statistique, théorie et gestion de portefeuille - Docs at ISFA

statistique, théorie et gestion de portefeuille - Docs at ISFA

statistique, théorie et gestion de portefeuille - Docs at ISFA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A Corcos <strong>et</strong> al Q UANTITATIVE F INANCE<br />

all the fits (except for the largest interval p − 1/2 < 0.2,<br />

for which pc = 0.8). In sum, the procedure (18) and its<br />

results show th<strong>at</strong> the effective power-law represent<strong>at</strong>ion (16) is<br />

a crossover phenomenon: it is not domin<strong>at</strong>ed by the ‘critical’<br />

value ρhb = ρbh of the jump of the map obtained in the limit<br />

of large m.<br />

Introducing the not<strong>at</strong>ion ɛ = p − 1/2, the dynamics<br />

associ<strong>at</strong>ed with the effective map (16) can be rewritten<br />

ɛ ′ − ɛ = α(m)ɛ + β(m)ɛ µ(m) , (19)<br />

which, in the continuous time limit, yields<br />

dɛ<br />

dt = α(m)ɛ + β(m)ɛµ(m) . (20)<br />

Thus, for small ɛ, we obtain an exponential growth r<strong>at</strong>e<br />

while for large enough ɛ<br />

ɛt ∝ e α(m)t , (21)<br />

1<br />

−<br />

ɛt ∝ (tc − t) µ(m)−1 . (22)<br />

Of course, these behaviours become invalid for t too close to<br />

tc for which the reinjection mechanism oper<strong>at</strong>es and ensures<br />

th<strong>at</strong> the probability remains less than one.<br />

For example, for m = 60 with ρhb = ρbh = 0.72 and<br />

ρhh = ρbb = 0.85, we can check on figure 6 th<strong>at</strong> µ(m) = 3,<br />

which yields for large ɛ:<br />

pt − 1<br />

2 ∝<br />

1<br />

√ . (23)<br />

tc − t<br />

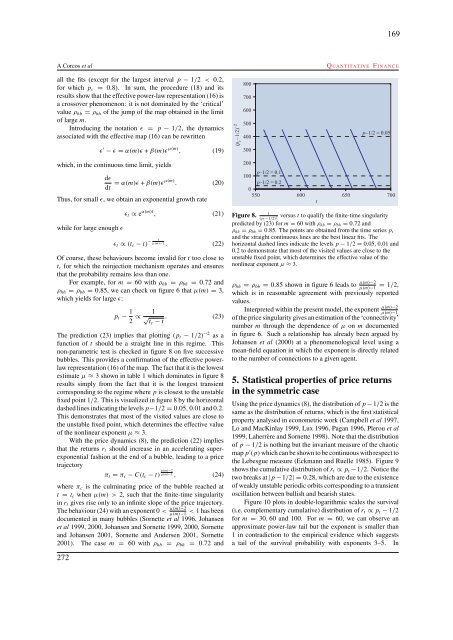

The prediction (23) implies th<strong>at</strong> plotting (pt − 1/2) −2 as a<br />

function of t should be a straight line in this regime. This<br />

non-param<strong>et</strong>ric test is checked in figure 8 on five successive<br />

bubbles. This provi<strong>de</strong>s a confirm<strong>at</strong>ion of the effective powerlaw<br />

represent<strong>at</strong>ion (16) of the map. The fact th<strong>at</strong> it is the lowest<br />

estim<strong>at</strong>e µ ≈ 3 shown in table 1 which domin<strong>at</strong>es in figure 8<br />

results simply from the fact th<strong>at</strong> it is the longest transient<br />

corresponding to the regime where p is closest to the unstable<br />

fixed point 1/2. This is visualized in figure 8 by the horizontal<br />

dashed lines indic<strong>at</strong>ing the levels p−1/2 = 0.05, 0.01 and 0.2.<br />

