<br />

Credit-Based Asset Servicing and Securitization<br />

2006-CB5 A1 4,925% /2036 (3) 662.737 657.845 0,22<br />

Residential Accredit Loans 2007-QO4 A3<br />

5,165% /2047 (3) 787.258 645.141 0,21<br />

GE Equipment Small Ticket 2005-1A A3<br />

4,38% /2009 638.046 637.615 0,21<br />

Harborview Mortgage Loan Trust<br />

2005-10 2A1B 5,345% /2035 (3) 698.621 636.332 0,21<br />

American Home Mortgage Assets<br />

2006-4 1A3 5,175% /2046 (3) 735.080 631.469 0,21<br />

FNMA Pool 943459 5,5% /2037 629.210 628.128 0,21<br />

FNMA Pool 254487 7,5% /2032 567.461 594.947 0,20<br />

Credit-Based Asset Servicing and Securitization<br />

2006-CB6 A21 4,905% /2036 (3) 596.946 584.363 0,19<br />

Citigroup Mortgage Loan Trust 2006-NC1 A2A<br />

4,935% /2036 (3) 576.010 571.517 0,19<br />

FNMA Pool 918662 5,5% /2037 565.303 564.332 0,19<br />

Banc of America Funding 2005-F 1A2<br />

5,29875% /2035 (3) 586.597 549.776 0,18<br />

Residential Accredit Loans 2006-QO1 2A1<br />

5,135% /2046 (3) 561.683 531.761 0,18<br />

Merrill Auto Trust Securitization 2005-1 A3<br />

4,1% /2009 514.662 513.976 0,17<br />

Banc of America Securities Auto Trust<br />

2005-WF1 A3 3,99% /2009 514.580 513.830 0,17<br />

Mastr Adjustable Rate Mortgages Trust<br />

2007-3 1M2 5,965% /2047 (3) 900.000 512.789 0,17<br />

GSAMP Trust 2006-HE4 A2A 4,935% /2036 (3) 513.252 508.794 0,17<br />

Freddie Mac Gold Pool C43084 7,5% /2030 485.856 508.630 0,17<br />

Capital Auto Receivables Asset Trust 2005-1 A4<br />

4,05% /2009 501.613 501.197 0,17<br />

Investimento<br />

Nominale in dollari USA<br />

se non a<strong>lt</strong>rimenti<br />

specificato<br />

Valore di<br />

mercato<br />

Titoli garantiti da attività e mutui ipotecari (seguito)<br />

% attivo<br />

netto<br />

Stati Uniti d’America (seguito)<br />

Hyundai Auto Receivables Trust 2005-A A3<br />

3,98% /2009 497.988 495.950 0,16<br />

Residential Accredit Loans 2006-QO1 1A1<br />

5,125% /2046 (3) 517.018 481.798 0,16<br />

Greenwich Capital Commercial Funding<br />

2007-GG9 A4 5,444% /2039 475.000 474.528 0,16<br />

Honda Auto Receivables Owner Trust<br />

2005-3 A3 3,87% /2009 470.154 468.931 0,15<br />

Fannie Mae FNR 2003-33 IA 6,5% /2033 2.015.772 468.849 0,15<br />

Greenpoint Mortgage Funding Trust<br />

2006-AR4 M1 5,275% /2046 (3) 575.000 456.121 0,15<br />

Option One Mortgage Loan Trust<br />

2006-2 2A1 4,915% /2036 (3) 447.640 443.644 0,15<br />

TXU Electric Delivery Transition Bond<br />

2004-1 A2 4,81% /2014 425.000 424.120 0,14<br />

Luminent Mortgage Trust 2006-5 B1<br />

5,225% /2036 (3) 423.275 379.335 0,12<br />

Harborview Mortgage Loan Trust<br />

2006-SB1 M1 5,345% /2036 (3) 500.000 373.329 0,12<br />

Daimler Chrysler Auto Trust<br />

2005-B A3 4,04% /2009 373.210 372.880 0,12<br />

