Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

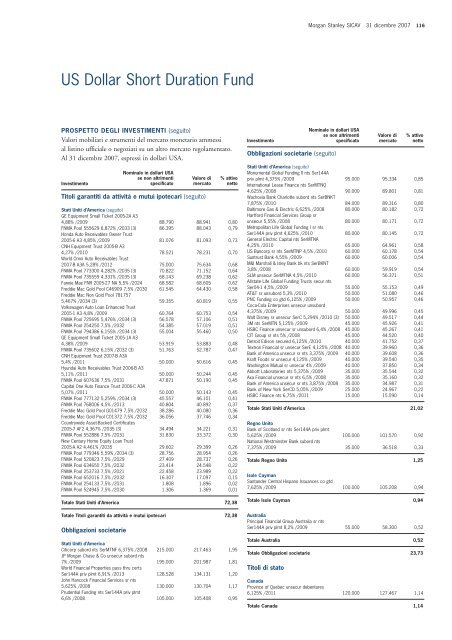

Morgan Stanley SICAV 31 dicembre 2007 116<br />

US Dollar Short Duration Fund<br />

PROSPETTO DEGLI INVESTIMENTI (seguito)<br />

Valori mobiliari e strumenti del mercato monetario ammessi<br />

al listino ufficiale o negoziati su un a<strong>lt</strong>ro mercato regolamentato.<br />