This <strong>de</strong>monstr<strong>at</strong>es th<strong>at</strong> most of the visited values are close to<br />

the unstable fixed point, which d<strong>et</strong>ermines the effective value<br />

of the nonlinear exponent µ ≈ 3.<br />

With the price dynamics (8), the prediction (22) implies<br />

th<strong>at</strong> the r<strong>et</strong>urns rt should increase in an acceler<strong>at</strong>ing superexponential<br />

fashion <strong>at</strong> the end of a bubble, leading to a price<br />

trajectory<br />

πt = πc − C(tc − t) µ(m)−2<br />

µ(m)−1 , (24)<br />

where πc is the culmin<strong>at</strong>ing price of the bubble reached <strong>at</strong><br />

t = tc when µ(m) > 2, such th<strong>at</strong> the finite-time singularity<br />

in rt gives rise only to an infinite slope of the price trajectory.<br />

The behaviour (24) with an exponent 0 < µ(m)−2<br />

< 1 has been<br />

µ(m)−1<br />

documented in many bubbles (Sorn<strong>et</strong>te <strong>et</strong> al 1996, Johansen<br />

<strong>et</strong> al 1999, 2000, Johansen and Sorn<strong>et</strong>te 1999, 2000, Sorn<strong>et</strong>te<br />

and Johansen 2001, Sorn<strong>et</strong>te and An<strong>de</strong>rsen 2001, Sorn<strong>et</strong>te<br />

2001). The case m = 60 with ρhb = ρbh = 0.72 and<br />

272<br />

169<br />

1<br />

Figure 8. (pt −1/2) 2 versus t to qualify the finite-time singularity<br />

predicted by (23) for m = 60 with ρhb = ρbh = 0.72 and<br />

ρhh = ρbb = 0.85. The points are obtained from the time series pt<br />

and the straight continuous lines are the best linear fits. The<br />

horizontal dashed lines indic<strong>at</strong>e the levels p − 1/2 = 0.05, 0.01 and<br />

0.2 to <strong>de</strong>monstr<strong>at</strong>e th<strong>at</strong> most of the visited values are close to the<br />

unstable fixed point, which d<strong>et</strong>ermines the effective value of the<br />

nonlinear exponent µ ≈ 3.<br />

ρhh = ρbb = 0.85 shown in figure 6 leads to µ(m)−2<br />

= 1/2,<br />

µ(m)−1<br />

which is in reasonable agreement with previously reported<br />

values.<br />

Interpr<strong>et</strong>ed within the present mo<strong>de</strong>l, the exponent µ(m)−2<br />

µ(m)−1<br />

of the price singularity gives an estim<strong>at</strong>ion of the ‘connectivity’<br />

number m through the <strong>de</strong>pen<strong>de</strong>nce of µ on m documented<br />

in figure 6. Such a rel<strong>at</strong>ionship has already been argued by<br />

Johansen <strong>et</strong> al (2000) <strong>at</strong> a phenomenological level using a<br />

mean-field equ<strong>at</strong>ion in which the exponent is directly rel<strong>at</strong>ed<br />

to the number of connections to a given agent.<br />

5. St<strong>at</strong>istical properties of price r<strong>et</strong>urns<br />

in the symm<strong>et</strong>ric case<br />

Using the price dynamics (8), the distribution of p − 1/2 is the<br />

same as the distribution of r<strong>et</strong>urns, which is the first st<strong>at</strong>istical<br />

property analysed in econom<strong>et</strong>ric work (Campbell <strong>et</strong> al 1997,<br />

Lo and MacKinlay 1999, Lux 1996, Pagan 1996, Plerou <strong>et</strong> al<br />

1999, Laherrère and Sorn<strong>et</strong>te 1998). Note th<strong>at</strong> the distribution<br />

of p − 1/2 is nothing but the invariant measure of the chaotic<br />

map p ′ (p) which can be shown to be continuous with respect to<br />

the Lebesgue measure (Eckmann and Ruelle 1985). Figure 9<br />

shows the cumul<strong>at</strong>ive distribution of rt ∝ pt −1/2. Notice the<br />

two breaks <strong>at</strong> |p − 1/2| =0.28, which are due to the existence<br />

of weakly unstable periodic orbits corresponding to a transient<br />

oscill<strong>at</strong>ion b<strong>et</strong>ween bullish and bearish st<strong>at</strong>es.<br />

Figure 10 plots in double-logarithmic scales the survival<br />

(i.e. complementary cumul<strong>at</strong>ive) distribution of rt ∝ pt − 1/2<br />

for m = 30, 60 and 100. For m = 60, we can observe an<br />

approxim<strong>at</strong>e power-law tail but the exponent is smaller than<br />

1 in contradiction to the empirical evi<strong>de</strong>nce which suggests<br />

a tail of the survival probability with exponents 3–5. In