Harborview Mortgage Loan Trust<br />

2006-12 2A11 5,055% /2038 (3) 375.931 371.623 0,12<br />

FNMA Pool 254311 6,5% /2032 354.287 364.306 0,12<br />

Structured Asset Investment Loan Trust<br />

2006-BNC1 A2 4,935% /2036 (3) 366.241 364.194 0,12<br />

FNMA Pool 490758 6,5% /2029 346.331 356.126 0,12<br />

Harborview Mortgage Loan Trust<br />

2006-1 X1 1,5485% /2037 (3) 7.976.446 353.955 0,12<br />

Countrywide A<strong>lt</strong>ernative Loan Trust<br />

2005-59 1A2B 4,99934% /2035 (3) 362.437 350.714 0,12<br />

GS Mortgage Securities<br />

2007-NIM2 N1 6,25% /2037 343.176 342.017 0,11<br />

FNMA Pool 899397 5,5% /2037 335.449 334.872 0,11<br />

FNMA Pool 535148 8% /2030 320.104 333.208 0,11<br />

Harborview Mortgage Loan Trust<br />

2005-5 2A1B 5,255% /2045 (3) 356.630 332.953 0,11<br />

FNMA Pool 938082 5,5% /2037 330.718 330.150 0,11<br />

Wachovia Auto Owner Trust<br />

2005-A A3 4,06% /2009 328.877 328.098 0,11<br />

Harborview Mortgage Loan Trust<br />

2005-16 B2 5,665% /2036 (3) 369.218 325.631 0,11<br />

Freddie Mac Gold Pool C39936 7,5% /2030 306.082 320.430 0,11<br />

ACE Securities 2004-IN1 A1 5,185% /2034 (3) 328.647 318.915 0,11<br />

Lehman XS Trust 2006-16N M2<br />

5,265% /2046 (3) 400.000 316.371 0,10<br />

WaMu Mortgage Pass Through Certificates<br />

2005-AR15 A1B1 5,115% /2045 (3) 311.753 306.106 0,10<br />

Freddie Mac Gold Pool A64548 6% /2037 299.725 304.174 0,10<br />

FNMA Pool 919577 5,5% /2037 299.598 299.083 0,10<br />

Countrywide A<strong>lt</strong>ernative Loan Trust<br />

2005-51 2A2A 5,23875% /2035 (3) 289.998 284.376 0,09<br />

WaMu Mortgage Pass Through Certificates<br />

2005-AR17 A1B1 5,115% /2045 (3) 286.011 281.341 0,09<br />

Carrin<strong>gt</strong>on Mortgage Loan Trust 2006-FRE1 A1<br />

4,93% /2036 (3) 269.349 267.610 0,09<br />

FNMA Pool 771191 7% /2034 249.031 259.148 0,09<br />

Mastr Adjustable Rate Mortgages Trust<br />

2007-3 1M1 5,715% /2047 (3) 400.000 257.940 0,08<br />

Freddie Mac Gold Pool A10594 7,5% /2027 243.270 254.673 0,08<br />

RAAC Series 2006-SP1 A1 4,965% /2045 (3) 254.406 252.311 0,08<br />

Fannie Mae FNR 2003-39 IO 6% /2033 (3) 1.192.477 252.110 0,08<br />

Argent Securities 2004-W5 AV3B<br />

5,315% /2034 (3) 241.448 241.362 0,08<br />

FNMA Pool 735483 7% /2034 231.795 241.212 0,08<br />

FNMA Pool 672440 8% /2032 226.069 235.323 0,08<br />

FNMA Pool 937906 5,5% /2037 224.167 223.782 0,07<br />

Countrywide A<strong>lt</strong>ernative Loan Trust<br />

2005-44 1A2A 5,155% /2035 (3) 216.504 214.083 0,07<br />

Fannie Mae FNR 2006-28 1P 1,7096% /2036 7.931.797 213.167 0,07<br />

Bear Stearns Asset Backed Securities<br />

2005-AQ1 2A1 5,085% /2035 (3) 207.885 207.185 0,07<br />

FNMA Pool 938774 5% /2037 198.720 193.907 0,06<br />

Fannie Mae FNR 2003-25 IK 7% /2033 836.841 187.619 0,06