Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

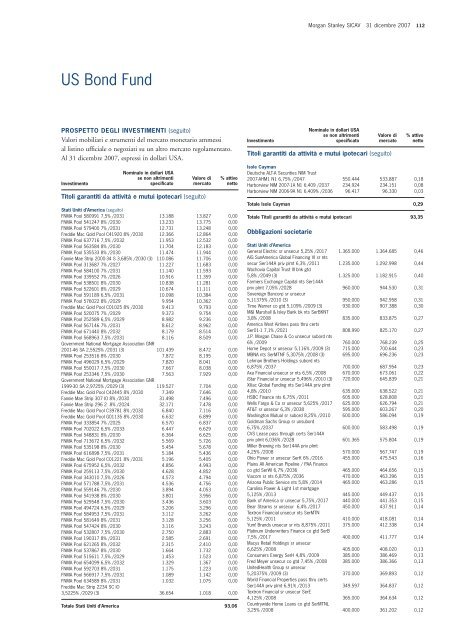

Morgan Stanley SICAV 31 dicembre 2007 112<br />

US Bond Fund<br />

PROSPETTO DEGLI INVESTIMENTI (seguito)<br />

Valori mobiliari e strumenti del mercato monetario ammessi<br />

al listino ufficiale o negoziati su un a<strong>lt</strong>ro mercato regolamentato.<br />

