You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

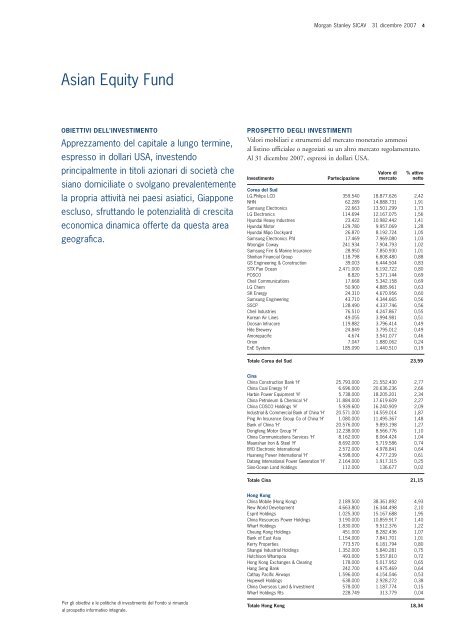

Morgan Stanley SICAV 31 dicembre 2007 4<br />

Asian Equity Fund<br />

OBIETTIVI DELL’INVESTIMENTO<br />

Apprezzamento del capitale a lungo termine,<br />

espresso in dollari USA, investendo<br />

principalmente in titoli azionari di società che<br />

siano domiciliate o svolgano prevalentemente<br />

la propria attività nei paesi asiatici, Giappone<br />

escluso, sfruttando le potenzialità di crescita<br />

economica dinamica offerte da questa area<br />

geografica.<br />

PROSPETTO DEGLI INVESTIMENTI<br />

Valori mobiliari e strumenti del mercato monetario ammessi<br />

al listino ufficialee o negoziati su un a<strong>lt</strong>ro mercato regolamentato.<br />

Al 31 dicembre 2007, espressi in dollari USA.<br />

Investimento<br />

Partecipazione<br />

Valore di<br />

mercato<br />

% attivo<br />

netto<br />

Corea del Sud<br />

LG.Philips LCD 359.540 18.877.626 2,42<br />

NHN 62.289 14.888.731 1,91<br />

Samsung Electronics 22.663 13.501.299 1,73<br />

LG Electronics 114.694 12.167.075 1,56<br />

Hyundai Heavy Industries 23.422 10.982.442 1,41<br />

Hyundai Motor 129.780 9.957.069 1,28<br />

Hyundai Mipo Dockyard 26.870 8.192.724 1,05<br />

Samsung Electronics Pfd 17.469 7.969.080 1,03<br />

Woongjin Coway 241.934 7.904.793 1,02<br />

Samsung Fire & Marine Insurance 28.950 7.850.930 1,01<br />

Shinhan Financial Group 118.798 6.808.480 0,88<br />

GS Engineering & Construction 39.003 6.444.504 0,83<br />

STX Pan Ocean 2.471.000 6.192.722 0,80<br />

POSCO 8.820 5.371.144 0,69<br />

Cheil Communications 17.668 5.342.158 0,69<br />

LG Chem 50.900 4.885.961 0,63<br />

SK Energy 24.310 4.670.956 0,60<br />

Samsung Engineering 43.710 4.344.665 0,56<br />

SSCP 128.490 4.337.746 0,56<br />

Cheil Industries 76.510 4.247.867 0,55<br />

Korean Air Lines 49.055 3.994.981 0,51<br />

Doosan Infracore 119.882 3.796.414 0,49<br />

Hite Brewery 24.849 3.795.012 0,49<br />

Amorepacific 4.674 3.541.077 0,46<br />

Orion 7.047 1.880.062 0,24<br />

EnE System 185.090 1.440.510 0,19<br />

Totale Corea del Sud 23,59<br />

Cina<br />

China Construction Bank ‘H’ 25.793.000 21.552.430 2,77<br />

China Coal Energy ‘H’ 6.696.000 20.636.236 2,66<br />

Harbin Power Equipment ‘H’ 5.738.000 18.205.201 2,34<br />

China Petroleum & Chemical ‘H’ 11.884.000 17.619.609 2,27<br />

China COSCO Holdings ‘H’ 5.939.600 16.240.909 2,09<br />

Industrial & Commercial Bank of China ‘H’ 20.571.000 14.559.014 1,87<br />

Ping An Insurance Group Co of China ‘H’ 1.080.000 11.495.367 1,48<br />

Bank of China ‘H’ 20.576.000 9.893.198 1,27<br />

Dongfeng Motor Group ‘H’ 12.238.000 8.566.776 1,10<br />

China Communications Services ‘H’ 8.162.000 8.064.424 1,04<br />

Maanshan Iron & Steel ‘H’ 8.692.000 5.719.586 0,74<br />

BYD Electronic International 2.572.000 4.978.841 0,64<br />

Huaneng Power International ‘H’ 4.598.000 4.777.239 0,61<br />

Datang International Power Generation ‘H’ 2.164.000 1.917.315 0,25<br />

Sino-Ocean Land Holdings 112.000 136.677 0,02<br />

Totale Cina 21,15<br />

Hong Kong<br />

China Mobile (Hong Kong) 2.189.500 38.361.892 4,93<br />

New World Development 4.663.800 16.344.498 2,10<br />

Esprit Holdings 1.025.300 15.167.688 1,95<br />

China Resources Power Holdings 3.190.000 10.859.917 1,40<br />

Wharf Holdings 1.830.000 9.512.376 1,22<br />

Cheung Kong Holdings 451.000 8.282.436 1,07<br />

Bank of East Asia 1.154.000 7.841.701 1,01<br />

Kerry Properties 773.570 6.181.794 0,80<br />

Shangai Industrial Holdings 1.352.000 5.840.281 0,75<br />

Hutchison Whampoa 493.000 5.557.810 0,72<br />

Hong Kong Exchanges & Clearing 178.000 5.017.952 0,65<br />

Hang Seng Bank 242.700 4.975.469 0,64<br />

Cathay Pacific Airways 1.596.000 4.154.546 0,53<br />

Hopewell Holdings 638.000 2.928.272 0,38<br />

China Overseas Land & Investment 578.000 1.187.774 0,15<br />

Wharf Holdings Rts 228.749 313.779 0,04<br />

Per gli obiettivi e le politiche di investimento del Fondo si rimanda<br />

al prospetto informativo integrale.<br />

Totale Hong Kong 18,34