Al 31 dicembre 2007, espressi in dollari USA.<br />

Investimento<br />

Titoli garantiti da attività e mutui ipotecari (seguito)<br />

Stati Uniti d’America (seguito)<br />

GE Equipment Small Ticket 2005-2A A3<br />

4,88% /2009 88.790 88.941 0,80<br />

FNMA Pool 555629 6,872% /2033 (3) 86.395 88.043 0,79<br />

Honda Auto Receivables Owner Trust<br />

2005-6 A3 4,85% /2009 81.076 81.093 0,73<br />

CNH Equipment Trust 2005-B A3<br />

4,27% /2010 78.521 78.231 0,70<br />

World Omni Auto Receivables Trust<br />

2007-B A3A 5,28% /2012 75.000 75.634 0,68<br />

FNMA Pool 773300 4,282% /2035 (3) 70.822 71.152 0,64<br />

FNMA Pool 735559 4,331% /2035 (3) 68.143 69.238 0,62<br />

Fannie Mae FNR 2005-27 NA 5,5% /2024 68.582 68.605 0,62<br />

Freddie Mac Gold Pool C46909 7,5% /2030 61.545 64.430 0,58<br />

Freddie Mac Non Gold Pool 781757<br />

5,467% /2034 (3) 59.355 60.819 0,55<br />

Volkswagen Auto Loan Enhanced Trust<br />

2005-1 A3 4,8% /2009 60.764 60.753 0,54<br />

FNMA Pool 725695 5,476% /2034 (3) 56.578 57.106 0,51<br />

FNMA Pool 254250 7,5% /2032 54.385 57.019 0,51<br />

FNMA Pool 794386 6,155% /2034 (3) 55.004 55.460 0,50<br />

GE Equipment Small Ticket 2005-1A A3<br />

4,38% /2009 53.919 53.883 0,48<br />

FNMA Pool 735602 6,15% /2032 (3) 51.763 52.787 0,47<br />

CNH Equipment Trust 2007-B A3A<br />

5,4% /2011 50.000 50.616 0,45<br />

Hyundai Auto Receivables Trust 2006-B A3<br />

5,11% /2011 50.000 50.244 0,45<br />

FNMA Pool 607636 7,5% /2031 47.871 50.190 0,45<br />

Capital One Auto Finance Trust 2006-C A3A<br />

5,07% /2011 50.000 50.143 0,45<br />

FNMA Pool 777132 5,259% /2034 (3) 45.557 46.101 0,41<br />

FNMA Pool 768006 4,5% /2013 40.804 40.892 0,37<br />

Freddie Mac Gold Pool G01479 7,5% /2032 38.286 40.080 0,36<br />

Freddie Mac Gold Pool C01372 7,5% /2032 36.056 37.746 0,34<br />

Countrywide Asset-Backed Certificates<br />

2005-7 AF2 4,367% /2035 (3) 34.494 34.221 0,31<br />

FNMA Pool 552886 7,5% /2031 31.830 33.372 0,30<br />

New Century Home Equity Loan Trust<br />

2005-A A2 4,461% /2035 29.602 29.399 0,26<br />

FNMA Pool 779346 5,59% /2034 (3) 28.756 28.954 0,26<br />

FNMA Pool 520823 7,5% /2029 27.409 28.737 0,26<br />

FNMA Pool 634650 7,5% /2032 23.414 24.548 0,22<br />

FNMA Pool 253733 7,5% /2021 22.458 23.989 0,22<br />

FNMA Pool 652016 7,5% /2032 16.307 17.097 0,15<br />

FNMA Pool 254133 7,5% /2031 1.808 1.896 0,02<br />

FNMA Pool 524945 7,5% /2030 1.306 1.369 0,01<br />

Totale Stati Uniti d’America 72,38<br />

Totale Titoli garantiti da attività e mutui ipotecari 72,38<br />

Obbligazioni societarie<br />

Nominale in dollari USA<br />

se non a<strong>lt</strong>rimenti<br />

specificato<br />

Valore di<br />

mercato<br />

% attivo<br />

netto<br />

Stati Uniti d’America<br />

Citicorp subord nts SerMTNF 6,375% /2008 215.000 217.463 1,95<br />

JP Morgan Chase & Co unsecur subord nts<br />

7% /2009 195.000 201.987 1,81<br />

World Financial Properties pass thru certs<br />

Ser144A priv plmt 6,91% /2013 128.528 134.131 1,20<br />

John Hancock Financial Services sr nts<br />

5,625% /2008 130.000 130.704 1,17<br />

Prudential Funding nts Ser144A priv plmt<br />

6,6% /2008 105.000 105.408 0,95<br />

Investimento<br />

Obbligazioni societarie (seguito)<br />

Stati Uniti d’America (seguito)<br />

Monumental Global Funding II nts Ser144A<br />

priv plmt 4,375% /2009 95.000 95.334 0,85<br />

International Lease Finance nts SerMTNQ<br />

4,625% /2008 90.000 89.801 0,81<br />

Wachovia Bank Charlotte subord nts SerBNKT<br />

7,875% /2010 84.000 89.316 0,80<br />

Ba<strong>lt</strong>imore Gas & Electric 6,625% /2008 80.000 80.182 0,72<br />

Hartford Financial Services Group sr<br />

unsecur 5,55% /2008 80.000 80.171 0,72<br />

Metropolitan Life Global Funding I sr nts<br />

Ser144A priv plmt 4,625% /2010 80.000 80.145 0,72<br />

General Electric Capital nts SerMTNA<br />

4,25% /2010 65.000 64.961 0,58<br />

US Bancorp sr nts SerMTNP 4,5% /2010 60.000 60.178 0,54<br />

Suntrust Bank 4,55% /2009 60.000 60.006 0,54<br />

M&I Marshall & Isley Bank bk nts SerBKNT<br />

3,8% /2008 60.000 59.919 0,54<br />

SLM unsecur SerMTNA 4,5% /2010 60.000 56.371 0,51<br />

Allstate Life Global Funding Trusts secur nts<br />

Ser04-1 4,5% /2009 55.000 55.153 0,49<br />

AT&T sr unsubord 5,3% /2010 50.000 51.080 0,46<br />

PNC Funding co <strong>gt</strong>d 6,125% /2009 50.000 50.957 0,46<br />

Coca-Cola Enterprises unsecur unsubord<br />

4,375% /2009 50.000 49.996 0,45<br />

Wa<strong>lt</strong> Disney sr unsecur SerC 5,294% /2010 (3) 50.000 49.517 0,44<br />

3M nts SerMTN 5,125% /2009 45.000 45.926 0,41<br />

HSBC Finance unsecur sr unsubord 6,4% /2008 45.000 45.267 0,41<br />

CIT Group sr nts 5% /2008 45.000 44.520 0,40<br />

Detroit Edison secured 6,125% /2010 40.000 41.752 0,37<br />

Textron Financial sr unsecur SerE 4,125% /2008 40.000 39.960 0,36<br />

Bank of America unsecur sr nts 3,375% /2009 40.000 39.608 0,36<br />

Kraft Foods sr unsecur 4,125% /2009 40.000 39.540 0,35<br />

Washin<strong>gt</strong>on Mutual sr unsecur 4% /2009 40.000 37.850 0,34<br />

Abbott Laboratories nts 5,375% /2009 35.000 35.544 0,32<br />

Axa Financial unsecur sr nts 6,5% /2008 35.000 35.160 0,32<br />

Bank of America unsecur sr nts 3,875% /2008 35.000 34.987 0,31<br />

Bank of New York SerCD 5,05% /2009 25.000 24.967 0,22<br />

HSBC Finance nts 6,75% /2011 15.000 15.590 0,14<br />

Totale Stati Uniti d’America 21,02<br />

Regno Unito<br />

Bank of Scotland sr nts Ser144A priv plmt<br />

5,625% /2009 100.000 101.570 0,92<br />

National Westminster Bank subord nts<br />

7,375% /2009 35.000 36.518 0,33<br />

Totale Regno Unito 1,25<br />

Isole Cayman<br />

Santander Central Hispano Issuances co <strong>gt</strong>d<br />

7,625% /2009 100.000 105.208 0,94<br />

Totale Isole Cayman 0,94<br />

Australia<br />

Principal Financial Group Australia sr nts<br />

Ser144A priv plmt 8,2% /2009 55.000 58.300 0,52<br />

Totale Australia 0,52<br />

Totale Obbligazioni societarie 23,73<br />

Titoli di stato<br />

Nominale in dollari USA<br />

se non a<strong>lt</strong>rimenti<br />

specificato<br />

Valore di<br />

mercato<br />

% attivo<br />

netto<br />

Canada<br />

Province of Quebec unsecur debentures<br />

6,125% /2011 120.000 127.467 1,14<br />

Totale Canada 1,14