Al 31 dicembre 2007, espressi in dollari USA.<br />

Investimento<br />

Nominale in dollari USA<br />

se non a<strong>lt</strong>rimenti<br />

specificato<br />

Valore di<br />

mercato<br />

Titoli garantiti da attività e mutui ipotecari (seguito)<br />

% attivo<br />

netto<br />

Stati Uniti d’America (seguito)<br />

FNMA Pool 580991 7,5% /2031 13.188 13.827 0,00<br />

FNMA Pool 541247 8% /2030 13.233 13.775 0,00<br />

FNMA Pool 579400 7% /2031 12.731 13.248 0,00<br />

Freddie Mac Gold Pool C41920 8% /2030 12.366 12.864 0,00<br />

FNMA Pool 637716 7,5% /2032 11.953 12.532 0,00<br />

FNMA Pool 563584 8% /2030 11.704 12.183 0,00<br />

FNMA Pool 535533 8% /2030 11.474 11.944 0,00<br />

Fannie Mae Strip 2000-34 S 3,685% /2030 (3) 110.086 11.706 0,00<br />

FNMA Pool 313687 7% /2027 11.227 11.683 0,00<br />

FNMA Pool 584100 7% /2031 11.140 11.593 0,00<br />

FNMA Pool 339552 7% /2026 10.916 11.359 0,00<br />

FNMA Pool 538501 8% /2030 10.838 11.281 0,00<br />

FNMA Pool 522601 8% /2029 10.674 11.111 0,00<br />

FNMA Pool 591189 6,5% /2031 10.098 10.384 0,00<br />

FNMA Pool 576022 8% /2029 9.954 10.362 0,00<br />

Freddie Mac Gold Pool C01025 8% /2030 9.413 9.793 0,00<br />

FNMA Pool 520075 7% /2029 9.373 9.754 0,00<br />

FNMA Pool 252589 6,5% /2029 8.982 9.236 0,00<br />

FNMA Pool 567146 7% /2031 8.612 8.962 0,00<br />

FNMA Pool 671440 8% /2032 8.179 8.514 0,00<br />

FNMA Pool 568963 7,5% /2031 8.116 8.509 0,00<br />

Government National Mortgage Association GNR<br />

2001-46 SA 2,5525% /2031 (3) 101.439 8.472 0,00<br />

FNMA Pool 253516 8% /2030 7.872 8.195 0,00<br />

FNMA Pool 496029 6,5% /2029 7.820 8.041 0,00<br />

FNMA Pool 550017 7,5% /2030 7.667 8.038 0,00<br />

FNMA Pool 253346 7,5% /2030 7.563 7.929 0,00<br />

Government National Mortgage Association GNR<br />

1999-30 SA 2,9725% /2029 (3) 119.527 7.704 0,00<br />

Freddie Mac Gold Pool C42445 8% /2030 7.349 7.646 0,00<br />

Fannie Mae Strip 307 IO 8% /2030 31.498 7.496 0,00<br />

Fannie Mae Strip 296 2 8% /2024 32.171 7.478 0,00<br />

Freddie Mac Gold Pool C39781 8% /2030 6.840 7.116 0,00<br />

Freddie Mac Gold Pool G01135 8% /2030 6.632 6.899 0,00<br />

FNMA Pool 333854 7% /2025 6.570 6.837 0,00<br />

FNMA Pool 702022 6,5% /2033 6.447 6.629 0,00<br />

FNMA Pool 548831 8% /2030 6.364 6.625 0,00<br />

FNMA Pool 713672 6,5% /2032 5.569 5.726 0,00<br />

FNMA Pool 535198 8% /2030 5.454 5.678 0,00<br />

FNMA Pool 616898 7,5% /2031 5.184 5.436 0,00<br />

Freddie Mac Gold Pool C01221 8% /2031 5.196 5.405 0,00<br />

FNMA Pool 675952 6,5% /2032 4.856 4.993 0,00<br />

FNMA Pool 259113 7,5% /2030 4.628 4.852 0,00<br />

FNMA Pool 343010 7,5% /2026 4.573 4.794 0,00<br />

FNMA Pool 571788 7,5% /2031 4.536 4.756 0,00<br />

FNMA Pool 559146 7% /2030 3.894 4.053 0,00<br />

FNMA Pool 541938 8% /2030 3.801 3.956 0,00<br />

FNMA Pool 529548 7,5% /2030 3.436 3.603 0,00<br />

FNMA Pool 494724 6,5% /2029 3.206 3.296 0,00<br />

FNMA Pool 584953 7,5% /2031 3.112 3.262 0,00<br />

FNMA Pool 581649 8% /2031 3.128 3.256 0,00<br />

FNMA Pool 547424 8% /2030 3.116 3.243 0,00<br />

FNMA Pool 532807 7,5% /2030 2.750 2.883 0,00<br />

FNMA Pool 190317 8% /2031 2.585 2.691 0,00<br />

FNMA Pool 621265 8% /2032 2.315 2.410 0,00<br />

FNMA Pool 537867 8% /2030 1.664 1.732 0,00<br />

FNMA Pool 515611 7,5% /2029 1.453 1.523 0,00<br />

FNMA Pool 654099 6,5% /2032 1.329 1.367 0,00<br />

FNMA Pool 592703 8% /2031 1.175 1.223 0,00<br />

FNMA Pool 566917 7,5% /2031 1.089 1.142 0,00<br />

FNMA Pool 634589 8% /2031 1.032 1.075 0,00<br />

Freddie Mac Strip 2234 SC IO<br />

3,5225% /2029 (3) 36.654 1.018 0,00<br />

Totale Stati Uniti d’America 93,06<br />

Investimento<br />

Titoli garantiti da attività e mutui ipotecari (seguito)<br />

