- Page 1:

Public Disclosure Authorized Public

- Page 5 and 6:

International Trade in Services New

- Page 7 and 8:

CONTENTS About the Editors and Cont

- Page 9 and 10:

Contents vii Boxes 2.1 Extent of Te

- Page 11 and 12:

Contents ix 1.4 Worker Remittances

- Page 13:

Contents xi 6.6 A Checklist of Ques

- Page 16 and 17:

xiv About the Editors and Contribut

- Page 18 and 19:

xvi Foreword Beyond describing the

- Page 20 and 21:

xviii Acknowledgments Finally, this

- Page 23 and 24:

1 Assessing the Potential of Servic

- Page 25 and 26:

Assessing the Potential of Services

- Page 27 and 28:

Assessing the Potential of Services

- Page 29 and 30:

Assessing the Potential of Services

- Page 31 and 32:

Assessing the Potential of Services

- Page 33 and 34:

Assessing the Potential of Services

- Page 35 and 36:

Assessing the Potential of Services

- Page 37 and 38:

Assessing the Potential of Services

- Page 39 and 40:

Assessing the Potential of Services

- Page 41 and 42:

Assessing the Potential of Services

- Page 43 and 44:

Assessing the Potential of Services

- Page 45 and 46:

Assessing the Potential of Services

- Page 47 and 48:

Assessing the Potential of Services

- Page 49 and 50:

Assessing the Potential of Services

- Page 51 and 52:

2 Increasing Labor Mobility: Option

- Page 53 and 54:

Increasing Labor Mobility 31 unders

- Page 55 and 56:

Table 2.2. Quantitative Estimates o

- Page 57 and 58:

Borjas, George “Heaven’s Doors:

- Page 59 and 60:

Increasing Labor Mobility 37 contri

- Page 61 and 62:

Increasing Labor Mobility 39 must h

- Page 63 and 64:

Worker categories covered Specifica

- Page 65 and 66:

Provisions on professionals Annex o

- Page 67 and 68:

Increasing Labor Mobility 45 The EU

- Page 69 and 70:

Provisions on professionals Annex o

- Page 71 and 72:

Provisions on professionals Annex o

- Page 73 and 74:

Table 2.7. Agreements between Austr

- Page 75 and 76:

Specified quotas n.a. Entry subject

- Page 77 and 78:

Increasing Labor Mobility 55 Figure

- Page 79 and 80:

Increasing Labor Mobility 57 Bilate

- Page 81 and 82:

Increasing Labor Mobility 59 Jamaic

- Page 83 and 84:

Increasing Labor Mobility 61 factor

- Page 85 and 86:

Increasing Labor Mobility 63 indivi

- Page 87 and 88:

Increasing Labor Mobility 65 that a

- Page 89 and 90:

3 Legal Services: Does More Trade R

- Page 91 and 92:

Legal Services: Does More Trade Rhy

- Page 93 and 94:

Legal Services: Does More Trade Rhy

- Page 95 and 96:

Legal Services: Does More Trade Rhy

- Page 97 and 98:

Table 3.3. Trade in Legal Services:

- Page 99 and 100:

Legal Services: Does More Trade Rhy

- Page 101 and 102:

Legal Services: Does More Trade Rhy

- Page 103 and 104:

Legal Services: Does More Trade Rhy

- Page 105 and 106:

Legal Services: Does More Trade Rhy

- Page 107 and 108:

Legal Services: Does More Trade Rhy

- Page 109 and 110:

Legal Services: Does More Trade Rhy

- Page 111 and 112:

Legal Services: Does More Trade Rhy

- Page 113 and 114:

Table 3.8. Uruguay Round Commitment

- Page 115 and 116:

Legal Services: Does More Trade Rhy

- Page 117 and 118:

Legal Services: Does More Trade Rhy

- Page 119:

Legal Services: Does More Trade Rhy

- Page 122 and 123:

100 International Trade in Services

- Page 124 and 125:

102 International Trade in Services

- Page 126 and 127:

104 International Trade in Services

- Page 128 and 129:

106 International Trade in Services

- Page 130 and 131:

108 International Trade in Services

- Page 132 and 133:

110 International Trade in Services

- Page 134 and 135:

112 International Trade in Services

- Page 136 and 137:

114 International Trade in Services

- Page 138 and 139:

116 International Trade in Services

- Page 140 and 141:

118 International Trade in Services

- Page 142 and 143:

120 International Trade in Services

- Page 144 and 145:

122 International Trade in Services

- Page 146 and 147:

124 International Trade in Services

- Page 148 and 149:

126 International Trade in Services

- Page 150 and 151:

128 International Trade in Services

- Page 152 and 153:

130 International Trade in Services

- Page 154 and 155:

132 International Trade in Services

- Page 156 and 157:

134 International Trade in Services

- Page 158 and 159: 136 International Trade in Services

- Page 160 and 161: 138 International Trade in Services

- Page 162 and 163: 140 International Trade in Services

- Page 164 and 165: 142 International Trade in Services

- Page 166 and 167: 144 International Trade in Services

- Page 168 and 169: 146 International Trade in Services

- Page 170 and 171: 148 International Trade in Services

- Page 172 and 173: 150 International Trade in Services

- Page 174 and 175: 152 International Trade in Services

- Page 176 and 177: 154 International Trade in Services

- Page 178 and 179: 156 International Trade in Services

- Page 180 and 181: 158 International Trade in Services

- Page 182 and 183: 160 International Trade in Services

- Page 184 and 185: 162 International Trade in Services

- Page 186 and 187: 164 International Trade in Services

- Page 188 and 189: 166 International Trade in Services

- Page 190 and 191: 168 International Trade in Services

- Page 192 and 193: 170 International Trade in Services

- Page 194 and 195: 172 International Trade in Services

- Page 196 and 197: 174 International Trade in Services

- Page 198 and 199: 176 International Trade in Services

- Page 200 and 201: 178 International Trade in Services

- Page 202 and 203: 180 International Trade in Services

- Page 204 and 205: 182 International Trade in Services

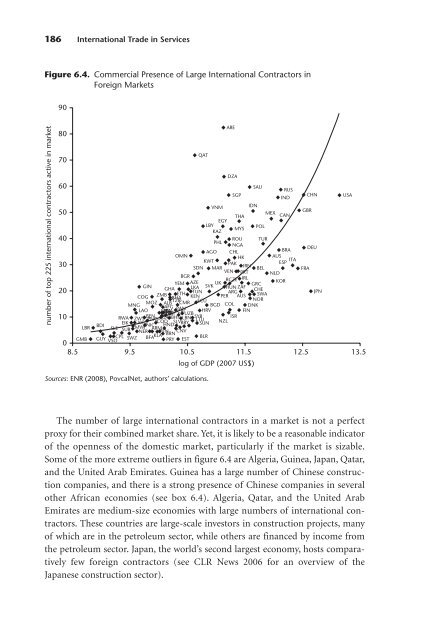

- Page 206 and 207: 184 International Trade in Services

- Page 210 and 211: 188 International Trade in Services

- Page 212 and 213: Figure 6.6. Number of Days Required

- Page 214 and 215: 192 International Trade in Services

- Page 216 and 217: 194 International Trade in Services

- Page 218 and 219: 196 International Trade in Services

- Page 220 and 221: 198 International Trade in Services

- Page 222 and 223: 200 International Trade in Services

- Page 224 and 225: 202 International Trade in Services

- Page 226 and 227: 204 International Trade in Services

- Page 228 and 229: 206 International Trade in Services

- Page 230 and 231: 208 International Trade in Services

- Page 232 and 233: 210 International Trade in Services

- Page 234 and 235: 212 International Trade in Services

- Page 236 and 237: 214 International Trade in Services

- Page 238 and 239: 216 International Trade in Services

- Page 241 and 242: 7 Exporting Information Technology

- Page 243 and 244: Exporting Information Technology Se

- Page 245 and 246: Table 7.1. Major Exporters and Impo

- Page 247 and 248: Exporting Information Technology Se

- Page 249 and 250: Exporting Information Technology Se

- Page 251 and 252: Exporting Information Technology Se

- Page 253 and 254: Table 7.3. Information and Communic

- Page 255 and 256: Exporting Information Technology Se

- Page 257 and 258: Exporting Information Technology Se

- Page 259 and 260:

Exporting Information Technology Se

- Page 261 and 262:

Exporting Information Technology Se

- Page 263 and 264:

Exporting Information Technology Se

- Page 265 and 266:

Exporting Information Technology Se

- Page 267 and 268:

Exporting Information Technology Se

- Page 269 and 270:

Exporting Information Technology Se

- Page 271 and 272:

Exporting Information Technology Se

- Page 273 and 274:

Exporting Information Technology Se

- Page 275 and 276:

Brunei Darussalam 48.2 2.9 2,954 66

- Page 277 and 278:

Honduras 6.0 — 4,081 10.1 3.3 —

- Page 279 and 280:

Norway 85.0 30.6 31,726 82.0 78.0 5

- Page 281 and 282:

Uganda 3.6 — 306 5.1 — 170.0 41

- Page 283 and 284:

Exporting Information Technology Se

- Page 285 and 286:

8 Accounting Services: Ensuring Goo

- Page 287 and 288:

Accounting Services 265 exceeding 5

- Page 289 and 290:

Accounting Services 267 Links to la

- Page 291 and 292:

Accounting Services 269 The account

- Page 293 and 294:

Accounting Services 271 Box 8.3: Ex

- Page 295 and 296:

Accounting Services 273 service mar

- Page 297 and 298:

Accounting Services 275 Table 8.5.

- Page 299 and 300:

Accounting Services 277 Box 8.6: Re

- Page 301 and 302:

Accounting Services 279 Box 8.7: An

- Page 303 and 304:

Accounting Services 281 Table 8.6.

- Page 305 and 306:

Accounting Services 283 Restriction

- Page 307 and 308:

Accounting Services 285 Commercial

- Page 309 and 310:

Accounting Services 287 Colleges of

- Page 311 and 312:

Accounting Services 289 Administrat

- Page 313:

Accounting Services 291 IESBA (Inte

- Page 316 and 317:

294 International Trade in Services

- Page 318 and 319:

296 International Trade in Services

- Page 320 and 321:

298 International Trade in Services

- Page 322 and 323:

300 International Trade in Services

- Page 324 and 325:

302 International Trade in Services

- Page 326 and 327:

304 International Trade in Services

- Page 328 and 329:

306 International Trade in Services

- Page 330 and 331:

308 International Trade in Services

- Page 332 and 333:

310 International Trade in Services

- Page 334 and 335:

312 International Trade in Services

- Page 336 and 337:

314 International Trade in Services

- Page 338 and 339:

316 International Trade in Services

- Page 340 and 341:

318 International Trade in Services

- Page 342 and 343:

320 International Trade in Services

- Page 344 and 345:

322 International Trade in Services

- Page 346 and 347:

324 International Trade in Services

- Page 348 and 349:

326 International Trade in Services

- Page 350 and 351:

328 International Trade in Services

- Page 352 and 353:

330 International Trade in Services

- Page 354 and 355:

332 International Trade in Services

- Page 356 and 357:

334 International Trade in Services

- Page 358 and 359:

336 International Trade in Services

- Page 360 and 361:

338 International Trade in Services

- Page 362 and 363:

340 International Trade in Services

- Page 364 and 365:

342 International Trade in Services

- Page 366 and 367:

344 International Trade in Services

- Page 368 and 369:

346 International Trade in Services

- Page 370 and 371:

348 International Trade in Services

- Page 372 and 373:

350 Index Association of Certified

- Page 374 and 375:

352 Index Convention on Combating B

- Page 376 and 377:

354 Index Former Yugoslav Republic

- Page 378 and 379:

356 Index International Public Sect

- Page 380 and 381:

358 Index migrants. See labor mobil

- Page 382 and 383:

360 Index public-private partnershi

- Page 384 and 385:

362 Index Thailand construction ser

- Page 386:

ECO-AUDIT Environmental Benefits St