Isole Cayman<br />

Deutsche ALT-A Securities NIM Trust<br />

2007-AHM1 N1 6,75% /2047 550.444 533.887 0,18<br />

Harborview NIM 2007-1A N1 6,409 /2037 234.924 234.151 0,08<br />

Harborview NIM 2006-9A N1 6,409% /2036 96.417 96.330 0,03<br />

Totale Isole Cayman 0,29<br />

Totale Titoli garantiti da attività e mutui ipotecari 93,35<br />

Obbligazioni societarie<br />

Nominale in dollari USA<br />

se non a<strong>lt</strong>rimenti<br />

specificato<br />

Valore di<br />

mercato<br />

% attivo<br />

netto<br />

Stati Uniti d’America<br />

General Electric sr unsecur 5,25% /2017 1.365.000 1.364.685 0,46<br />

AIG SunAmerica Global Financing VI sr nts<br />

secur Ser144A priv plmt 6,3% /2011 1.235.000 1.292.998 0,44<br />

Wachovia Capital Trust III bnk <strong>gt</strong>d<br />

5,8% /2049 (3) 1.325.000 1.182.915 0,40<br />

Farmers Exchange Capital nts Ser144A<br />

priv plmt 7,05% /2028 960.000 944.530 0,31<br />

Sovereign Bancorp sr unsecur<br />

5,11375% /2010 (3) 950.000 942.958 0,31<br />

Time Warner co <strong>gt</strong>d 5,109% /2009 (3) 930.000 907.388 0,30<br />

M&I Marshall & Isley Bank bk nts SerBKNT<br />

3,8% /2008 835.000 833.875 0,27<br />

America West Airlines pass thru certs<br />

Ser01-1 7,1% /2021 808.990 825.170 0,27<br />

J.P. Morgan Chase & Co unsecur subord nts<br />

6% /2009 760.000 768.239 0,25<br />

Home Depot sr unsecur 5,116% /2009 (3) 715.000 700.644 0,23<br />

MBNA nts SerMTNF 5,3075% /2008 (3) 695.000 696.236 0,23<br />

Lehman Brothers Holdings subord nts<br />

6,875% /2037 700.000 687.954 0,23<br />

Axa Financial unsecur sr nts 6,5% /2008 670.000 673.061 0,22<br />

iStar Financial sr unsecur 5,496% /2010 (3) 720.000 645.839 0,21<br />

Xlliac Global Funding nts Ser144A priv plmt<br />

4,8% /2010 635.000 638.522 0,21<br />

HSBC Finance nts 6,75% /2011 605.000 628.808 0,21<br />

Wells Fargo & Co sr unsecur 5,625% /2017 625.000 626.794 0,21<br />

AT&T sr unsecur 6,3% /2038 595.000 603.267 0,20<br />

Washin<strong>gt</strong>on Mutual sr subord 8,25% /2010 600.000 586.094 0,19<br />

Goldman Sachs Group sr unsubord<br />

6,75% /2037 600.000 583.498 0,19<br />

CVS Lease pass through certs Ser144A<br />

priv plmt 6,036% /2028 601.365 575.804 0,19<br />

Miller Brewing nts Ser144A priv plmt<br />

4,25% /2008 570.000 567.747 0,19<br />

Ohio Power sr unsecur SerK 6% /2016 455.000 475.543 0,16<br />

Plains All American Pipeline / PAA Finance<br />

co <strong>gt</strong>d SerWI 6,7% /2036 465.000 464.656 0,15<br />

Viacom sr nts 6,875% /2036 470.000 463.396 0,15<br />

Arizona Public Service nts 5,8% /2014 465.000 463.286 0,15<br />

Carolina Power & Light 1st mortgage<br />

5,125% /2013 445.000 449.437 0,15<br />

Bank of America sr unsecur 5,75% /2017 440.000 441.353 0,15<br />

Bear Stearns sr unsecur 6,4% /2017 450.000 437.911 0,14<br />

Textron Financial unsecur nts SerMTN<br />

5,125% /2011 410.000 418.081 0,14<br />

Yum! Brands unsecur sr nts 8,875% /2011 375.000 412.338 0,14<br />

Platinum Underwriters Finance co <strong>gt</strong>d SerB<br />

7,5% /2017 400.000 411.777 0,14<br />

Macys Retail Holdings sr unsecur<br />

6,625% /2008 405.000 408.020 0,13<br />

Consumers Energy SerH 4,8% /2009 385.000 386.469 0,13<br />

Fred Meyer unsecur co <strong>gt</strong>d 7,45% /2008 385.000 386.366 0,13<br />

UnitedHea<strong>lt</strong>h Group sr unsecur<br />

5,20375% /2009 (3) 370.000 369.893 0,12<br />

World Financial Properties pass thru certs<br />

Ser144A priv plmt 6,91% /2013 349.597 364.837 0,12<br />

Textron Financial sr unsecur SerE<br />

4,125% /2008 365.000 364.634 0,12<br />

Countrywide Home Loans co <strong>gt</strong>d SerMTNL<br />

3,25% /2008 400.000 361.202 0,12